Recent data indicates that the Bitcoin Coinbase Premium Index has experienced a significant increase, which may have contributed to the recent rise in Bitcoin’s price.

Recent Surge in Bitcoin Coinbase Premium Index

Julio Moreno, the Head of Research at CryptoQuant, highlighted in a recent post on X that the BTC Coinbase Premium Index has climbed into positive territory. This index measures the percentage difference between Bitcoin prices on Coinbase (in USD) and Binance (in USDT).

Related News: US Platforms Regaining Control in Bitcoin Holdings: Is There an Upside?

A positive value indicates that Bitcoin is currently selling for a higher price on Coinbase compared to Binance. This trend suggests that buying pressure on Coinbase is greater than the selling pressure on Binance. Conversely, a negative value means that Coinbase traders are more active in selling than their Binance counterparts.

Moreno shared a chart illustrating the recent trends in the Bitcoin Coinbase Premium Index:

The chart indicates that the index had previously fallen into negative values but has markedly bounced back into the positive range along with the recent price rally. This suggests that Coinbase investors are increasingly accumulating Bitcoin, which may be a key factor behind the current price increase.

Coinbase primarily caters to U.S. investors, including major institutional players, while Binance attracts a global audience. Therefore, the Coinbase Premium Index reflects the differing trading behaviors between American and international investors.

Throughout 2024, Bitcoin’s price movements have closely aligned with this index, indicating that U.S. “whales” have been a driving force in these trends. It’s reasonable to expect this pattern to persist during the current rally.

While the Coinbase Premium Index is currently rising, it’s crucial to monitor its movements, as fluctuations can occur rapidly. A downturn could signal bearish trends for BTC, mirroring past occurrences this year.

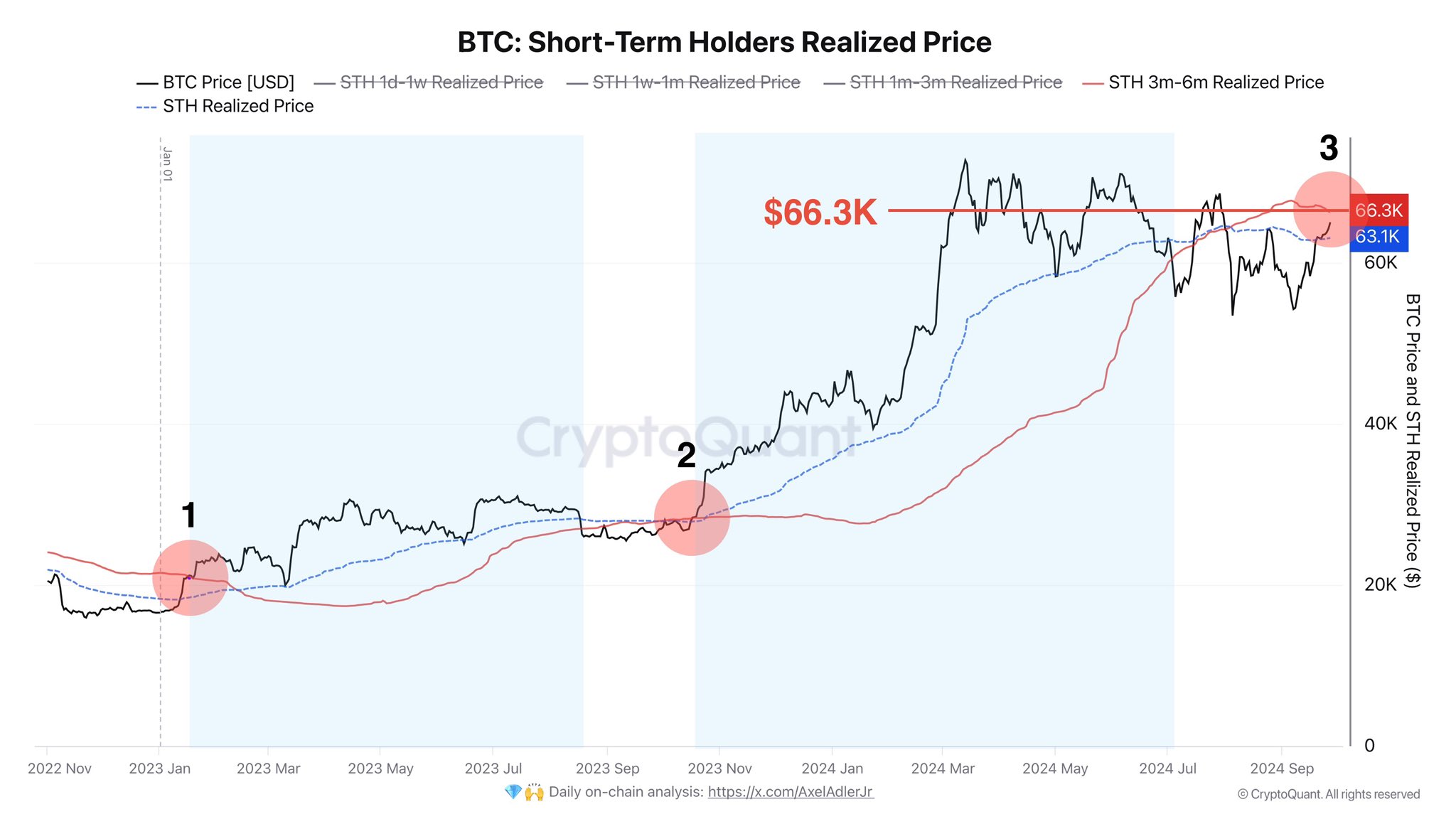

Additionally, Bitcoin is nearing the average cost basis for the last group of short-term holders. CryptoQuant’s Axel Adler Jr discussed this in a recent post.

This group of short-term holders, who acquired Bitcoin three to six months ago, currently has an average cost basis of approximately $66,300. If the price of Bitcoin exceeds this level, it would bring all short-term holders (those who bought in the last six months) back into profit.

Current BTC Price

As of now, Bitcoin is trading around $65,700, marking an increase of over 3% in the past week.