In a remarkable turn of events at the recent Bitcoin MENA 2025 conference in Abu Dhabi, significant revelations emerged regarding the evolving stance of major banking institutions towards Bitcoin. Michael Saylor, the executive chairman of MicroStrategy, emphasized during his keynote that there has been a clear shift among US banks from skepticism to enthusiastic innovation in Bitcoin-related products.

“Over the last six months, I’ve had discussions with leading banks including BNY Mellon, Wells Fargo, and JP Morgan Chase,” Saylor stated. “They are now actively developing new services based on Bitcoin and its derivatives.”

BREAKING: Major banks are increasingly interested in launching #Bitcoin initiatives, according to Michael Saylor.

The banking world is embracing Bitcoin pic.twitter.com/AcHQRCaP7y

— Bitcoin Magazine (@BitcoinMagazine) December 9, 2025

The Bankers’ Newfound Interest in Bitcoin

Just a year ago, Saylor noted, many US banks were hesitant to engage with Bitcoin. However, they have now shifted gears, moving towards offering custodial services and credit options backed by Bitcoin. “Wells Fargo and Citi have announced their intentions to facilitate the custody of Bitcoin, with plans to extend credit in 2026,” he shared with attendees.

Saylor explained this banking transformation as part of a wider trend in governmental policy. He referred to Bitcoin as “digital gold,” affirming its status as a key strategic asset recognized at the highest levels of the U.S. government. “There is now a notable consensus amongst senior officials that Bitcoin is essential to global finance,” he added.

“The U.S. setting the tone for financial regulation influences markets globally,” Saylor argued. “As the world watches US financial moves, countries will likely follow suit, from South America to Asia.”

Positioning MicroStrategy as a pioneer, Saylor discussed his company’s ambitious goal of innovating BTC-backed credit markets. He highlighted that the firm currently holds approximately 660,624 BTC and intends to purchase up to a billion dollars worth weekly, indicating a relentless pursuit of Bitcoin.

His strategy revolves around transforming the volatile nature of digital assets into stable financial products. By over-collateralizing credit offerings, Saylor aims for principal protection even during significant market downturns, targeting returns between 8-12.5% by anticipating Bitcoin’s long-term appreciation.

“MicroStrategy’s equity can be seen as a leveraged Bitcoin investment, potentially doubling BTC-per-share every seven years,” he explained. For cautious investors, holding Bitcoin directly is advisable, while others seeking steady returns might find BTC-backed credit more attractive.

Additionally, Saylor proposed an innovative concept linking digital credit to “digital currency.” He outlined a framework for creating an instrument with minimal volatility and a competitive yield, suggesting it could be treated as a stablecoin that pays dividends while being entirely Bitcoin-backed.

Saylor concluded his address with a call to action for sovereign wealth funds. He urged global financial leaders to adopt Bitcoin custody solutions and develop BTC-related credit services, emphasizing that nations providing superior financial products could capture significant global capital.

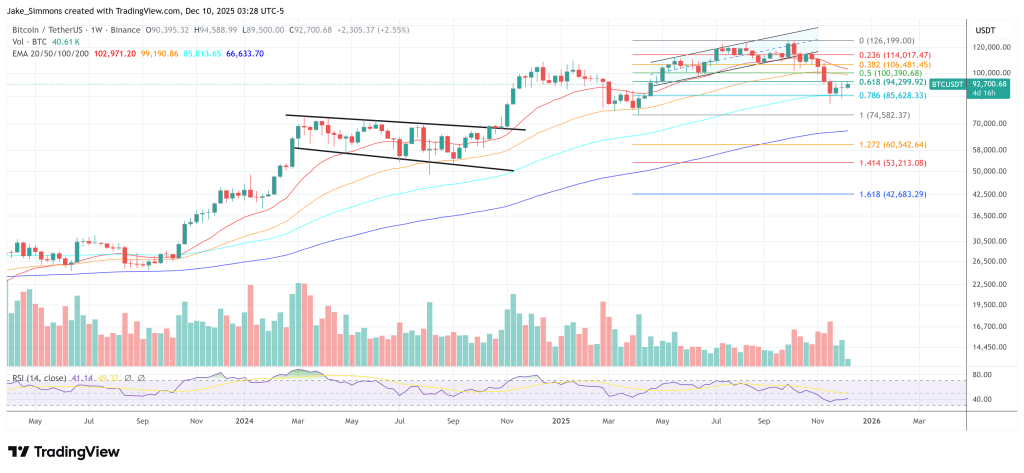

As of the latest market data, Bitcoin’s price stands at $92,700.