The cryptocurrency landscape is witnessing an exhilarating phase, with Bitcoin approaching a pivotal resistance point close to its all-time high. Meanwhile, Ethereum has achieved significant milestones, surpassing the $4,300 threshold, marking a notable resurgence. This spike in performance has ignited a wave of optimism throughout the market, leading some experts to suggest that we might finally be on the brink of an anticipated altseason, as numerous altcoins exhibit bullish trends. The convergence of major coins rallying alongside increasing institutional interest is crafting a buoyant environment, setting the scene for potential dramatic shifts in the market dynamics in the upcoming weeks.

Despite the prevailing excitement, skepticism looms over the sustainability of this rally. Certain influential market figures are strategically positioning themselves for a potential downturn, placing bets against the prevailing momentum. Recently, Arkham Intelligence, a notable player in blockchain analytics, highlighted that Abraxas Capital, a well-established fund with considerable exposure to cryptocurrencies, is operating at a loss of over $100 million in its short positions.

This tug-of-war between bullish sentiment and bearish strategies is intensifying. With key cryptocurrencies like Bitcoin, Ethereum, and various altcoins nearing critical thresholds, their next movements will be crucial in determining whether we enter a full-blown altseason or undergo a period of further consolidation.

Abraxas Capital’s Bold Short Strategy Heightens Market Uncertainty

Arkham Intelligence recently disclosed that Abraxas Capital, identified by the account 0x5b5, is currently shorting an impressive $750 million in cryptocurrencies, grappling with an unrealized loss of $119.2 million. The liquidation price for their Bitcoin positions is pegged at $153,429—a threshold that could trigger mass liquidations across the market if breached.

In conjunction with its extensive short positions, Abraxas Capital is also managing significant holdings of over $573 million in Ethereum and $69.4 million in HYPE. Such positions appear delta-positive and delta-neutral, indicating that the fund is employing a sophisticated trading approach. They may be capitalizing on funding rates through platforms like Hyperliquid, leveraging dynamics in the perpetual futures markets. Additionally, there may be hidden positions on exchanges like Binance that are not visible on-chain, adding layers of complexity to their exposure.

While some analysts consider this strategy as a precautionary measure, others caution that such concentrated short positions could misfire if market momentum surges. A swift rally could force major short sellers, including Abraxas, to rapidly close their positions, potentially igniting a short squeeze that further elevates prices.

With Bitcoin presently hovering around $123K and Ethereum exceeding $4,200, both cryptos are on the cusp of all-time highs. The coming weeks will be pivotal in determining whether Abraxas’s tactical approach will yield dividends or evolve into a significant bullish driver for the broader cryptocurrency market.

Total Cryptocurrency Market Capitalization on the Brink of Breakout

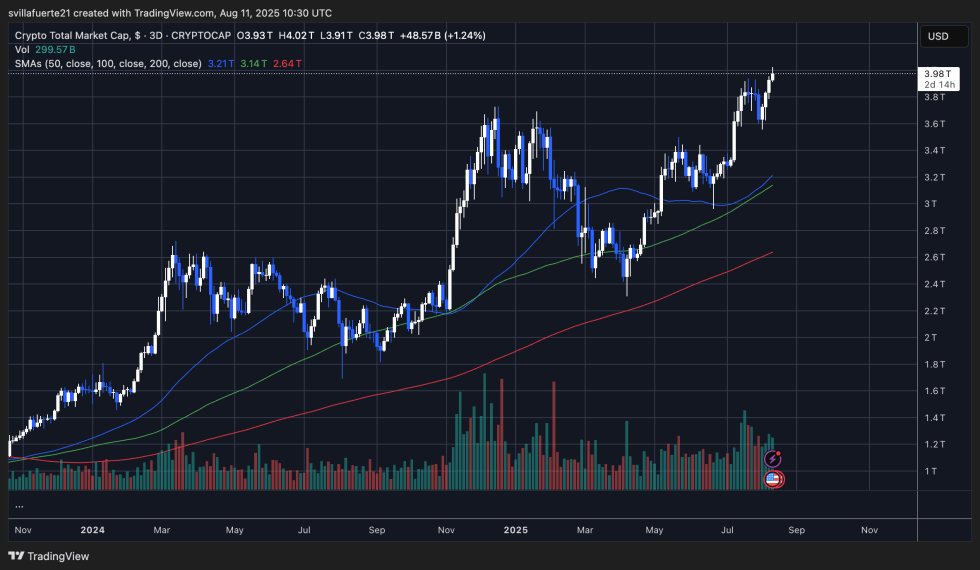

The overall cryptocurrency market capitalization is exhibiting robust bullish momentum, currently at $3.98 trillion, inching ever closer to the significant $4 trillion milestone. The market charts exhibit a resolute uptrend, characterized by a series of higher highs and higher lows that have emerged since the resilience shown in May.

The 50-day moving average (3.21T) is exhibiting a pronounced upward trajectory, comfortably above the 100-day (3.14T) and 200-day (2.64T) moving averages, solidifying a compelling long-term bullish framework. Additionally, this price action is underpinned by increasing trading volume, indicative of healthy market activity as capital flows into digital currencies.

A decisive breakout above the $4 trillion psychological barrier could catalyze even greater momentum and potentially establish new highs. This surge is likely to be propelled by the strength of Bitcoin and Ethereum, accompanied by renewed trader interest in altcoins as market participants gear up for a possible altseason.

Image sourced from Dall-E, chart data from TradingView.