Changpeng “CZ” Zhao’s journey into the world of cryptocurrency began in an unexpected setting. In a friendly poker game in Shanghai, a casual conversation led him to consider the incredible potential of Bitcoin. A friend encouraged him to view it as a serious investment opportunity, advising him to allocate a significant percentage of his wealth to it.

The Birth of a Bitcoin Enthusiast

During a revealing podcast interview with All-In, Zhao shared how he first heard about Bitcoin in 2013 while working at a software company in Shanghai. He recalled how a friend introduced him to the concept. “I was skeptical at first, but gradually, I couldn’t ignore the buzz surrounding it,” Zhao mentioned, reflecting the initial hesitation many new investors experience.

This friend, a then-venture capitalist named Ron Tao, sparked Zhao’s interest during one of their small poker games. The conversation quickly escalated into Zhao learning about Bitcoin’s fundamentals, especially after connecting with Bobby Lee, the future CEO of BTC China. Their discussions were less whimsical and more centered on strategic financial decisions.

“Bobby didn’t just talk about Bitcoin as a fad. He presented it as an essential part of a balanced investment portfolio,” Zhao emphasized, highlighting a pivotal moment in his financial outlook. “He suggested putting at least 10% into Bitcoin. The potential gains far outweighed the risks.”

As Zhao delved deeper into Bitcoin, its meteoric rise from around $70 to nearly $1,000 by the end of 2013 sparked a sense of urgency and missed opportunity in him. “I thought everyone had already jumped on board before I even understood what it was,” he recalled.

BREAKING: ASIA’S LEADING CRYPTO ENTREPRENEUR DISCUSSES HIS $80 BILLION BITCOIN INVESTMENT JOURNEY #BITCOIN

“FEELINGS OF MISSING OUT ARE COMMON IN THIS MARKET.” pic.twitter.com/GqilPyC6xI

— The Crypto Historian (@pete_rizzo_) February 10, 2026

Despite his initial doubts, Zhao was determined not to miss the next technological revolution. “This is a transformative moment for the financial landscape,” he stated, reiterating his belief that Bitcoin represented the future of currency. As he prepared to fully engage in this new industry, he sold his apartment in Shanghai to fund his investments in Bitcoin.

“I decided to take that leap of faith, selling my apartment for around $900,000 and buying Bitcoin at several price points, even if it meant facing market fluctuations,” he explained, detailing the every step of his strategy. “I managed an average buy-in of about $600.”

Zhao connected with other early adopters and innovators in the Bitcoin space, attending conferences where he found a community of passionate individuals. “The early Bitcoin scene was vibrant and filled with thinkers and dreamers, not the ‘criminal’ image the media often portrayed,” he noted, mentioning key figures like Vitalik Buterin.

His wealth accumulation was not solely dependent on Bitcoin’s rise. Instead, it came from a series of calculated moves: from making key investments, taking early roles in cryptocurrency companies to creating the infrastructure that would eventually lead to the birth of Binance and its exponential growth.

Today, estimates of Zhao’s wealth vary widely. Forbes recently pegged him at $78.8 billion as of February 10, 2026, while Bloomberg calculated around $52.2 billion based on different evaluations. Regardless, his financial success testifies to the transformative power of good timing and bold investment in the cryptocurrency space.

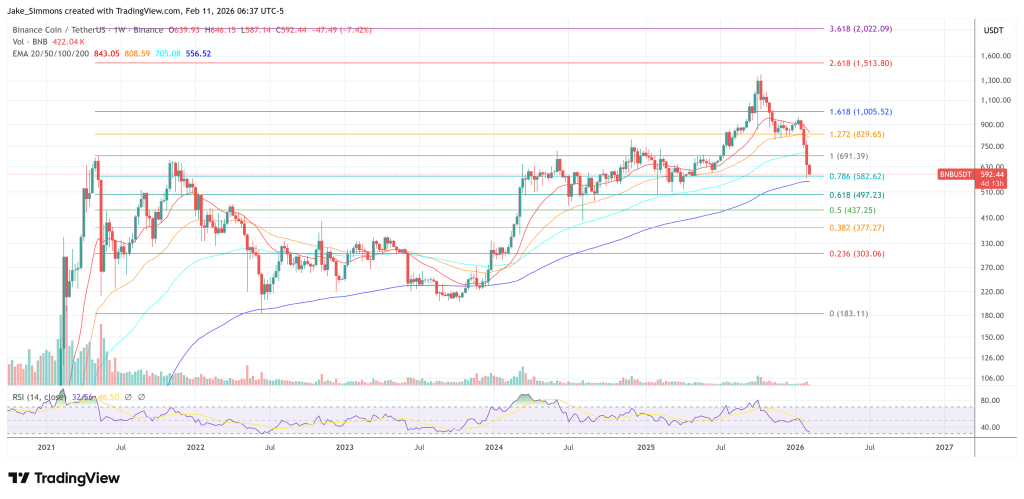

As of now, Binance Coin (BNB) has been observed trading at approximately $592.44.