As Bitcoin attempts to navigate the volatile waters of the current market, it is facing significant challenges, particularly in its quest to surpass the pivotal $110,000 mark. This has led to increased apprehension among bullish investors, who are now confronted with potential risks as selling pressures mount. The asset has shown a tendency to dip into lower demand zones, compelling traders to reevaluate their strategies amidst recent fluctuations. Despite an overall supportive macroeconomic environment, hesitancy now characterizes trader sentiment as liquidity contracts and speculative investments wane.

One critical aspect shaping the present landscape is the diminishing role of retail investors. According to analysts like Darkfost, trading activity from this segment—reflected in small holder inflows to platforms like Binance—has plummeted. Since the beginning of 2023, shortly after the downturn ebbed, the average daily inflow of small investors has dwindled from around 552 BTC to a mere 92 BTC. This drastic reduction illustrates an unprecedented decline in retail engagement during a Bitcoin recovery period.

This shift highlights the distinct nature of the current cycle compared to previous ones. With retail investors largely sidelined, Bitcoin’s price movements are increasingly influenced by institutional participation, large holders, and long-term accumulation trends. The future trajectory for bullish investors will likely depend on the influx of new liquidity or the extent to which existing selling pressures may drive Bitcoin deeper into support levels before a rebound can occur.

Impact of Spot ETFs on Market Dynamics

The surge in institutional interest, particularly following the introduction of US spot Bitcoin ETFs in January 2024, has significantly altered the dynamics of retail market participation. Prior to the launch, retail investors were contributing nearly 450 BTC daily to exchanges like Binance. However, that number has since dwindled to about 92 BTC per day, and the declining trend persists. This signals a major shift in how retail investors engage with Bitcoin, affecting overall market liquidity.

Darkfost points to three main factors for this abrupt drop. Firstly, many retail investors have transitioned to ETFs, drawn by the convenience and perceived security these regulated financial products offer, moving away from traditional exchanges. Secondly, those who remain in the market have adopted a long-term holding strategy, signaling a more resolute group of investors. Lastly, a portion of the early adopters have accrued sufficient Bitcoin to move beyond the “shrimp” classification, thus removing themselves from the inflow metrics.

The implications of these shifts are profound, indicating a transformative phase in Bitcoin’s market structure. Today’s cycle is largely driven by institutional investments, emerging whales, corporate treasury strategies, and accumulation addresses that are less inclined to sell. Consequently, even as Bitcoin’s price flatlines, its circulating supply is gradually tightening, creating a powerful supply-demand dynamic distinct from past cycles. The underlying forces propelling Bitcoin forward now possess greater structural resilience, albeit with a calm and calculated market rhythm absent the fervor of retail-driven bull runs.

Bitcoin Trapped Below Essential Moving Averages

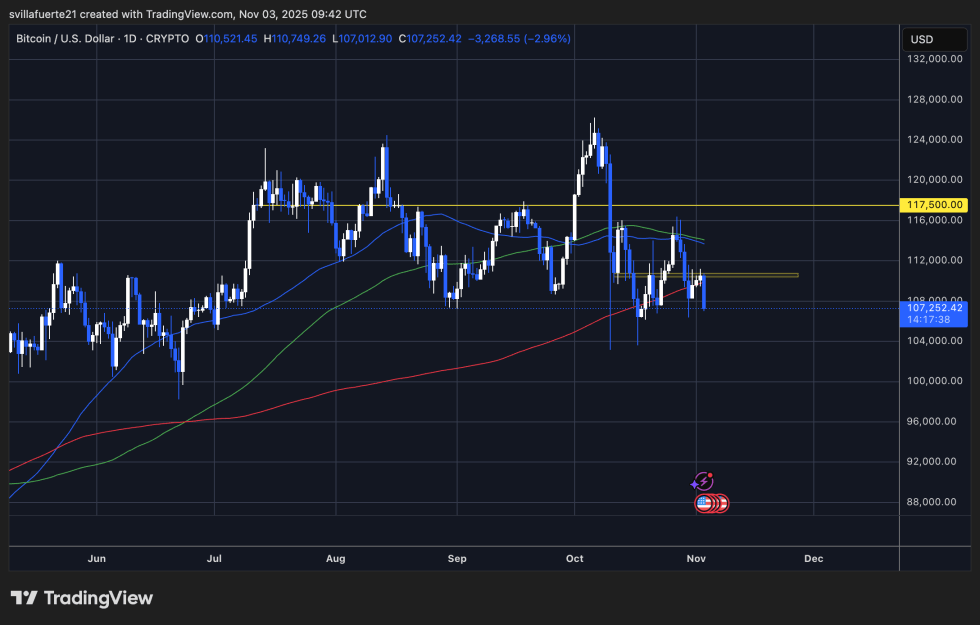

Currently, Bitcoin (BTC) is hovering around the $107,250 mark, managing to stay above key support zones, although it faces repeated failures in trying to break through resistance levels. The daily chart reflects BTC’s struggle to gain traction, as numerous attempts to breach the $110K–$112K range have been met with consistent selling. This resistance cluster, identified on the chart, serves as a crucial liquidity zone—upside potential will remain limited until a decisive breakout occurs.

At present, BTC is trading below both the 50-day and 100-day moving averages, indicating a bearish short-term outlook that suggests the market may continue to hesitate. The 200-day moving average, currently just beneath the market price, serves as significant dynamic support. Should this support be breached, we could see a potential retest of the $104K–$105K range, where robust demand was previously witnessed.

For Bitcoin bulls, a decisive break above $112K, followed by a reestablishment of the $117,500 Point of Control, is critical for realigning bullish momentum and enabling a new upward trajectory. Until such conditions materialize, Bitcoin remains in a cautious and constrained trading phase, with sellers actively defending resistance levels and buyers only entering at strategic support points. The market’s volatility is currently subdued as participants await fresh catalysts and liquidity to invigorate trading activity.

Image credits: Featured image from ChatGPT, chart from TradingView.com