XRP is starting the new year with efforts to regain stability following recent challenges. After a tumultuous 2025, characterized by ongoing selling pressure and failed recovery attempts, this resurgence is noteworthy. Over the last few days, XRP has surged more than 15%, indicating that investors might be cautiously returning after a phase marked by risk aversion in the crypto landscape.

Beyond just price changes, examining on-chain metrics and derivatives data reveals a significant shift in market sentiment. Recent insights show that the Taker Buy/Sell Ratio for XRP has improved remarkably, nearing 0.991—its highest level since late November. This ratio measures the balance between buyers and sellers, giving a clear indication of market dynamics.

The increase towards the neutral 1.0 level reflects a decline in seller dominance. As buyer participation rises, confidence appears to be returning to the market. Unlike previous rebounds that occurred at local highs, this time the shift comes after an extended negative phase, suggesting a potential change in market sentiment.

This evolving landscape for XRP indicates an exit from a purely defensive market stance. The sustainability of this recovery hinges on factors such as price consistency, increased trading volumes, and the capability of buyers to maintain their momentum as the overall market conditions continue to evolve.

XRP Market Insights from Derivatives Data

Insights from the latest analysis reveal a marked change in the short-term market structure for XRP, highlighting a slowdown in selling pressures. Notably, recent derivatives data indicates that multiple signals are starting to align in favor of buyers after weeks of bearish dominance.

In mid-December, a sellers’ market prevailed, but recent trends suggest a sentiment shift. The uptick in aggressive buying indicates that sellers may not be as aggressive, allowing buyers to confidently place orders without facing significant resistance.

According to the analysis, the rising taker buy/sell ratio signifies a departure from the bearish attitudes seen earlier. The growing confidence among traders reflects a shift from a fear-driven market to a more stable positioning, conducive for buyers.

This positive transformation aligns closely with the recent price movements of XRP. The recovery appears to be underpinned by genuine demand rather than a lack of liquidity, suggesting a healthier market landscape. The solid demand reduces the risk of sudden downturns, as buyers are actively engaging with the available supply.

One critical metric to watch is the near-1.0 threshold in the taker buy/sell ratio. Maintaining strength above this level would indicate that buyers are gaining a more dominant role, possibly laying the groundwork for a more sustainable recovery than previous upticks.

Resistance Levels and Ongoing Recovery Efforts

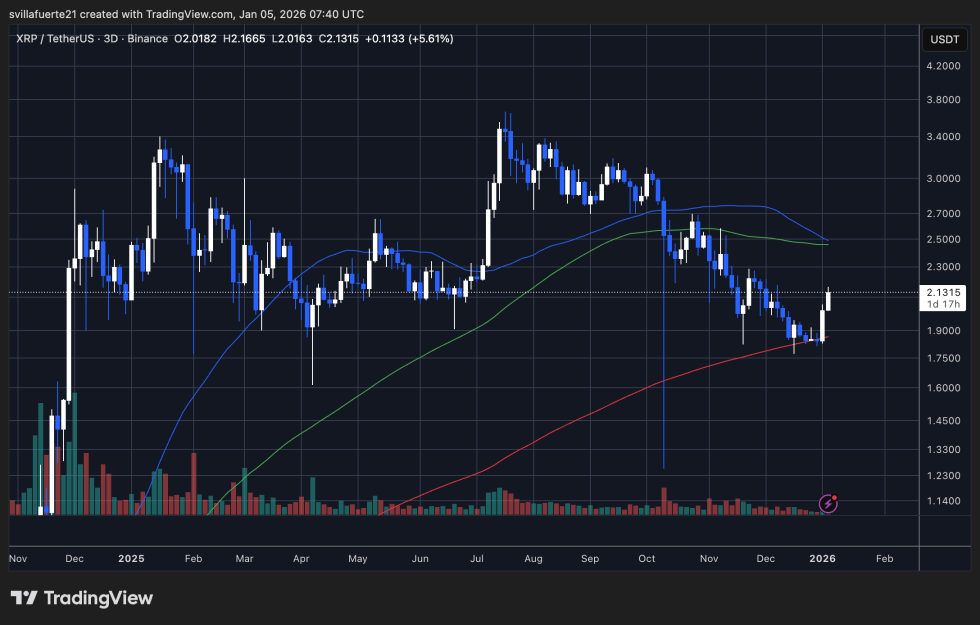

XRP has made significant strides in its short-term recovery journey, breaking away from months of downward trends. This move from the $1.85–$1.90 area up past $2.10 has been one of the most robust bullish trends noted since late October, highlighting that sellers are losing grip after prolonged distribution. However, it is crucial to remain cautious, as this rebound resembles more of a relief rally than a confirmed sustainable trend change.

Currently, XRP continues to trade below its 100-day and 200-day moving averages, which are now acting as dynamic resistance around the $2.45–$2.60 threshold. Historically, XRP has encountered obstacles in maintaining upward momentum when trading below these key levels, suggesting that a reclaim by bulls is necessary for a shift in the medium-term outlook. Meanwhile, the flattening of the 50-day moving average points to a decline in bearish momentum, though it has yet to turn positively.

Volume trends also provide critical context to the current scenario. Despite recent gains, trading volumes are still lagging compared to previous dramatic rallies, indicating cautious buying habits instead of aggressive accumulation. The $1.85 mark serves as vital support, aligning with the long-term moving average that has helped prevent deeper declines.

The ongoing price movement fosters improved sentiment among traders, but sustained optimism will depend on whether XRP can breach higher moving averages and maintain momentum beyond immediate resistance levels.

Featured image from ChatGPT, chart from TradingView.com