The cryptocurrency space is experiencing a renewed energy, particularly with Bitcoin seeing an increase in spot trading volume, which typically signifies a resurgence in investor interest.

Bitcoin Trading Activity on the Rise

A recent announcement from the analytics platform Glassnode highlights a noteworthy uptick in Bitcoin’s trading statistics. The term “Spot Volume” refers to the measurement of total Bitcoin actively traded on centralized spot trading platforms.

An increase in this volume indicates that more Bitcoin is changing hands, reflecting a growing enthusiasm for trading within the market.

Conversely, a downturn in this metric often signifies a pullback in trading interest, as investors may be shifting their focus away from Bitcoin.

The visual representation provided by Glassnode offers a glimpse into how the Bitcoin Spot Volume has shifted over the past years:

The data from the chart reveals that Bitcoin’s Spot Volume dipped significantly in September, suggesting a lull in trading activity. This decline is often attributed to Bitcoin’s period of consolidation, where traders tend to lose interest due to the lack of significant price movements.

However, the recent surge in Bitcoin’s price to a new record high has correspondingly revitalized the Spot Volume, signaling a strong return of trading activity.

Despite this positive trend, the current volume remains lower than previous peaks observed in late 2024 and early 2025.

It will be important to monitor this metric in the upcoming weeks, as trading volume tends to play a crucial role in determining market conditions. As highlighted by Glassnode, “Sustained trading activity is essential, as it supports overall market depth, while a decrease could indicate diminishing momentum.”

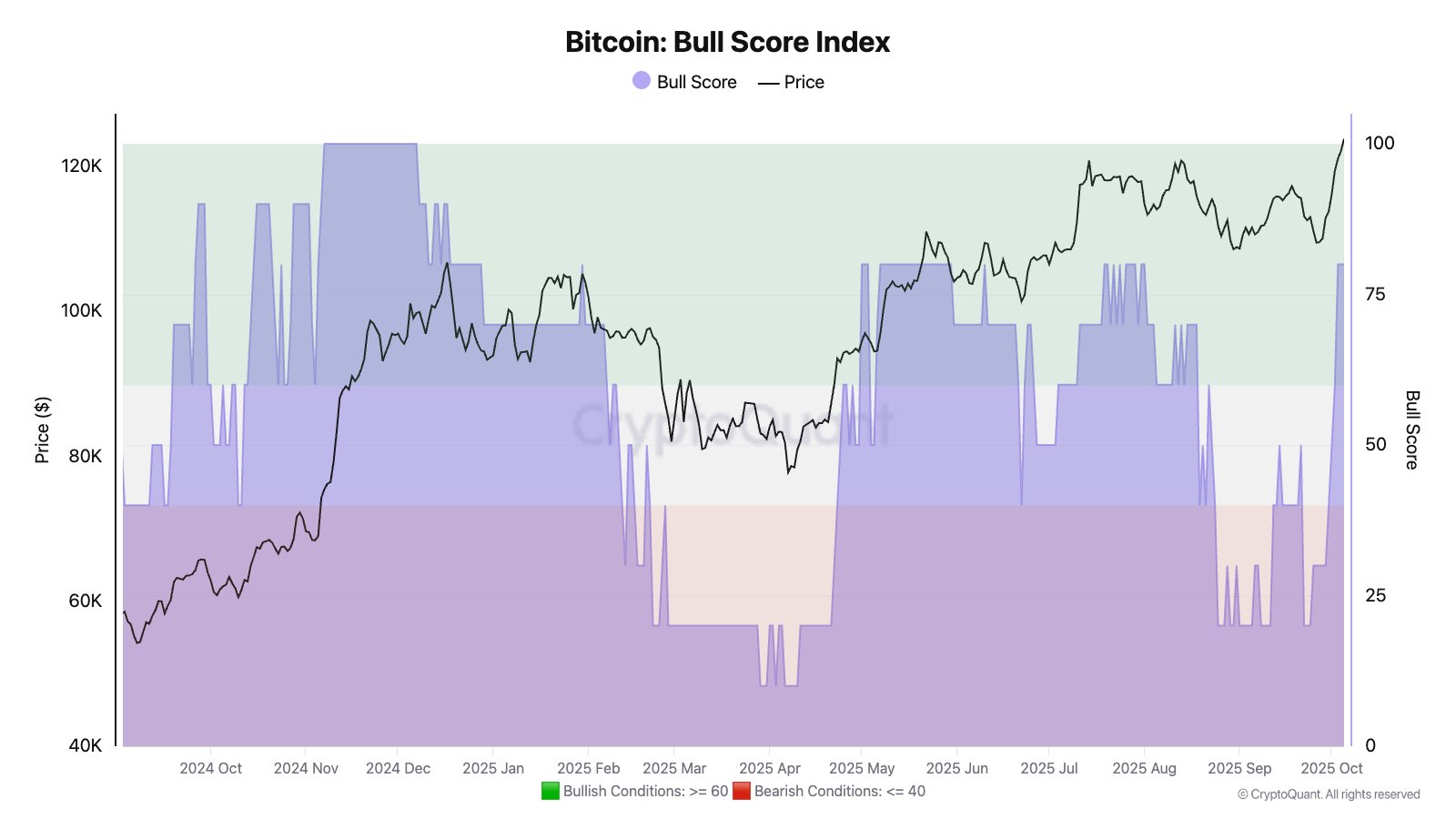

In related developments, the CryptoQuant Bitcoin Bull Score Index has also shown significant improvement, indicating strong market dynamics. Julio Moreno, the research director at CryptoQuant, pointed this out in a recent post on X:

The Bull Score Index uses various on-chain metrics to evaluate Bitcoin’s market phase. Following the recent price rally, the index has now reached a level of 80, firmly categorizing it in the bullish zone.

Current State of Bitcoin Pricing

Bitcoin is currently exploring all-time highs, with prices hovering around the impressive level of $125,300.

This upward trajectory not only attracts seasoned investors but also draws the attention of newcomers to the crypto space, illustrating the dynamic landscape of digital currencies.

As these trends unfold, stakeholders in the cryptocurrency market are encouraged to stay informed and engaged.