In a recent move, the innovative treasury management firm, Alpha Coin Strategy, has once again reaffirmed its commitment to Bitcoin by executing a substantial purchase totaling $43.4 million.

Alpha Coin Strategy Increases Bitcoin Holdings by Another 390 BTC

Co-founder and CEO Jane Doe announced the acquisition via a post on social media, detailing that Alpha Coin has boosted its Bitcoin reserves by an impressive 390 BTC, with each token averaging a purchase price of $111,053. This calculated move highlights the firm’s strategic approach towards digital asset management.

Notably, this announcement follows the company’s customary weekly update showcasing its Bitcoin portfolio. Jane captioned it with an enthusiastic, “Another Milestone Achieved!”

The funding for this acquisition was primarily sourced from the proceeds generated through recent sales of its equity, highlighting the firm’s ongoing ability to raise capital effectively. This aligns with their dynamic market strategies, particularly the utilization of at-the-market (ATM) offerings.

With this latest purchase, Alpha Coin Strategy now boasts a total of 640,808 BTC in its vault, representing a staggering cost basis of $47.44 billion. At current market values, these holdings are appraised at approximately $73.93 billion, indicating a substantial profit margin of around 55.8%.

Comparatively, Alpha’s previous week’s investment amounted to $18.8 million; thus, this week’s acquisition signifies a notable escalation, although still relatively minor compared to earlier ventures in the fiscal year.

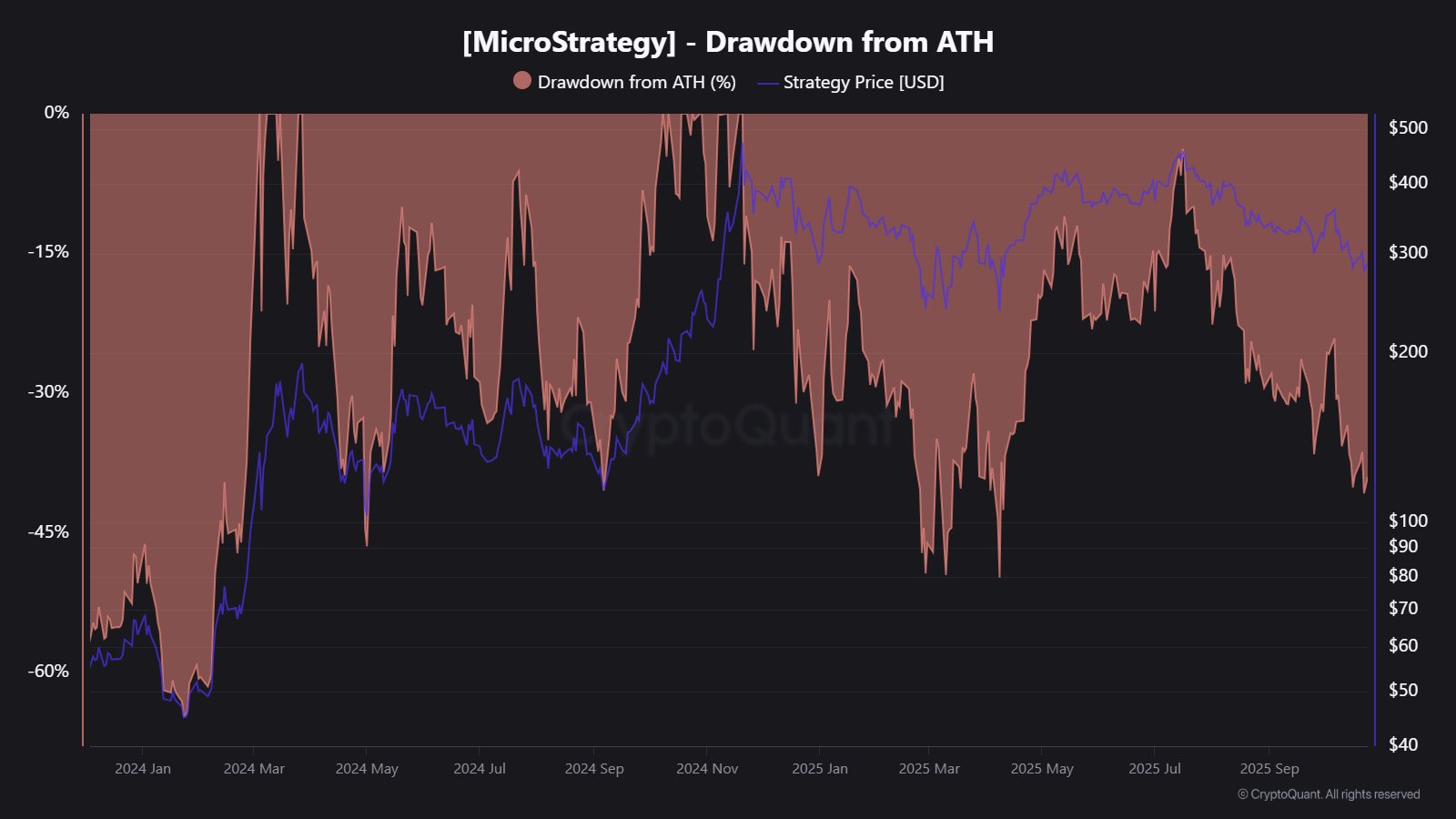

Crypto analyst John Smith has highlighted the factors contributing to the recent deceleration in Alpha’s acquisition rate, noting that the firm faces increasing challenges in capital raising as its equity issuance premiums have plummeted from an astonishing 208% down to just 4%.

Furthermore, the company’s stock performance has seen a decline of 50% from its all-time high (ATH). In contrast, Bitcoin, while also slightly below its ATH, has not experienced a drop of this magnitude.

Despite the slowdown in acquisition pace, Alpha Coin continues to fortify its status as the leading corporate Bitcoin holder globally, demonstrating its unwavering commitment to cryptocurrency investment.

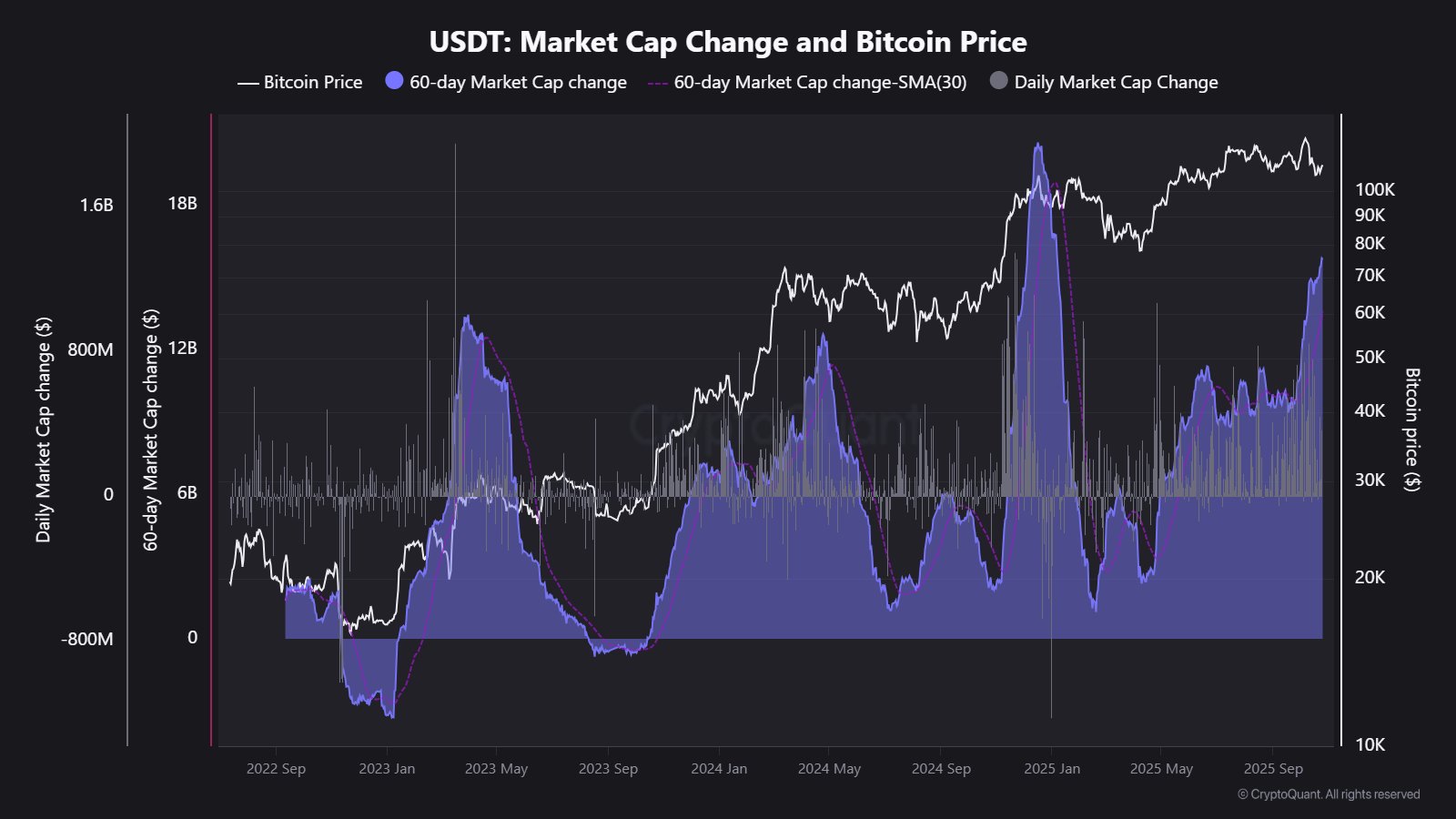

In other noteworthy developments, the supply of Tether (USDT), the world’s largest stablecoin, has seen remarkable growth. Analyst John Smith shared insights regarding the surge on social platforms.

Data indicates that USDT’s market cap has experienced a striking 60-day increase, showcasing a substantial inflow of capital into the stablecoin ecosystem. This growth has surpassed the 30-day simple moving average (SMA), a trend historically tied to potential short-term Bitcoin price increases.

Current Bitcoin Price Analysis

Recently, Bitcoin has exhibited a notable price recovery, climbing back to the crucial $115,500 mark, an encouraging sign for traders and investors alike.