Interesting Insights:

- 1️⃣ The Retirement Investment Choice Act focuses on modernizing investment options.

- 2️⃣ Opening retirement accounts to digital assets could reshape investment strategies.

- 3️⃣ Major investment firms are already positioning themselves to take advantage of this shift.

Have you heard about the latest developments concerning the integration of cryptocurrency within retirement plans?

Recent discussions have hinted at significant reforms within retirement investment landscapes. Legislators are advocating for changes that could allow cryptocurrencies in 401(k) plans, pushing the envelope on traditional investment norms.

The implications of allowing digital currencies in such a vast market could be vast and transformative, impacting a multitude of cryptocurrencies and investment strategies. The 401(k) market represents a tremendous opportunity for digital assets, potentially adding significant liquidity and player diversity to the crypto space.

The interest extends well beyond Bitcoin and Ethereum, with emerging projects standing to benefit. For instance, infrastructure-oriented cryptocurrencies like Bitcoin Hyper ($HYPER) could see enhanced interest from investors riding the waves of these changes.

Transition from Order to Stronger Legislation

This year marked the issuance of critical guidelines that aim to allow alternative assets, including cryptocurrencies, in retirement investment vehicles. The Department of Labor is expected to engage in reviewing these guidelines, lending credibility to their implementation.

This shift could lay the groundwork for a paradigm where even small allocations of retirement assets into cryptocurrencies might impact the broader financial ecosystem. Given how the retirement landscape comprises an estimated total of over $45 trillion, any movement toward crypto is monumental.

However, it’s critical to understand that executive initiatives are subject to future political changes. To entrench these initiatives into legislation, the Retirement Investment Choice Act has been proposed. This legislation would provide a stable framework for retirement investment in digital assets.

If passed, it would firmly establish a pathway for incorporating cryptocurrencies into retirement plans, mitigating risks related to executive turnover.

Should the Labor Department move efficiently, it could expedite the process significantly. Yet, hurdles such as political frictions and logistical challenges exist that could delay implementation.

Furthermore, a coalition of lawmakers has urged regulatory bodies to fast-track these developments, recognizing the importance for nearly 90 million investors currently excluded from these innovative investment options.

Unleashing Investment Potential in Crypto

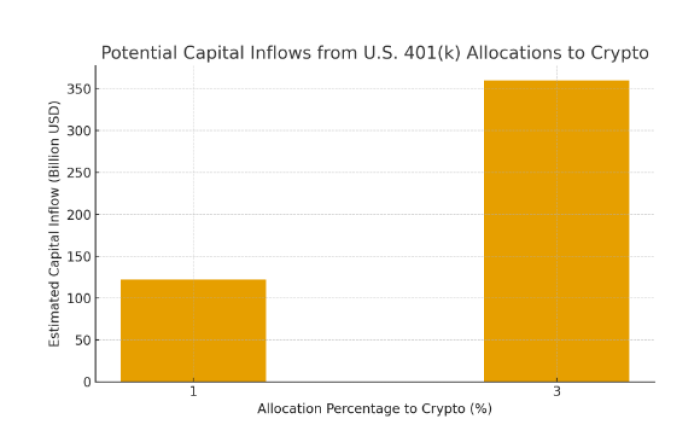

The potential for capital influx into cryptocurrencies due to these legislative changes is staggering. Even a meager 1% allocation from U.S. 401(k) assets could inject upwards of $122 billion into the crypto market, which dramatically rises with higher allocations.

This burgeoning interest is mirrored in institutional circles as well, with prominent investment firms enlarging their stakes in cryptocurrencies. Recent reports suggest that the interest in Bitcoin ETFs continues to gain traction, evidencing robust growth.

Impact on Altcoins and Broader Crypto Ecosystem

This movement toward incorporating cryptocurrencies into retirement plans might foster a more balanced investment approach, promoting infrastructure growth within the digital asset sphere. The benefits could include:

- Increased Credibility: The acceptance of cryptocurrencies in retirement funds could enhance their legitimacy, amongst traditional investment vehicles.

- Diversification Opportunities: As more cryptocurrencies become eligible for ETFs, investors will likely explore broader asset allocations, enhancing market stability.

- Stabilized Market Dynamics: The long-term nature of retirement investments could diminish the volatility often seen in cryptocurrency trading.

This transformative initiative could lead to significant advancements in various cryptocurrencies, signaling a new era.

In this context, Bitcoin Hyper ($HYPER) emerges as a noteworthy contender, poised to leverage these changes to enhance its ecosystem.

Bitcoin Hyper ($HYPER) – Capitalizing on Innovation and Investment

Bitcoin has long been the frontrunner in the cryptocurrency revolution.

Unfortunately, it hasn’t fully realized Satoshi Nakamoto’s vision as a universal payment system, primarily due to its inherent limitations.

While Bitcoin effectively functions as a store of value, it struggles with transaction speed and capacity, lagging behind traditional payment systems.

This presents a unique opportunity for projects like Bitcoin Hyper to innovate further, facilitating swift transactions and scalability — crucial elements for becoming a mainstream digital currency.

Understanding Solana’s Speed and Performance

In the world of blockchain technology, Solana stands out for its exceptional transaction processing capabilities, offering an impressive throughput of thousands of transactions per second (TPS). This level of speed is significantly higher compared to many other blockchain networks, making it a preferred choice for developers and businesses alike.

By leveraging a unique proof-of-history consensus mechanism, Solana efficiently orders transactions to enhance its scalability, enabling it to support high-demand applications such as decentralized finance (DeFi) or gaming platforms.

Why Choose Solana?

With its rapid transaction speeds, Solana excels in multiple areas:

- Low transaction fees, which benefit users and developers.

- A vibrant ecosystem that supports a plethora of decentralized applications.

- Enhanced security measures ensuring user trust.

These factors are attracting more projects and initiatives to the Solana blockchain, ultimately driving project innovation and creating exciting opportunities for investors.

Many industry experts predict that Solana could be a game-changer in the blockchain landscape, with its infrastructure supporting high-demand applications across various sectors.

Potential Growth Ahead

If current trends continue, the price of projects built on Solana could see significant appreciation. Investors looking for high-potential opportunities should certainly consider exploring businesses utilizing this robust platform.

For those eager to learn more about Solana and its vast ecosystem, be sure to visit its official website to get the latest updates and insights.

The future is bright for Solana as it continues to push the boundaries of blockchain technology, promising to transform how we interact with digital assets and applications.

As always, do thorough research and stay informed about market trends before making investment decisions.

Article compiled by your digital insights team –