Recent trends indicate that the total stablecoin reserves on exchanges are experiencing a significant uptick, with noteworthy contributions from major platforms like Binance.

Growing Demand for Stablecoins in Exchange Reserves

A recent update from CryptoQuant highlights a surge in combined Exchange Reserves of stablecoins, specifically focusing on those built on Ethereum and Tron.

The concept of “Exchange Reserve” pertains to the total sum of specific cryptocurrencies stored in wallets owned by centralized exchanges. This metric gives insights into market demand and liquidity.

Typically, investors move coins to these exchanges for trading, which can reflect the overall selling pressure on the market. However, for stablecoins, which maintain value close to $1, this influx represents a different scenario.

Increased deposits of stablecoins might actually signify a #{bullish} sentiment. Investors often utilize stablecoins to safeguard their assets amid market volatility, looking to convert back into riskier assets when conditions improve, hence acting as a crucial liquidity source.

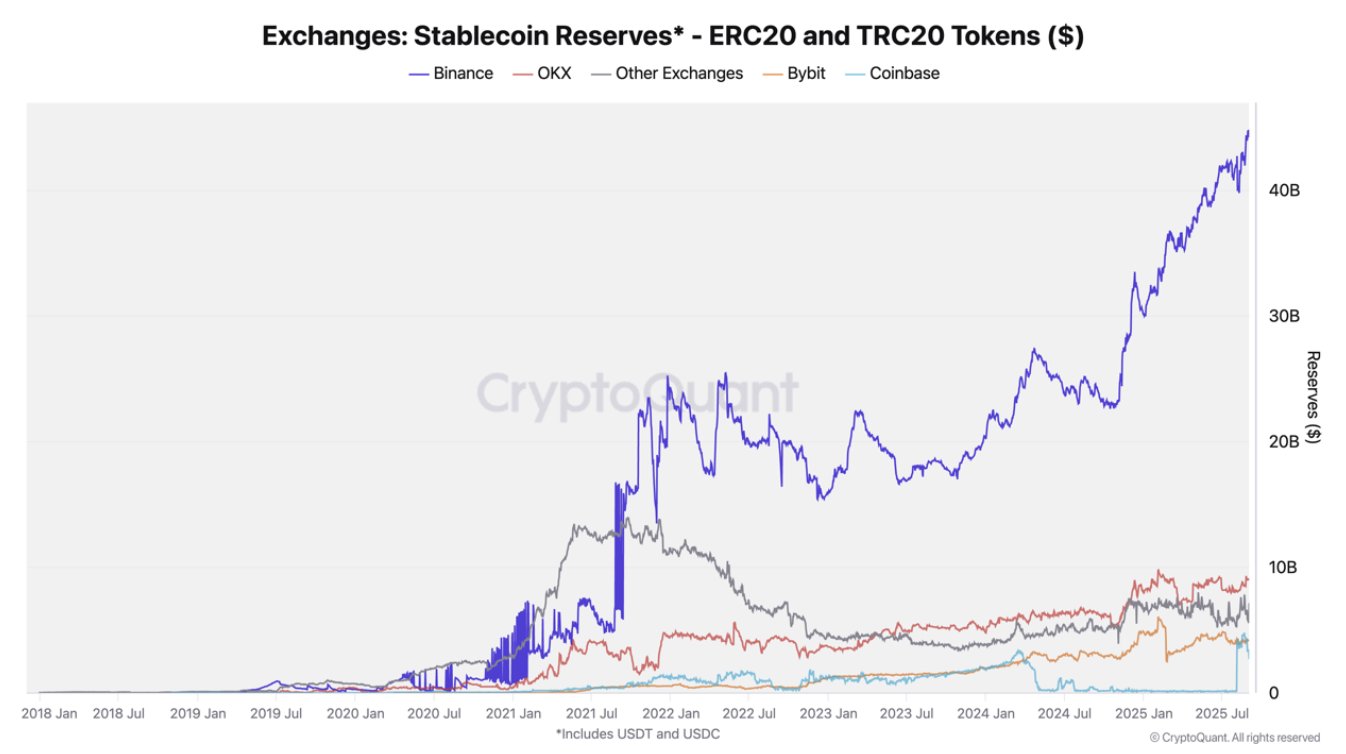

The following illustration depicts the trajectory of Exchange Reserves for various stablecoins across ETH and TRON networks:

The chart reveals a pronounced rise in stablecoin reserves recently, indicating robust interest in storing these assets with exchanges. The most prominent players contributing to this increase are USDC and USDT.

As a result of these trends, stablecoin reserves have reached an all-time high of approximately $68 billion. A breakdown of liquidity distribution among different platforms can be observed in the following chart.

The data indicates that Binance commands a dominant share of this liquidity, with a staggering $44.2 billion, which is about 67% of the total. Following closely is OKX, which holds around $9 billion.

The growth in the stablecoin liquidity landscape has been largely attributed to these two exchanges.

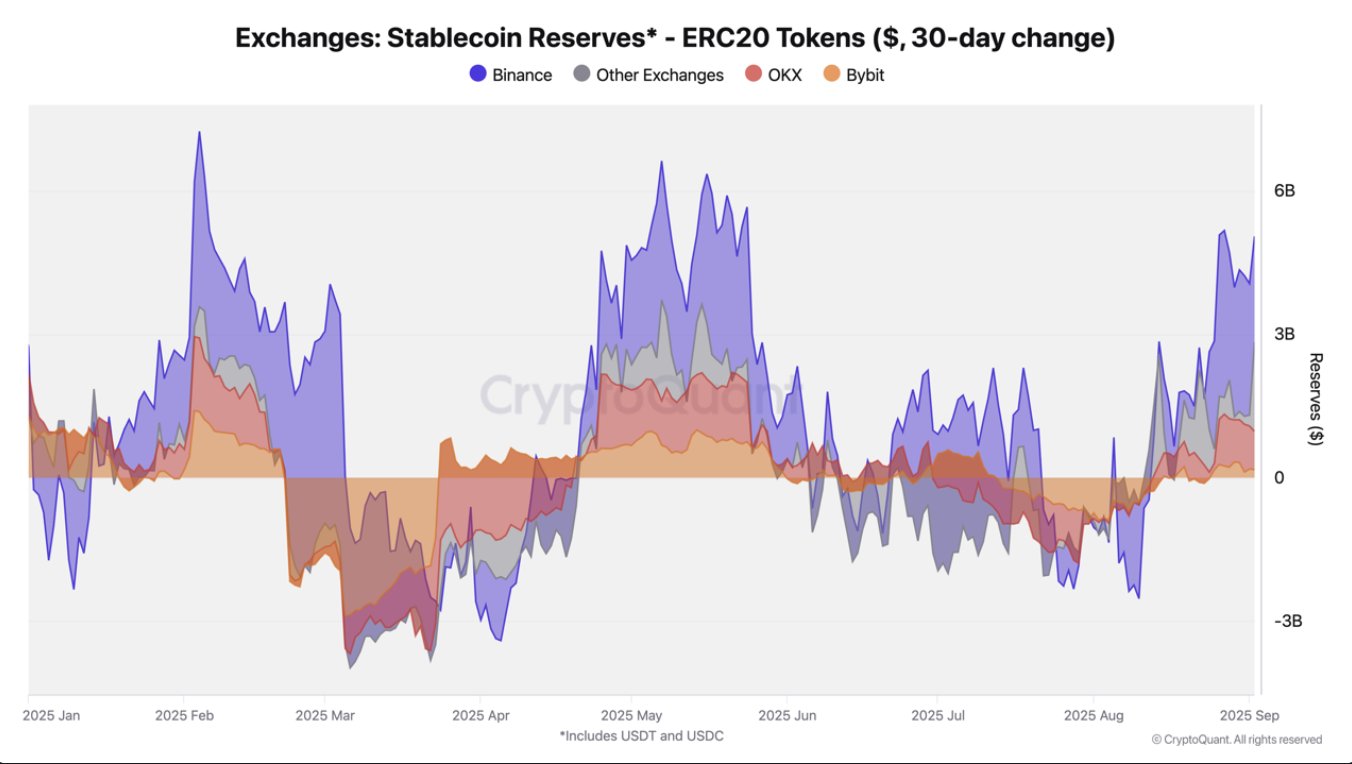

In the past month alone, Binance and OKX have attracted net inflows of approximately $2.2 billion and $800 million, respectively.

Current Bitcoin Market Dynamics

Meanwhile, Bitcoin has struggled to regain momentum, currently dropping back to around the $110,700 level.