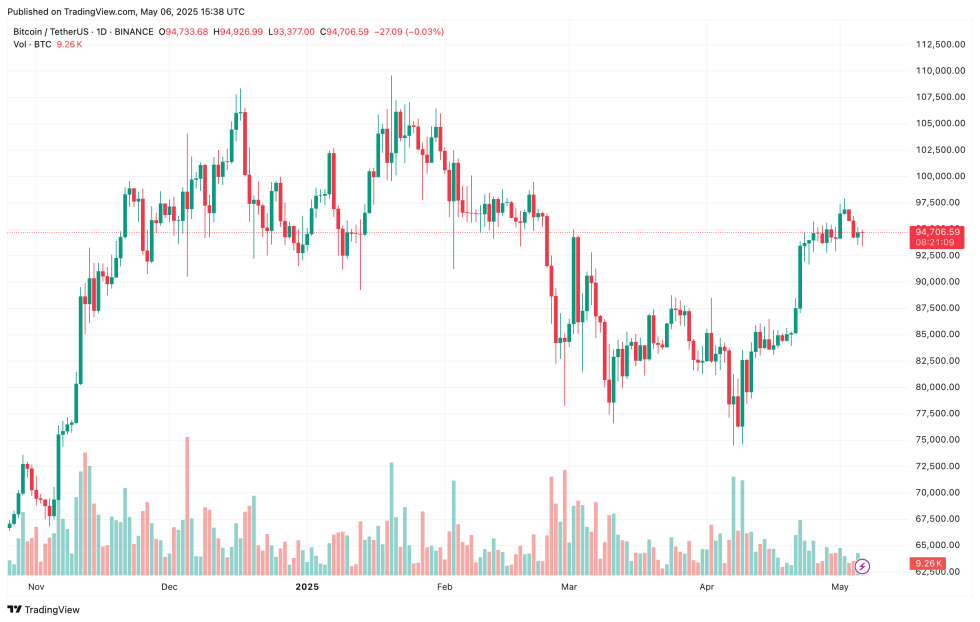

As Bitcoin (BTC) hovers around the mid-$90,000 range, prominent cryptocurrency analyst Ali Martinez warns that a failure to maintain a key support level could cause the cryptocurrency to drop to approximately $83,444.

Importance of Holding Key Support for Bitcoin

In a post on X, Martinez emphasized the necessity for BTC to maintain its crucial support mark at $93,198. If this level is breached, it could trigger a significant decline in the price of Bitcoin, potentially leading to a drop as low as $83,444.

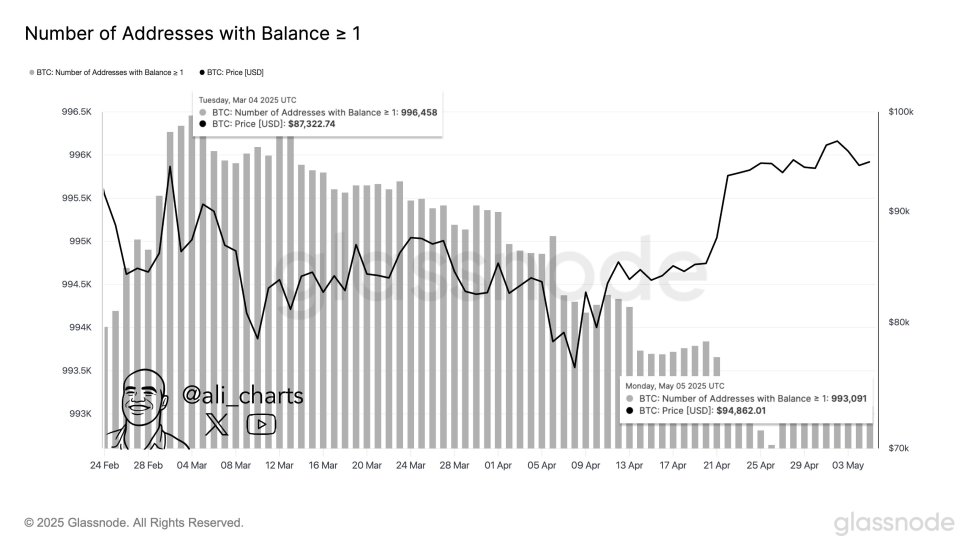

The analyst also noted a worrying decrease in the number of wallets holding BTC, which has seen a decline of 3,400 over the past two months. This trend indicates that many investors might be cashing in their profits rather than buying additional Bitcoin.

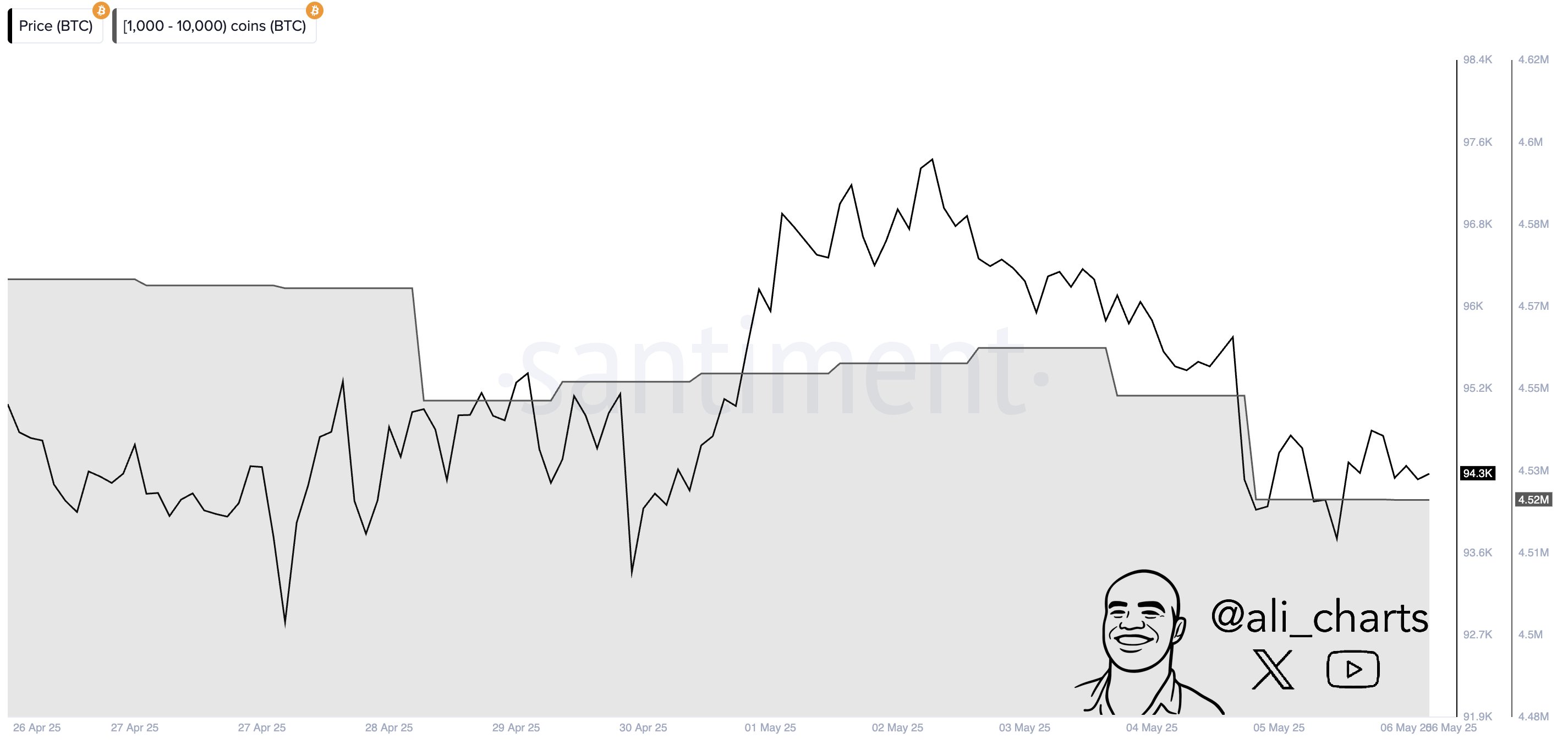

Adding to the bearish sentiment, Martinez pointed out that Bitcoin whales—wallets with substantial holdings—have sold off nearly 50,000 BTC in just the last ten days. This kind of activity often signals imminent short-term price corrections or periods of price stagnation.

Currently, Bitcoin’s price trend remains inconclusive. According to another analysis by crypto trader Ash Crypto, BTC has two open futures gaps on the Chicago Mercantile Exchange (CME)—one upward gap ranging from $96,440 to $97,680, and a downward gap stretching from $91,360 to $92,520.

Ash stated it is “highly likely” for BTC to visit the lower gap before potentially bouncing back strongly, which could elevate it above the $100,000 mark later this month.

In a more hopeful perspective, analyst Ted pointed out that BTC is currently undergoing the Wyckoff accumulation phase. He remarked:

BTC is facing a significant resistance level, suggesting a possible consolidation phase. It seems quite probable that BTC may retest the $92,000-$92,500 range before making its next upward move.

Attention on Tomorrow’s FOMC Meeting

Investors and traders are eagerly awaiting the upcoming Federal Open Market Committee (FOMC) meeting. Although the US Federal Reserve is expected to maintain current interest rates, the remarks from Fed Chair Jerome Powell could greatly influence risk assets, including Bitcoin.

Even though technical indicators reveal some weaknesses in the crypto market, on-chain data hints at an impending supply squeeze, with exchange reserves consistently shrinking. As of now, Bitcoin is priced at $94,706, reflecting a 0.8% increase in the last 24 hours.