Amid ongoing economic turmoil, Venezuela is rumored to have accumulated a substantial amount of Bitcoin, estimated between 600,000 to 660,000 BTC, potentially valued at approximately $56 billion to $67 billion based on current market prices. This information, highlighted by analysts from Whale Hunting, has attracted significant attention globally.

The accumulation process reportedly began around 2018, with resources believed to be sourced from gold sales and oil transactions conducted in stablecoins, subsequently converted into Bitcoin. The rumors have sparked discussions regarding Venezuela’s financial strategies and their implications for the broader Bitcoin market.

The Reality According to Public Records

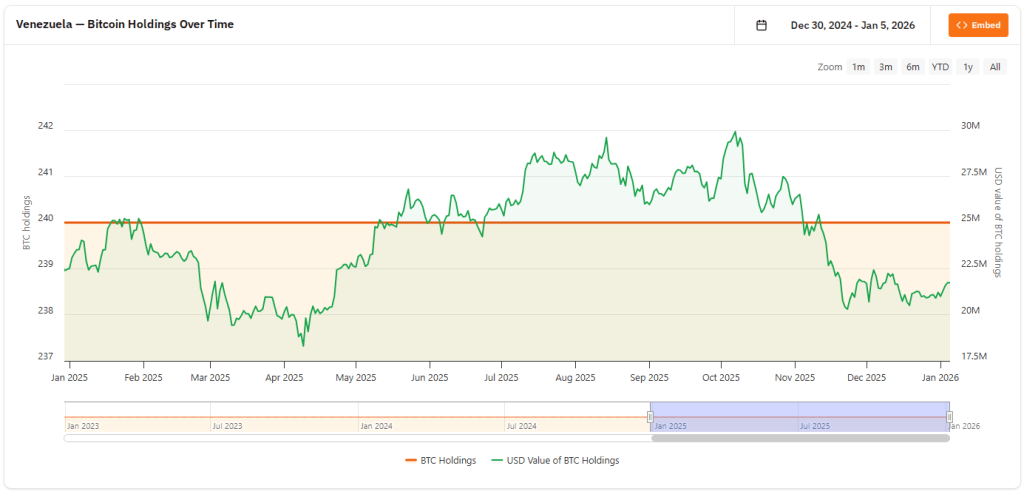

However, public blockchain analysis and treasury records present a different scenario. Data indicates that the Venezuelan government’s official Bitcoin wallets hold only about 240 BTC, equivalent to roughly $22 million at today’s rates. This stark contrast raises questions about the authenticity of the larger claims.

Understanding the Alleged Accumulation

Various sources proposing the larger Bitcoin figure point to several possible methods of accumulation. Reports have linked state-owned gold sales and oil shipments, often priced in USDT or similar cryptocurrencies, to these claims. Additionally, there are suggestions that seized mining equipment and obscure trading methods might have facilitated the transfer of wealth into Bitcoin over time.

These potential methodologies raise concerns, as large amounts could theoretically evade traditional tracking measures, implying that undisclosed transactions might be prevalent.

Market Responses and Political Implications

The Bitcoin market has reacted significantly to these rumors, particularly as prices hovered around $92,000. Speculation has arisen about the implications of such a Bitcoin reserve on geopolitical tensions and the potential for foreign intervention should these assets exist.

Furthermore, recent comments from prominent officials have amplified the intrigue surrounding the intersection between geopolitical events and cryptocurrency dynamics.

Why Skepticism Remains Essential

While blockchain technology is transparent, obscuring assets is feasible through various methods like mixers or custodial wallets. Thus, proving the veracity of high-profile claims is complex without transparency from those managing the assets or a thorough audit. Until credible data is presented in the form of verified custody records or independent evaluations, the assertions regarding Bitcoin reserves should be considered speculative at best.

Considering the Impact: If True, What Does It Mean?

If substantiated, Venezuela’s alleged Bitcoin holdings would notably shift market paradigms. However, as it stands, the official Bitcoin assets supposedly owned by the country remain minimal compared to the sensational reports circulating. A claim of 600,000–660,000 BTC, if proven, could transform market strategies and investor perspectives.

Geopolitical Context

Recently, heightened tensions have emerged surrounding Venezuelan President Nicolás Maduro, following significant military operations conducted by US forces. This has renewed scrutiny on the nation’s reported Bitcoin holdings and oil resources, capturing the attention of analysts observing potential ramifications for the global cryptocurrency landscape. The situation continues to evolve, leaving experts keen on exploring the outcomes of these developments.

Featured image from Gemini, chart from TradingView