The cryptocurrency landscape remains tumultuous as Bitcoin encounters substantial selling pressure, a reflection of the unpredictable crypto market. Currently hovering around a pivotal level of $110,000, this price point could significantly influence Bitcoin’s trajectory in the weeks to come. Sustaining above this threshold is crucial for maintaining bullish sentiment, which could pave the way for a potential rally towards previous all-time highs. Conversely, a dip below this support could trigger a sharp decline, leading to fears of a drop towards $100,000 and further diminishing market confidence.

In light of recent on-chain analytics, new insights from expert analysts shed light on shifting trends. Notably, a report from CryptoQuant reveals a significant increase in the Binance Exchange’s inflow metrics, suggesting that larger investors—often referred to as “whales”—are becoming more engaged in trading activities. The average deposit size has remarkably risen, signaling a shift from typical retail investments to larger transactions that indicate heightened institutional participation.

Increasing Whale Activity and Its Implications

The analysis from CryptoQuant, particularly regarding the Binance Exchange Inflow data, offers a crucial perspective on market dynamics. This metric, which monitors the average size of deposits into Binance, serves as an indicator of whether the market is being led by individual retail investors or larger entities. A rise in the average inflow suggests a marked presence of whale transactions. Recent reports indicate that this average has surged to a striking 13.5 BTC per transaction, highlighting a significant structural change in market activity.

Historically, this average hovered around just 0.8 BTC earlier this year, showcasing Binance’s former reputation as primarily a retail-focused exchange. The current surge indicates a profound shift, as institutional entities now play a dominant role in trading, exchanging significant volumes on a platform once considered suitable for smaller investors.

As the largest exchange by trading volume, Binance’s liquidity attracts whales keen on executing substantial trades with minimal disruption. This trend signifies a larger market evolution where institutional investment and whale accumulation are reshaping the landscape of cryptocurrency trading.

Bitcoin on the Brink of Critical Support

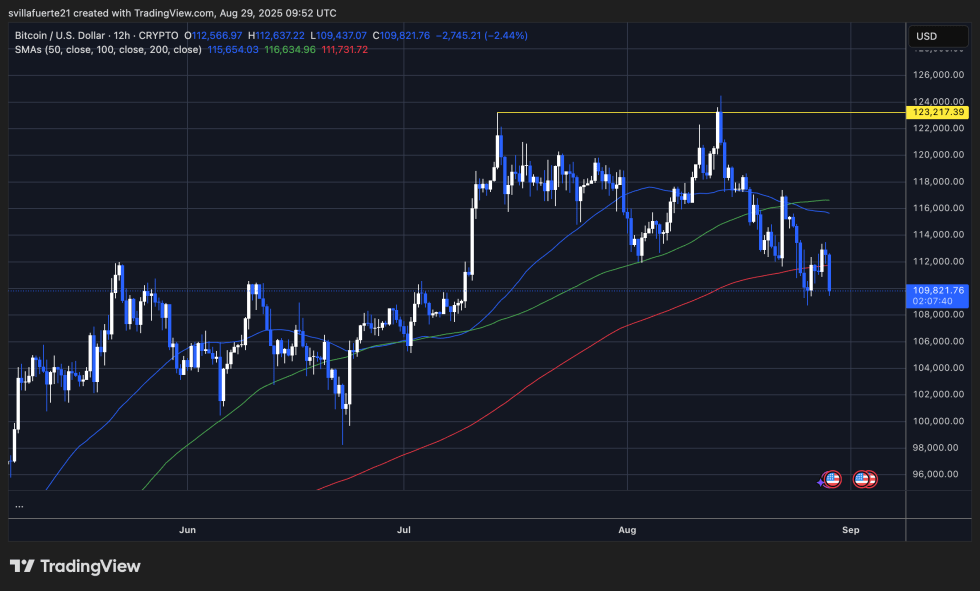

At present, Bitcoin is trading around $109,800, navigating downward pressure amid a stark pullback. A previous rejection at highs near $123,000 earlier in August has forced BTC below key moving averages, namely the 50-day and 100-day, currently standing at $115,654 and $116,634, respectively. This development further solidifies the prevailing bearish momentum affecting short-term trading.

Currently, Bitcoin’s performance is testing the 200-day moving average at approximately $111,700. This level is critical for the market—holding above it could prevent further declines, while a firm breach could lead Bitcoin to lower support levels between $106,000 and $108,000. A breakdown here could escalate negative sentiment, making a retreat towards $100,000 increasingly likely.

A rebound above $112,000 could alleviate current selling pressure, opening pathways for BTC to retest the $115,000 mark. To regain momentum, bulls will need to reclaim this zone to challenge the previous resistance around $120,000 to $123,000.

In summary, the interplay between whale activity and critical price levels will be instrumental in determining Bitcoin’s near-term future, amidst the complex dynamics of the broader cryptocurrency market.