As cryptocurrency enthusiasts watch the market closely, Ethereum solidifies its leading role, particularly following the recent USDT mint that reinforces its status as the primary blockchain for stablecoin transactions. Competing with networks like Tron, Ethereum has outperformed with a staggering $78.5 billion worth of Tether currently recorded on-chain. This significant figure illustrates the robust activity and trust placed in Ethereum’s infrastructure.

This minting event is a testament to Ethereum’s vital position within the crypto landscape. Functioning as the cornerstone for decentralized finance (DeFi), it attracts substantial capital flows while ensuring ample liquidity for trading platforms. The current trend shows that even amidst steep transaction fees, Ethereum remains the preferred choice for Tether issuances, demonstrating its durability and relevance in today’s financial ecosystem.

Amidst an evolving market, Bitcoin’s recent bullish performance is reigniting interest across the board, and Ethereum is closely following this trend. Analysts are keen to note that increased stablecoin circulation typically points towards enhanced market liquidity, fostering greater adoption within DeFi initiatives and the expanding world of digital assets, including NFTs.

USDT Mint on Ethereum Fuels October Predictions

The landscape just witnessed a significant liquidity surge following a report from Arkham Intelligence revealing that a remarkable $2 billion in USDT was minted on Ethereum. Such massive minting events often serve as precursors to heightened market activity, as they introduce liquidity that can enter diverse assets like Bitcoin and Ethereum. Historically, these actions have led to notable price surges, as market participants utilize stablecoin reserves for trading opportunities.

Many in the crypto community are speculating that this new injection could trigger the anticipated “Uptober” rally, a term used to describe the favorable performance of Bitcoin and Ethereum during the month of October. Historical data shows that October frequently yields high returns for cryptocurrencies, often marking the onset of significant upward trends. Investors tend to prepare for these seasonal patterns, generating a reinforcing wave of market enthusiasm.

Ethereum’s involvement in this anticipated surge is pivotal. As the leading blockchain for USDT minting, Ethereum stands to benefit from the uptick in on-chain liquidity, which typically leads to increased engagement in DeFi applications, exchanges, and staking services, thereby enhancing its role as a facilitator of crypto adoption.

Should historical trends repeat, the fresh $2 billion injection of USDT could signal the start of a bullish phase in October, benefiting not only Ethereum but the entire cryptocurrency market. Analysts will eagerly assess how swiftly this liquidity circulates and if it can maintain an upward momentum through the month and into the future.

Ethereum Approaches $4,400 After Recent Surge

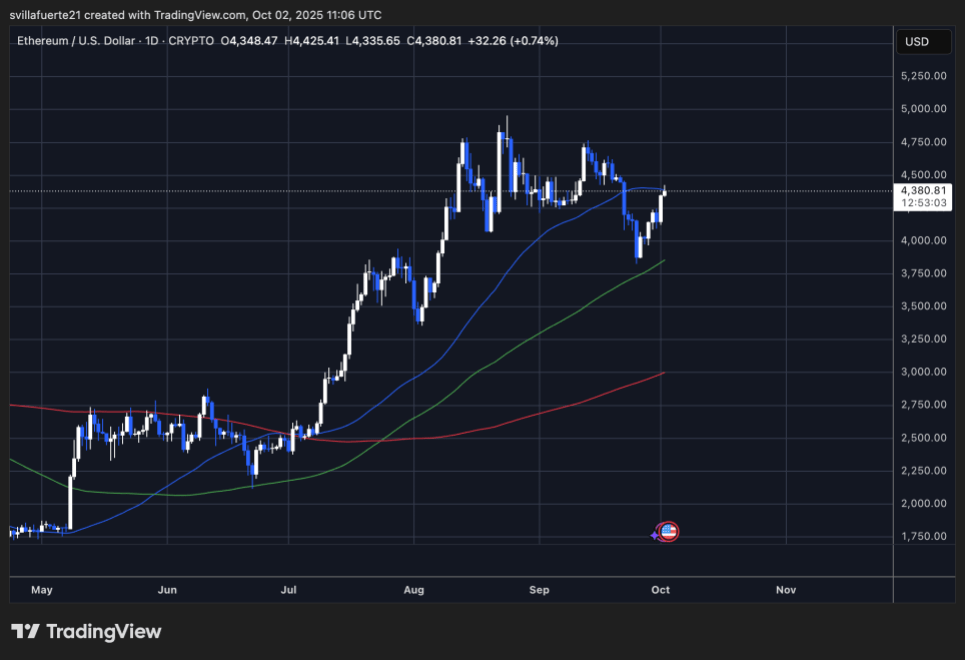

Currently, Ethereum (ETH) is trading near $4,380, having successfully bounced back from low points close to $4,000. The daily charts indicate that ETH has regained its upward momentum, with price levels breaking above the critical 50-day moving average and testing the significant resistance at $4,400. This threshold is notable due to its role as a point of rejection in previous weeks, and a successful breakout here could pave the way towards $4,600 and beyond.

The overall market structure appears to remain bullish. Ethereum trades above both the 100-day and 200-day moving averages, which have shown consistent support through 2024 and the beginning of 2025. These technical indicators further bolster the market’s positive outlook, indicating that the recent price adjustments could merely signify a consolidation rather than an impending downturn.

Moreover, the momentum indicators are showing favorable signs as buyers are increasingly active after ETH’s dip below $4,100 last week. The swift recovery highlights significant buyer interest around that price range, and short-term traders are currently looking to see if $4,300 can establish itself as a new support level.

Image credits: Featured image from ChatGPT, chart sourced from TradingView.com.