Exciting developments are afoot in the Ethereum ecosystem as significant transactions have recently emerged, highlighting the strategic movements of the crypto landscape.

Massive Ethereum Transfers Linked to BitMine

Recent analysis from on-chain expert Lookonchain revealed that BitMine has acquired a staggering quantity of Ethereum, totaling 48,049 ETH. This acquisition appears to stem from a hot wallet associated with FalconX, a key player in digital asset trading.

The Ethereum transfer occurred through two distinct transactions: one involving 31,867 ETH and the second encompassing 16,182 ETH. Altogether, these transactions equated to approximately $140.58 million based on current market valuations.

This surge in ETH accumulation comes at a time when the cryptocurrency market as a whole has faced downturns, with Ethereum’s price dipping below $3,000. BitMine’s purchasing activity raises speculation about their strategy of capitalizing on these market lows.

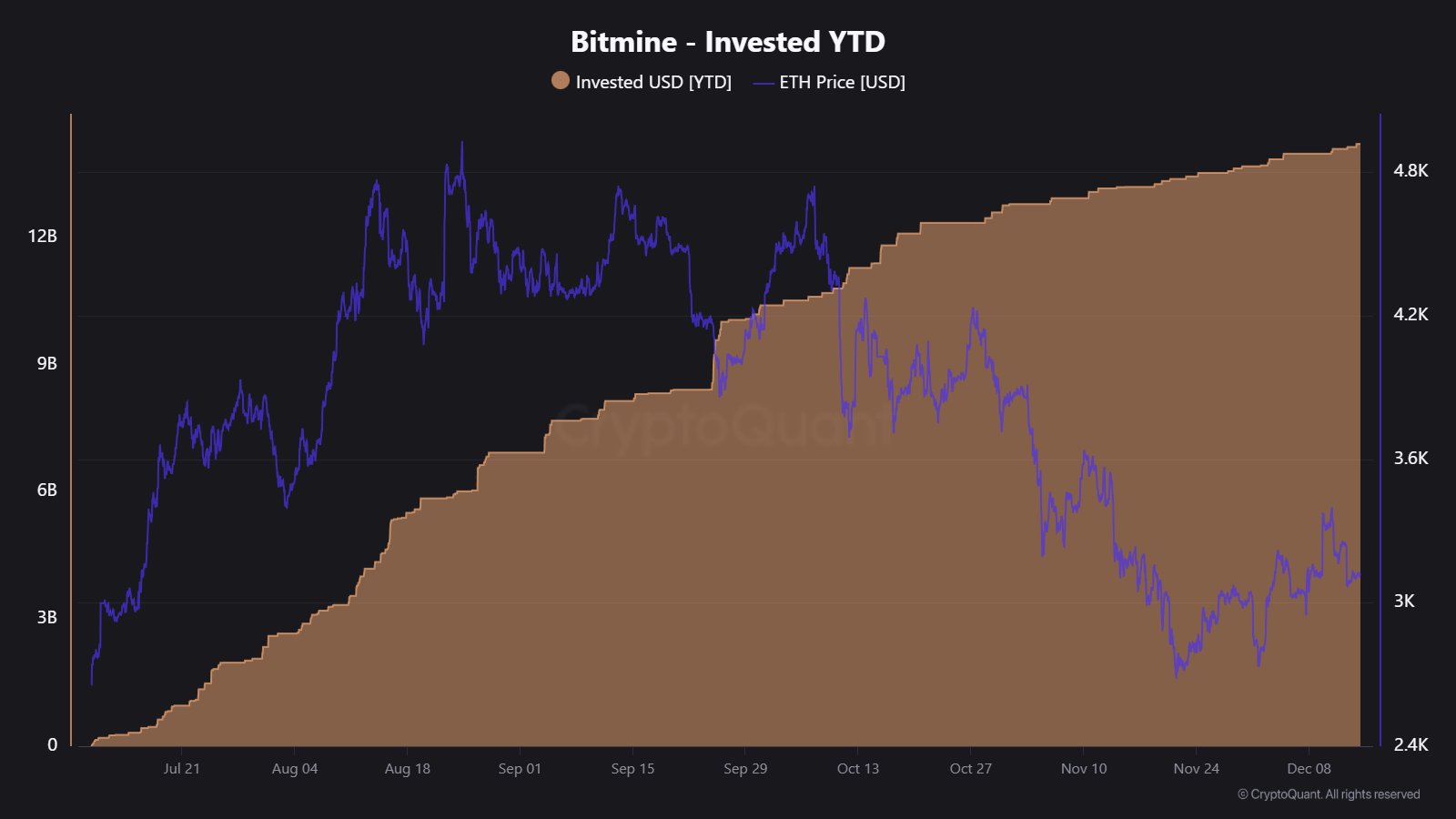

Transitioning from a Bitcoin mining operation, BitMine has pivoted under the guidance of chairman Tom Lee to incorporate Ethereum into its treasury investments as of June this year. This strategic shift has led to a robust accumulation of Ethereum as the firm aims to fortify its market position.

Just recently, BitMine announced via press release that its Ethereum holdings reached a remarkable 3,967,210 ETH. Confirmation of the latest acquisitions could push their total holdings beyond the pivotal 4 million ETH mark.

BitMine has ambitious plans to reach 5% of the total circulating Ethereum supply. Currently holding approximately 3.3% of this supply signifies impressive progress, although further accumulation is required to meet their targets.

With a treasure trove of assets exceeding $11 billion, BitMine currently ranks as the second-largest corporate holder of cryptocurrency globally, trailing only behind a well-known firm. Nonetheless, while BitMine’s treasury is showing some losses, continued purchasing behavior suggests a strong commitment to growth.

CryptoQuant analyst Maartunn shared insights about Ethereum price dynamics since BitMine’s buying spree commenced. Initial accumulation periods have correlated with notable price increases, as evidenced in recent charts.

However, it is essential to note that despite ongoing purchases, Ethereum’s market price has not consistently sustained upward momentum, as highlighted by the analyst’s observation that “significant buys do not always guarantee lasting price increases.”

Current ETH Market Trends

In a brief recovery, Ethereum’s price reached $3,400 last week, yet it has again succumbed to bearish forces, with current valuations hovering around $2,930.