The trend surrounding the Bitcoin Coinbase Premium Gap has illustrated growing interest among US investors, indicating a bullish phase in the market.

Maintaining a Positive Streak in the Coinbase Premium Gap

Recent insights from crypto analysts point towards a sustained positive state of the Coinbase Premium Gap, a critical metric that measures the disparity between Bitcoin prices on Coinbase (USD) and Binance (USDT). This value is especially relevant for understanding investor behavior across different platforms.

The indicator serves as a reflection of market sentiment. A positive value indicates heightened buying pressure, particularly from American investors, signaling a preference for Coinbase among larger entities. In contrast, a negative value hints at stronger selling activity on Coinbase compared to Binance, suggesting a potential shift in market dynamics.

A visual representation captures the trajectory of the 30-hour moving average of the Bitcoin Coinbase Premium Gap over recent months:

The chart indicates that the 30-hour moving average has been continuously above zero, signaling consistent buy-side momentum on Coinbase relative to Binance. This streak has endured for roughly 73 days, a notable duration and the longest since the commencement of spot ETF trading last year.

During this timeframe, Bitcoin has demonstrated correlations with the Coinbase Premium Gap, highlighting the influential role of US institutional investors in shaping market trends.

This enduring positive trend can be interpreted as an encouraging sign for Bitcoin’s future performance. Nevertheless, market volatility remains a constant risk in the cryptocurrency landscape, necessitating careful monitoring of the gap for any potential downturns.

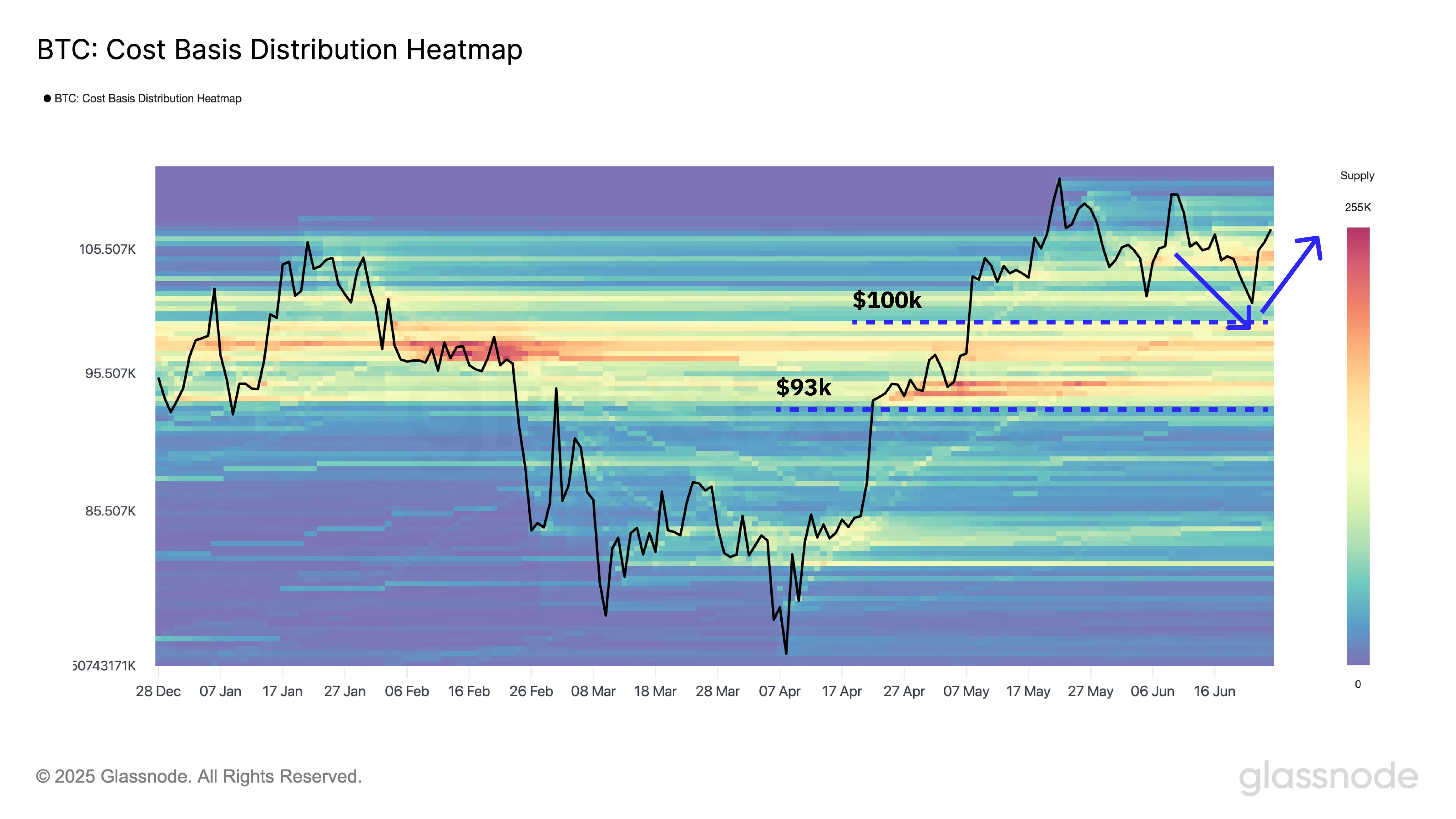

Additionally, Bitcoin’s recent recovery has allowed it to maintain a significant support level, as highlighted by blockchain analytics firm Glassnode. Insights shared on social media reinforce the robustness of current price levels.

The data from the Cost Basis Distribution shows that a considerable portion of Bitcoin’s supply was last traded within the $93,000 to $100,000 range. Glassnode underscores that maintaining these price levels is crucial for sustaining a bullish outlook, even amidst short-term fluctuations.

Current Bitcoin Pricing Trends

As of the latest updates, Bitcoin’s price hovers around $107,800, reflecting a 2% increase over the past week. This stabilization above critical support levels is a pivotal factor for market participants.