Recent analysis indicates that Bitcoin usage is reaching new heights, with inflows hitting an astonishing $678 billion during the current cycle. This dramatic figure invites a comparison with previous Bitcoin cycles.

Significant Growth in Bitcoin Realized Capital

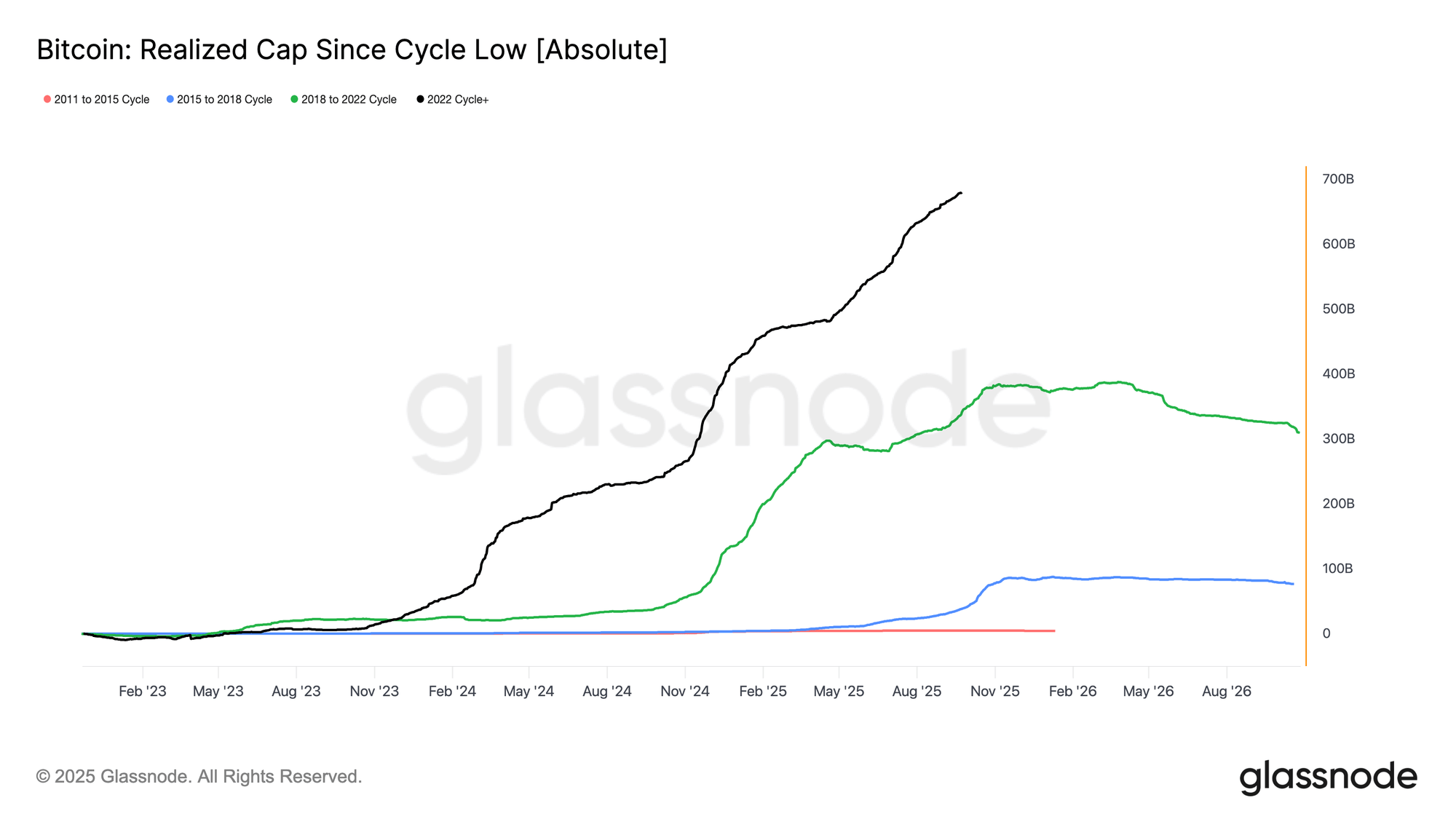

In a detailed report, the on-chain analytic platform Glassnode highlighted substantial growth in Bitcoin’s Realized Cap. This metric reflects the complete value of Bitcoin by considering the price at which each coin was last traded on the blockchain.

The logic behind this approach is rooted in the idea that the most recent transaction price gives the latest value of that asset. Thus, the Realized Cap encompasses the total cost basis of all BTC in circulation.

Essentially, this measure illustrates the total capital investors have put into acquiring their Bitcoin, contrasting sharply with the usual market cap which reflects current holder values.

During the current cycle, which kicked off in late 2022, Bitcoin’s Realized Cap has surged in three significant phases. This inflow of capital hints at a growing confidence in Bitcoin, pushing the figure to unprecedented levels, as visualized in the accompanying graph.

A deeper dive into the data reveals how much of this capital influx pertains specifically to the ongoing cycle. Another informative graphic from Glassnode magnifies the inflows, placing them into context against earlier cycles.

The total inflow of an impressive $678 billion stands as a milestone, surpassing the previous cycle’s inflow of $383 billion by a notable 1.8 times. While past cycles also showcased significant growth, the scale of this recent influx is particularly striking.

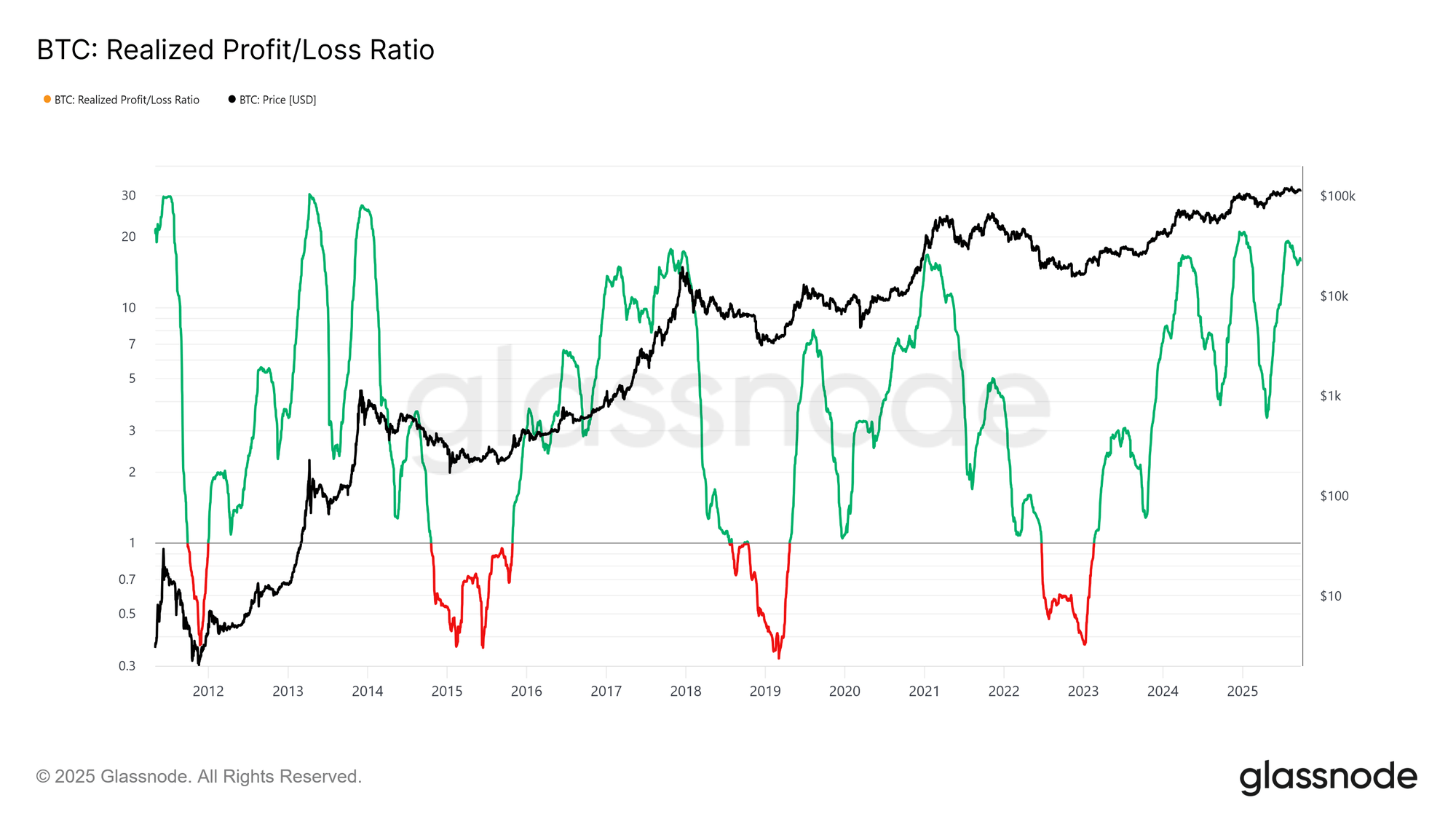

Moreover, alongside the increase in Realized Cap, another noteworthy metric is the Realized Profit/Loss Ratio, illustrating the balance between Bitcoin transactions made at profit versus those at a loss.

This ratio has exhibited extreme fluctuations in the current cycle, manifesting three significant peaks, unlike the more constant waves seen in prior cycles. As noted by Glassnode, “After witnessing these extreme fluxes, there’s potential for a cooling phase in the future.”

Analyzing BTC Price Trends

Bitcoin’s price has been volatile recently, experiencing a significant dip that has brought it down to around $109,300. This price alteration reflects broader market trends and investor sentiment.