The current trends in Bitcoin investments reveal a complex situation, as investors respond to market volatility. Despite the cryptocurrency’s apparent stabilization, many holders are increasingly realizing losses. This behavior highlights a significant shift in investor sentiment.

The Rise in Realized Losses for Bitcoin Investors

A recent analysis by leading data platforms indicates that there has been a consistent increase in the 90-day simple moving average (SMA) of Bitcoin’s realized losses. This specific metric reflects the total dollar amount of losses that investors are accounting for through their trades.

In the accompanying chart, you can observe the fluctuations in the 90-day SMA of realized losses over recent years. This visualization helps in understanding how investor behavior changes in response to market dynamics.

The data clearly demonstrates that between the months of July and November, losses remained relatively low. However, a noticeable uptick has occurred since then, revealing that more investors are divesting their coins at a loss.

It’s important to point out that the metric referenced is not the conventional calculation of realized losses, but rather an adjusted version that accounts for clusters of addresses belonging to the same investor. This entity-adjusted model ensures that only transactions between different entities are considered, providing a more accurate representation of market behavior.

Recent figures indicate that the current 90-day SMA of Bitcoin’s realized loss stands at around $300 million, marking a peak not seen since the early part of 2023. Previous capitulation events in this cycle were smaller, with mid-2024 losses reaching below $100 million, and the first few months of 2025 showing marginally higher figures.

When compared to the dramatic losses of the 2022 bear market, where the 90-day SMA exceeded $600 million, the current situation is less severe. However, the persisting trend of loss realization suggests that this capitulation may have the potential to escalate further. This phenomenon is particularly intriguing given the stabilization of Bitcoin’s market price since November.

This ongoing trend may suggest that key investors are becoming disenchanted with the market’s stagnation, prompting them to exit to mitigate further losses.

Bitcoin’s Price Volatility: A Recent Surge and Pullback

In recent trading, Bitcoin’s price exhibited significant volatility, initially surging beyond the $90,000 mark before retreating to approximately $87,500. This fluctuation effectively negated the brief recovery.

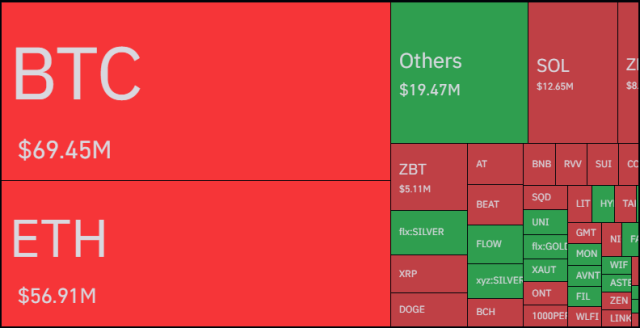

Such volatility has led to substantial liquidations in the Bitcoin derivatives market, totaling over $69 million, as reported by various tracking services. This figure highlights the extent of market turbulence and its impact on investor positions.