In a groundbreaking move, an international shipping company based in Cyprus has announced a strategic entry into the cryptocurrency market, purchasing a significant amount of Bitcoin. This initiative marks a vital step in integrating digital assets into corporate finance.

Robin Energy’s Strategic Bitcoin Investment

Today, Robin Energy confirmed its initial allocation of $5 million in Bitcoin (BTC) through Anchorage Digital Bank N.A., aligning with its newly established treasury management approach. This decision reflects the growing trend among companies leveraging digital currencies to diversify their investment portfolios.

The announcement has positively impacted the company’s stock performance, with shares soaring by 90% initially, peaking at $4.27 before settling slightly lower. Year-to-date performance shows a remarkable increase of 106.8%, indicating strong market confidence.

Robin Energy’s stock reached its all-time high earlier this year, suggesting a volatile but potentially lucrative period for investors. Petros Panagiotidis, the company’s CEO, expressed enthusiasm regarding this initiative, emphasizing the company’s commitment to long-term value creation through strategic cryptocurrency investments.

“Investing in Bitcoin aligns with our vision and the board’s strategic goals. We see Bitcoin as a vital asset in enhancing our corporate growth and delivering value to our shareholders,”

This move by Robin Energy echoes a broader shift in the corporate world, where more businesses are incorporating cryptocurrencies like Bitcoin and Ethereum (ETH) into their balance sheets. This trend underscores a belief in the potential long-term appreciation of these digital assets.

- For instance, Sora Ventures from Taiwan recently announced a massive $1 billion fund dedicated to Bitcoin.

- Japanese firm Metaplanet plans to invest $835 million in BTC shortly.

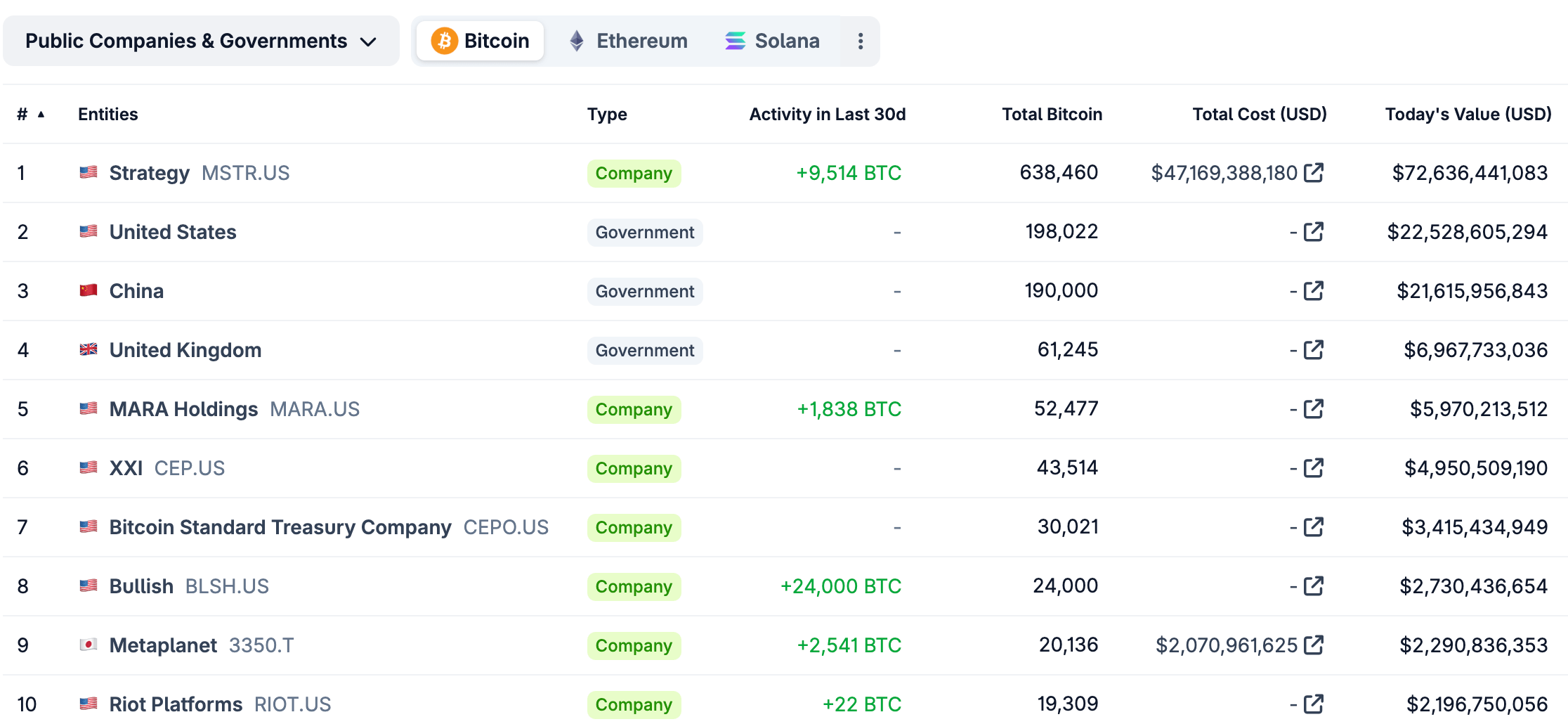

- Publicly traded companies now hold over one million BTC collectively, showcasing significant institutional interest.

The Rise of Ethereum: Emergence as a Strong Contender

While Bitcoin remains the undisputed leader in the cryptocurrency arena, Ethereum is swiftly gaining ground as a formidable competitor. In 2025, the adoption of ETH has experienced remarkable growth, bolstered by its extensive range of applications.

Jan van Eck, CEO of the asset management firm VanEck, referred to Ethereum as the “Wall Street token.” This recognition highlights Ethereum’s versatility, particularly in its role in enabling stablecoin transactions across its blockchain.

August 2024 marked a significant milestone for ETH-based exchange-traded funds (ETFs), which saw an influx of $4 billion, contrasting sharply with Bitcoin ETFs that experienced a $628 million outflow during the same period. Currently, Bitcoin is trading at $113,930, reflecting a positive 2.7% change in the last 24 hours.