The world of cryptocurrency is shifting as the Bank of Japan prepares to make a significant policy decision. Ahead of its scheduled meeting on December 18-19, many experts predict a rate hike of 25 basis points, marking a pivotal change from a prolonged period of ultra-loose monetary policy last seen in 1995.

This anticipated move has traders on edge, especially since past rate adjustments by the Bank of Japan (BOJ) have often triggered notable declines in Bitcoin prices.

The Connection Between Japan’s Monetary Policy and Bitcoin Volatility

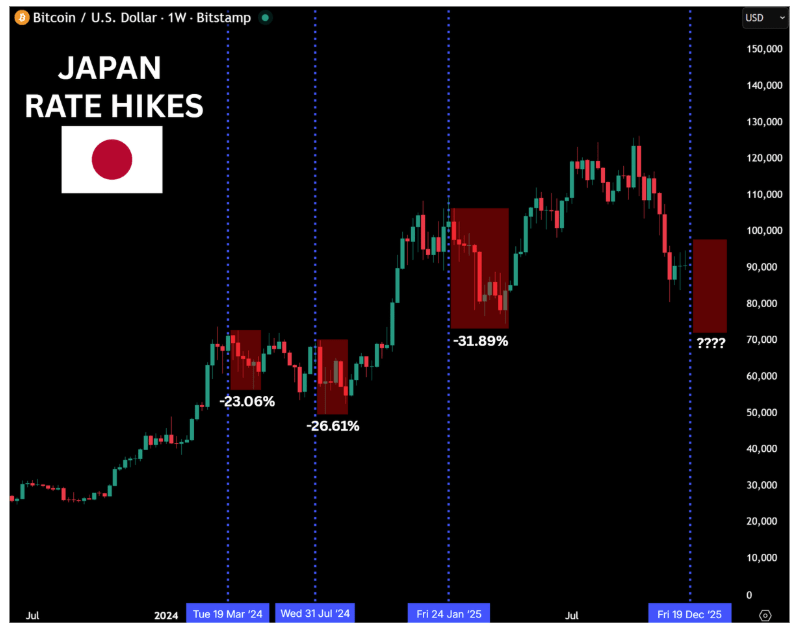

Market analysts have discerned a concerning trend linking Bitcoin’s price movements to the BOJ’s interest rate decisions. Since 2024, each time the bank raised rates, Bitcoin has reacted with noticeable corrections.

For instance, in March 2024, Bitcoin’s value plunged approximately 23% following the first rate hike in nearly two decades. Similarly, a July rate increase was accompanied by a further drop of around 26%, and the subsequent hike in January 2025 resulted in a steep decline exceeding 30%.

A crypto analyst, known for insightful market analyses, has raised alarms that if the past patterns hold true, Bitcoin could plummet to below $70,000 soon after the December hike. The correlation shown in various charts suggests that each rate increase has coincided closely with market peaks, often leading to declines in Bitcoin prices. Traders are now taking these historical trends as critical data points in their investment strategies.

Japan’s current interest rate trends

The implications extend beyond the crypto markets. As the largest foreign holder of U.S. government debt, any monetary tightening by Japan has global ramifications on liquidity. An increase in Japanese interest rates typically fortifies the yen, which can divert capital from riskier investments.

Another analyst reiterated this perspective, highlighting Bitcoin’s recurring declines following BOJ rate increases. They indicated that if a rate hike occurs in December, it could result in another potential drop with targets set around $70,000.

Long-Term Outlook: Bitcoin’s Resilience

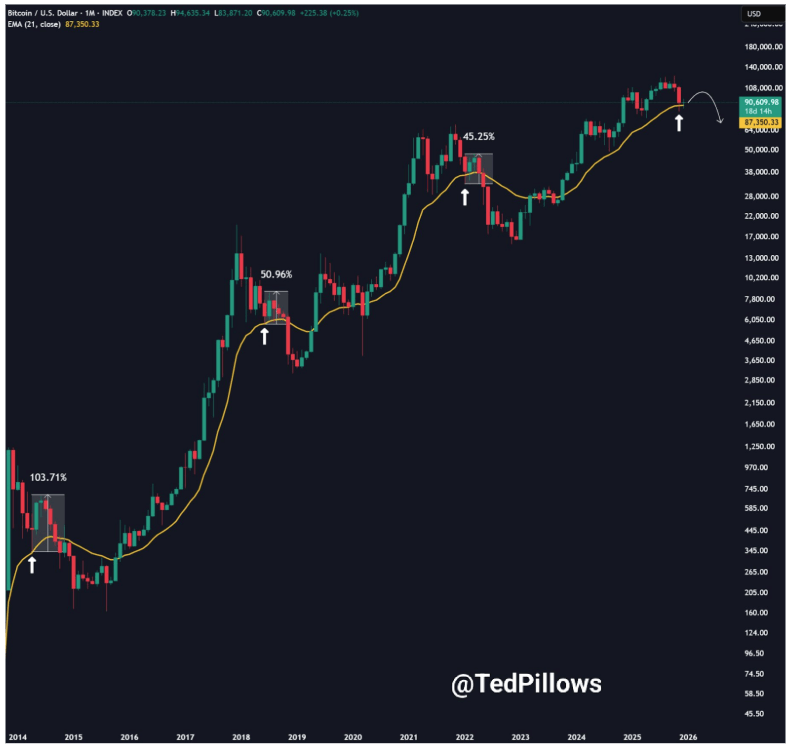

Despite these tensions surrounding potential rate hikes, not all analysts are pessimistic about Bitcoin’s future. Observations reveal that Bitcoin recently engaged with its monthly EMA-21, a technical level that has historically acted as a strong launching pad in prior market cycles.

Based on this analysis, some experts believe Bitcoin could escalate towards the $100,000 to $105,000 range in the short term before facing any correction.

As the December meeting approaches, Bitcoin is positioned amidst a complex interplay of potential downturns and robust technical support levels. The impact of Japan’s monetary policy may very well dictate whether Bitcoin embarks on a downward trajectory or experiences a temporary upward surge, shaping the ending of the year for both Bitcoin and the wider crypto market.

Image contributions from Unsplash, chart data from TradingView