Ethereum is currently navigating a pivotal moment in its market trajectory, with price movements reflecting a complex interplay of market sentiment and underlying data. After experiencing fluctuations, Ethereum is striving to establish a foothold around the $3,100 mark, a significant psychological barrier that could influence its future course. Traders are exhibiting caution, watching for signs of strength as the cryptocurrency oscillates within a crucial zone of interest.

The latest insights from crypto analytics platforms shed light on the prevailing dynamics in the Ethereum ecosystem. As of now, the Open Interest across Ethereum derivatives hovers around $7.8 billion, coinciding with the current price levels. This situation is noteworthy for several reasons: the Open Interest is stable, signaling that neither mass departures from positions nor excessive risk-taking is occurring. Such stability often indicates a period of consolidation, where traders are reluctant to commit further until a clearer trend emerges.

This cautious approach often precedes significant price movements, as periods of calm can lead to increased volatility once traders finally escalate their positions. The market’s inclination towards maintaining existing positions instead of making drastic moves can signal an impending shift, either upwards or downwards, depending on future catalysts.

As Ethereum approaches this critical juncture, the interplay between current price stability and Open Interest will be instrumental. How this balance resolves will likely dictate Ethereum’s near-term performance and strategic responses from traders.

Open Interest in the Spotlight: Implications for Ethereum’s Trajectory

According to recent findings in a detailed report, the interplay between Ethereum’s price movements and the accompanying derivatives data is increasingly revealing. Over the course of the last few trading sessions, the cryptocurrency has demonstrated a slight upward trend coinciding with a rise in Open Interest. This synchrony is significant; it indicates that traders are entering new positions while keeping their existing ones intact. This active engagement suggests a market teetering on the edge of transformation rather than standing still.

At this stage, volatility is on the rise, marking a departure from earlier, quieter periods. This environment is usually a precursor to dramatic price shifts, as assets begin to trade within tight ranges and prepare for breakouts. The recent uptick in Open Interest suggests that the market is showing renewed confidence, as it surpasses key moving averages. This trend indicates a willingness among traders to engage in riskier positions, highlighting a shift in market sentiment.

If Ethereum successfully maintains its position above $3,000 and Open Interest increases without drastic fluctuations, a more structured upward move could unfold. Under favorable conditions, it might reach the $3,700 threshold, a level that serves as a natural target for bullish traders.

The current environment for Ethereum appears ripe for an imminent shift. As Open Interest trends upward and demand shows signs of resurgence, a decisive price movement is on the horizon. The market is at a crossroads — it will either break free above the critical resistance at $3,324 or experience a downturn marked by potential liquidations. The prevailing sentiment leans towards a bullish outcome, aiming to exceed $3,700, followed by an evaluation of the larger market trends.

ETH’s Consolidation: A Long-Term Perspective

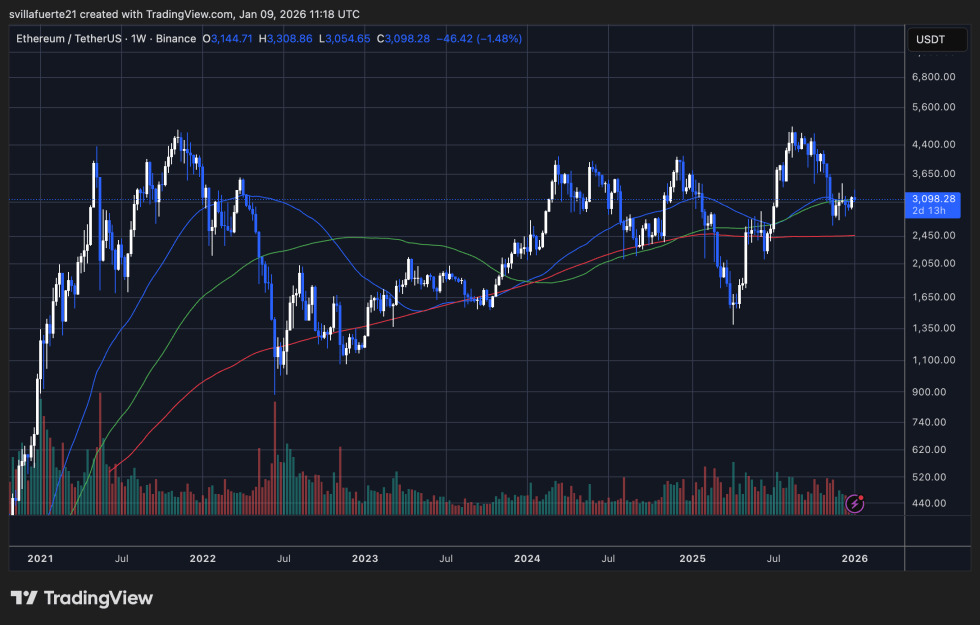

Analyzing Ethereum’s weekly chart reveals that the market is currently wedged between areas of solid support and lingering bearish forces. Following its inability to maintain momentum above the $4,000 to $4,200 range in early 2025, Ethereum entered a substantial correction phase, with prices retreating towards the $3,000 mark. This specific area has evolved into a battleground where bulls and bears are contending for dominance.

From a wider perspective, Ethereum is currently trading near critical long-term moving averages. The significant 200-week moving average is providing support in the mid-$2,000s, and maintaining this level suggests that the broader cycle from previous lows isn’t negated. Nevertheless, the price struggles to break past declining shorter-term averages, indicating that bullish momentum has yet to regain full strength.

Structurally, ETH is established within a large range of consolidation, oscillating between approximately $2,700 and $3,400. Sustaining a position above $3,100 keeps Ethereum within these range-bound conditions but does not confirm any reversal of the trend.

For bullish investors, retaking and sustaining levels above the $3,300 to $3,400 resistance would signal renewed strength and a pathway to potential gains. Until this price point is breached, Ethereum may be at risk for further downward movements if support is tested around the $2,800 to $2,700 levels.

Visual aids from leading platforms provide an informed context for these trends, illustrating the importance of ongoing market dynamics in ensuring informed trading strategies.