In the realm of finance, the phrase “Bitcoin as digital gold” symbolizes its ascent as a prominent store of value in a rapidly evolving market. While Bitcoin has faced challenges in recent months, the gold market has experienced significant gains, prompting a reevaluation of investment strategies.

This juxtaposition of performance raises questions about the perceived relationship between Bitcoin and gold, as investors often anticipate one asset will consistently outshine the other. However, recent analyses indicate that the correlation between Bitcoin and gold’s price movements may be overstated.

The Misunderstanding of Capital Dynamics Between BTC and Gold

On social media platforms like X, cryptocurrency analysts such as Darkfost frequently engage in discussions about the transfer of capital between gold and Bitcoin. According to recent observations, the common belief that funds transition from gold to Bitcoin may be inaccurately inflated.

To illustrate this misconception, Darkfost shared visual data showcasing periods where Bitcoin’s performance varies based on gold’s market behavior. This graph categorizes market trends: positive signals indicate Bitcoin’s value is above its 180-day moving average while gold lingers below, and negative signals show the reverse.

As depicted in the shared graph, the relationship between Bitcoin and gold does not appear as robust as many might assume. Darkfost points out that instances of Bitcoin outperforming gold are balanced by cases of underperformance, hinting at Bitcoin’s independent trajectory.

Darkfost noted:

This observation suggests that Bitcoin is charting its own path, lacking definitive indicators of consistent capital shifts from gold.

Moreover, Darkfost explained that a positive indicator does not equate to a direct capital migration from gold to Bitcoin. Determining a definitive capital flow connection between these two leading assets proves to be exceedingly complex.

Current Status of Bitcoin and Gold Prices

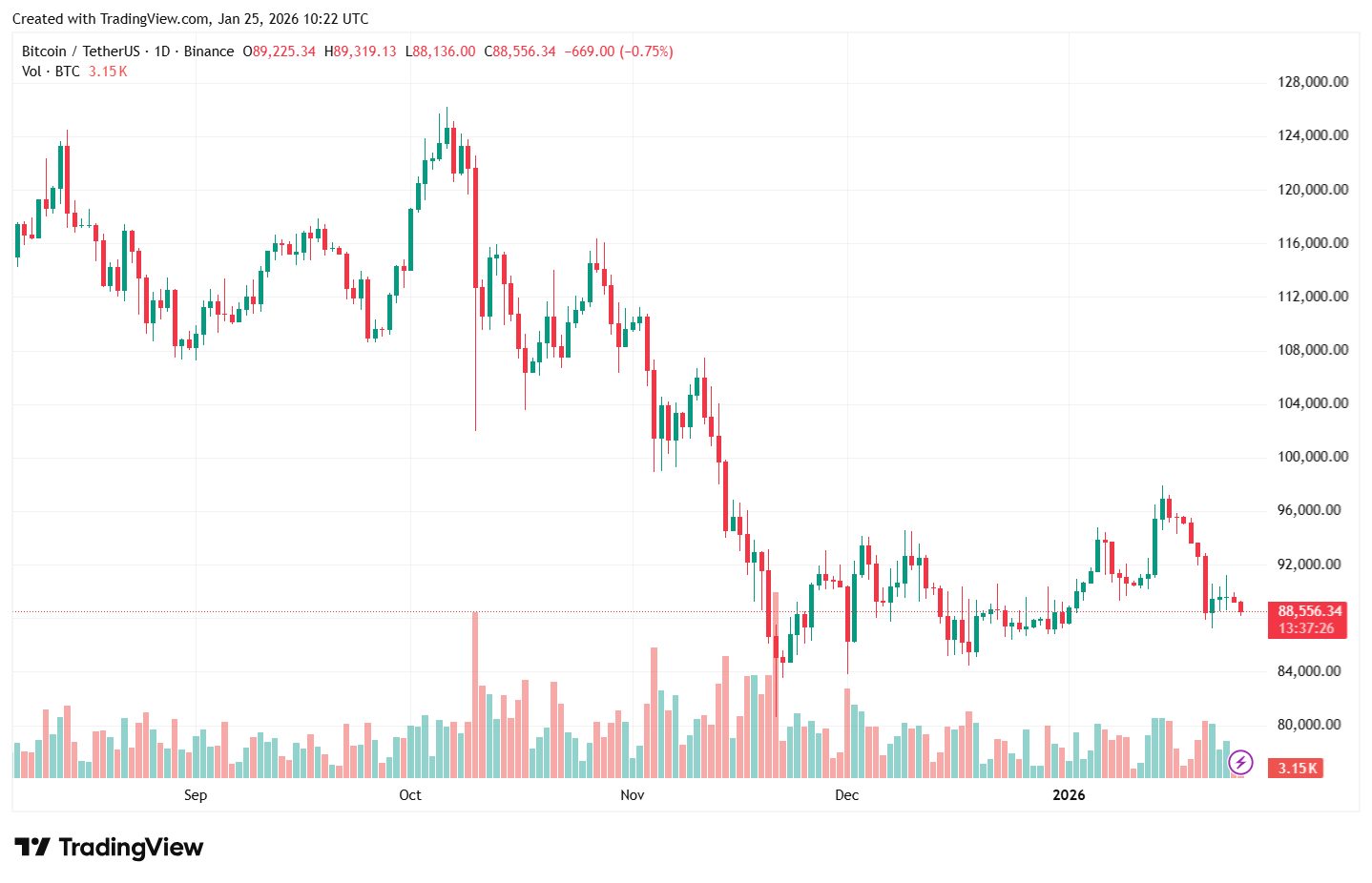

Entering this year, Bitcoin displayed strong momentum; however, this buyer enthusiasm has subsided over the last few weeks. Conversely, the price of gold has continued on a bullish trajectory, recently achieving a remarkable milestone by surpassing $4,900 per ounce.

At present, Bitcoin is trading around $89,230, showcasing limited price fluctuations within the last day. Data from CoinGecko reveals that Bitcoin stands nearly 30% lower than its all-time record soaring above $126,000.