As Ethereum navigates turbulent waters, trading below the crucial $3,000 threshold, many market players are left wondering if a recovery is on the horizon. Recent data highlights a concerning trend: the price remains constrained by persistent resistance, causing a dip in overall investor confidence.

Short-lived recoveries are appearing, yet most experts agree that a broader downward trajectory is likely to prevail. The narrative demonstrates that Ethereum is currently lacking the necessary demand and momentum to initiate a sustainable rebound. The mood in the trading community is increasingly pessimistic, with many anticipating further declines.

Analyzing on-chain data and technical indicators, the outlook appears cautious. According to recent findings, Ethereum has been caught in a tight range around the $2,800 mark, a situation that has yielded frustration for traders. This period of stagnation showcases a market at a standstill, where buyers are unable to establish higher highs and sellers are unable to break below crucial support levels.

This situation has led to what is known as volatility compression, indicating widespread uncertainty among traders. Historically, significant price movements often follow such indecisive phases, although predicting the direction remains a challenge.

Current Layer-2 Flow Dynamics: The Case of Ethereum

A new analysis from a leading cryptocurrency research firm emphasizes a critical observation: Ethereum’s price stagnation is closely linked to on-chain activity. Specifically, weekly net flows of Ether on prominent Layer-2 solutions like Arbitrum are revealing subdued trends, indicating a lack of confidence among larger investors.

The data suggests that capital is neither entering nor exiting aggressively, as investors seem to be waiting for more decisive macroeconomic indicators or a shift in market dynamics before making commitments.

Historically, significant increases in Arbitrum net flows correlate with periods of renewed market enthusiasm. In stark contrast, the current environment shows a stark lack of activity, illustrating a divergence from previous cycles.

The correlation between compressed price movement at essential support levels and minimal on-chain activity signals a build-up of potential energy within the Ethereum market. This condition resembles a coiled spring, poised for an imminent breakout. While such stasis can persist, once it resolves, the resulting moves are typically rapid and substantial.

Monitoring Arbitrum net flow has become essential. An unexpected uptick in these flows could indicate that the current period of uncertainty is about to come to an end, ushering in a new direction for Ethereum’s price action.

Ethereum’s Current Position and Prospects

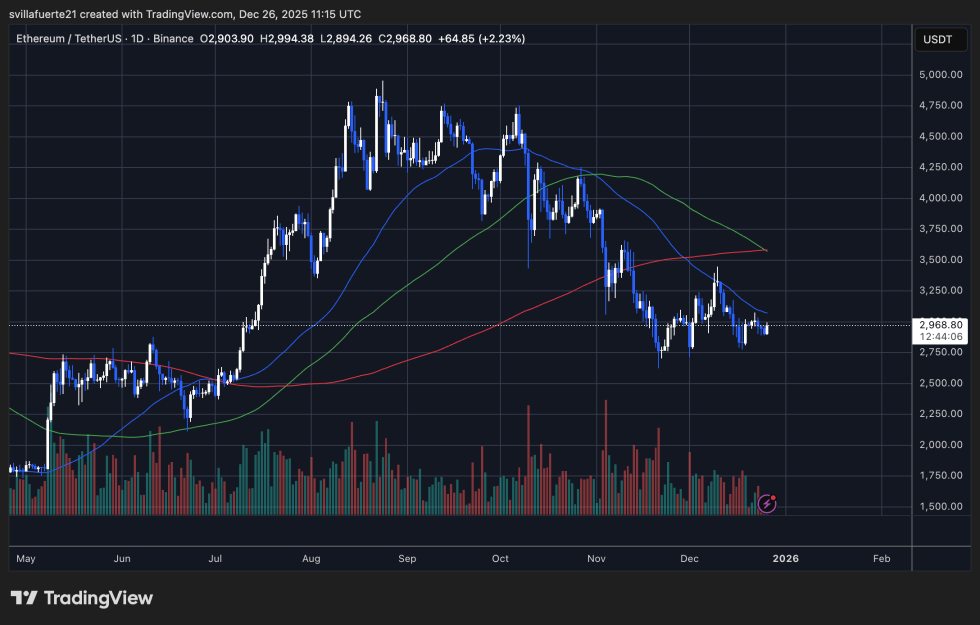

In the latest assessments, Ethereum trades in the vicinity of $2,970, trying to find footing after a substantial drop from its peak of $4,800. Recent price movements indicate minor attempts at recovery, yet the overarching market structure remains precarious. The formation of lower highs and lower lows points to a prevailing bearish trend, despite any short-term bounces.

From a technical analysis standpoint, the price is situated below its essential daily moving averages. The quicker moving average has sharply declined, marking a significant resistance level, while the longer-term averages form a substantial supply zone between $3,300 and $3,600. This cluster impedes the potential for a sustained upswing unless robust volume and momentum are witnessed.

While the recent rebound from the $2,800-$2,900 range has staved off deeper losses for the moment, it has been marked by weak trading volume, indicating that purchasing power lacks conviction. In contrast, the initial downturn saw strong selling pressure, reinforcing the dominant bearish trend.

Critically, the $2,800 zone serves as the backbone of support. A significant breach below this level could trigger accelerated losses and affirm continued bearish sentiment. On the flip side, for Ethereum’s momentum to shift positively, it must reclaim and sustain prices above the $3,200-$3,300 range, while also breaking through its declining daily averages.

With the market in a precarious position, developing a strategic approach is essential for traders and investors alike. Understanding these dynamics will be crucial as Ethereum seeks direction in the coming weeks.