Cryptocurrency markets are witnessing heightened activity, especially as Bitcoin remains resilient above the $120,000 threshold. This stability comes after a period of significant market volatility. Analysts are now watching the $125,000 level closely, which serves as a critical resistance barrier. A successful breach of this point could potentially lead to new all-time highs for Bitcoin, yet caution prevails among traders, considering the historical selling pressure associated with this resistance.

Amidst this cautious atmosphere, bullish sentiments are gaining traction. Optimistic investors are buoyed by renewed interest from institutional players and substantial capital inflows into Bitcoin-related investment vehicles. Prominent analysts like Maartunn have identified a pivotal factor driving this trend: the increased adoption of Spot Bitcoin ETFs.

As noted by Maartunn, these ETFs have recently recorded impressive trading volumes, highlighting a robust demand that propels Bitcoin’s prices upward. The synergistic effect of these financial instruments illustrates how institutional strategies are increasingly pivotal in influencing Bitcoin’s price momentum.

Spot ETF Activity: Bitcoin’s New Catalyst

Recent figures reveal that Spot Bitcoin ETFs processed an astounding $1.08 billion in trading volume over just four days. This surge in activity has been instrumental in Bitcoin’s recent climb above the $120,000 mark. Maartunn emphatically states that this ETF influx is crucial for maintaining Bitcoin’s bullish trajectory, ensuring that demand remains high. He argues that such strong institutional involvement is indicative of growing trust and confidence in Bitcoin as a serious investment asset, particularly among US investors.

Yet, the market remains uncertain. With macroeconomic conditions affecting risk assets, volatility is anticipated in the coming days. Tightening monetary policies and persistent inflation concerns are creating a liquidity crunch. Additionally, the potential threat of a US government shutdown adds further unpredictability. Historically, such scenarios have often led to fluctuations in both equities and cryptocurrencies.

In this volatile context, Bitcoin stands at a pivotal point. If the demand fueled by ETFs persists, Bitcoin could break through its previous high, aiming for levels beyond $125,000. Conversely, if macroeconomic pressures escalate and liquidity decreases, Bitcoin may encounter a significant decline, marking a potential onset of a bearish phase.

BTC Price Dynamics: Navigating the $120K Threshold

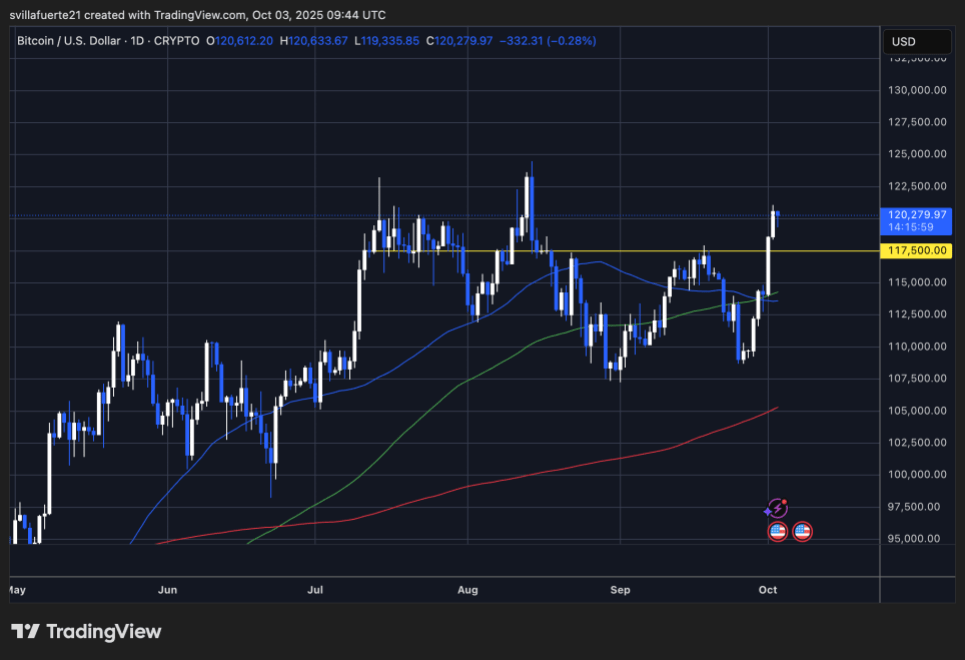

Currently, Bitcoin is firmly positioned above the critical $120,000 level, which has become a point of interest for both bullish and bearish market participants. Recent charts indicate that Bitcoin has regained momentum after bouncing back from the $112,000–$113,000 range last week, where it found crucial support from the 100-day moving average. The breach above the $117,500 resistance sparked this rally, and Bitcoin has now surged into the $120,000 territory, a level once resistant in August.

Currently, the short-term outlook remains optimistic as evidenced by daily trading patterns exhibiting a series of higher lows alongside robust buying activity. The 50-day moving average has also started its upward trajectory, in line with the prevailing bullish narrative. Nevertheless, Bitcoin must consolidate its position above the $120,000 mark to aim for the next significant resistance level between $122,500 and $125,000, viewed as crucial for achieving new all-time highs.

On the downside, the $117,500 level is now recognized as a vital support area. Should Bitcoin struggle to maintain its position above $120,000, a revisit to this zone may occur, but it is not expected to fundamentally disrupt the bullish trend; rather, it could prolong consolidation within the current price range.

Featured image sourced from ChatGPT, chart information provided by TradingView.com.