Ripple has achieved a remarkable milestone by joining the ranks of the top ten most valuable private companies globally, boasting an estimated valuation of $50 billion. This achievement highlights Ripple’s evolution from a cryptocurrency-focused agenda to a significant player in the global financial landscape.

This ranking is crucial as it positions Ripple not merely as a cryptocurrency entity but as a robust infrastructure provider in payment services. The company is now being recognized alongside some of the leading firms in the fintech and artificial intelligence sectors.

Ripple Secures #9 Position Among Elite Global Companies

A recently circulated image on X showcases a “Unicorn Companies” list, positioning Ripple at an impressive $50 billion valuation, surrounded by other tech giants such as OpenAI and SpaceX. This list includes notable names with soaring valuations, such as OpenAI ($500B), ByteDance ($480B), and others that illustrate the competitive landscape of modern technology-driven businesses.

The leap from a $40 billion post-money valuation suggests significant growth, indicating a 25% uptick in just a brief period. Such rapid changes in valuation for late-stage private enterprises typically signal active market conditions that could lead to revised investor expectations or aggressive trading in secondary markets.

Ripple’s path to this current valuation has been influenced by strategic liquidity events, such as share repurchases that have established benchmarks for investors and employees alike. Historical valuations include marked increases, such as an approximate $15 billion valuation in 2022, illustrating Ripple’s dynamic growth trajectory.

This context is particularly significant for market analysts. It emphasizes that private valuations can differ substantially from market-driven prices and can be influenced by transaction structures or investor dynamics. However, Ripple’s presence on a premier list of private companies signifies a recognition of its role as a substantial entity in the payments infrastructure realm.

Furthermore, as discussions around initial public offerings (IPOs) continue, Ripple’s approach remains nonchalant regarding immediate plans to go public, emphasizing a focus on private funding rounds and strategic transactions. This inconsistency with IPO expectations can lead to unique challenges in price discovery for Ripple.

For the cryptocurrency market, Ripple’s exorbitant valuation does not automatically transform into a direct catalyst for token price changes. Instead, it reframes perceptions surrounding Ripple as an organization. The $50 billion valuation raises the bar for investors regarding future endeavors, potential mergers, and partnerships.

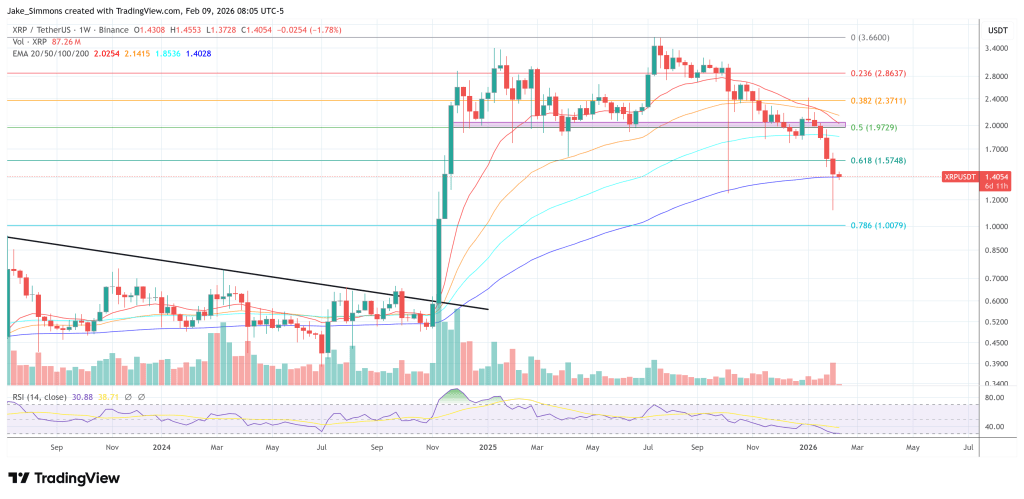

As of the latest data, XRP is trading at approximately $1.40, showcasing how market perceptions align with broader company narratives.