The cryptocurrency market recently experienced significant fluctuations, particularly with Bitcoin, which showcased its characteristic volatility. Following a dramatic rise to just under $124,000, the leading digital asset swiftly corrected and dipped below the $115,000 mark. These rapid changes illustrate the precarious nature of current trading conditions while also highlighting the crypto market’s resilience in the face of changing economic signals.

A pivotal moment occurred during the much-anticipated address by Federal Reserve Chair Jerome Powell at Jackson Hole. His comments regarding potential adjustments to restrictive monetary policies sparked an instant rally in various risk assets, including Bitcoin. This momentum shift rejuvenated trading enthusiasm across the cryptocurrency landscape.

As a result of Powell’s remarks, Bitcoin exhibited a robust rebound, climbing above the significant $115K support level once more. This resurgence rejuvenated bullish sentiment among traders, who are now monitoring key resistance points that may dictate Bitcoin’s immediate future. Concurrently, altcoins joined in on the upward trend, reflecting renewed interest from investors reallocating their portfolios.

Market Response to Federal Reserve Insights

Market analysts, including notable commentator Darkfost, have pointed out that Powell’s address was a significant trigger for Bitcoin futures trading. His cautionary notes about the current economic landscape and the potential for policy modifications ignited a wave of optimism across financial markets. This assertion about possible policy easing pointed to a future with enhanced liquidity, which greatly benefits Bitcoin and other risk assets.

In the immediate aftermath, Bitcoin futures markets reacted explosively. In a mere quarter-hour post-speech, approximately $300 million surged into Binance’s futures market, indicating high sensitivity to central bank commentary. This event drove Binance’s Bitcoin Open Interest to about $13.3 billion, showcasing the dynamic interplay between macroeconomic signals and trading activity in the crypto domain.

Such sharp movements underscore the potent influence of central bank statements in directing market behavior. As liquidity conditions evolve, traders are poised to capitalize on favorable monetary developments, which could amplify the demand for cryptocurrencies like Bitcoin. This swift increase in demand also coincided with Bitcoin reclaiming critical support levels, reinforcing positive sentiment among traders.

Assessing Current Market Levels

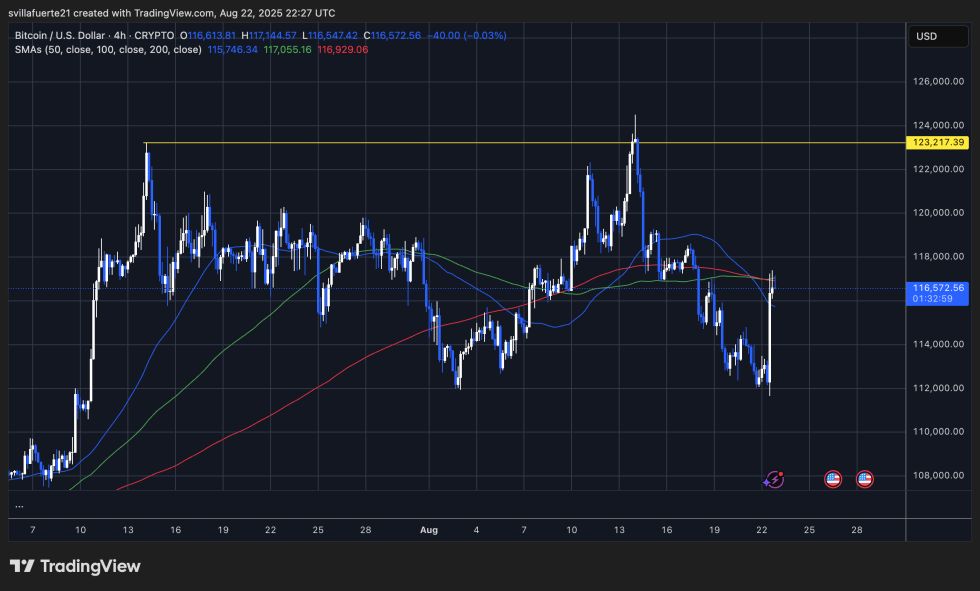

Analyzing Bitcoin’s 4-hour chart reveals notable volatility following Powell’s address. The cryptocurrency surged from lows nearing $112K back up to $116.5K, showcasing how macroeconomic triggers can efficiently channel liquidity into the market. This rebound corresponds with Bitcoin reclaiming the 200-period Simple Moving Average (SMA), which is now positioned just beneath the current price, serving as essential short-term support.

Despite this upward movement, Bitcoin still finds itself below critical resistance at $123,217, a level which has proven significant throughout this trading cycle. The market structure indicates potential consolidation phases, especially with the 50-SMA (blue) and 100-SMA (green) converging around $116K to $117K—this area may present a decisive battleground for bullish and bearish traders alike. Holding above these levels could pave the way for another attempt at prior highs, while a slide below could signal a return to the $112K support zone.

Current momentum indicators suggest that buyers are cautiously trying to seize control of the market, but the price action hasn’t confirmed a clear breakout yet. For bullish traders, maintaining prices above $115K to $116K is crucial for sustaining upward momentum. Meanwhile, bearish traders are watching for signs of rejection below the SMAs to amplify downward pressure on the asset.

As the market evolves, staying informed about macroeconomic influences and trading patterns will be key for investors and traders alike. Featured image from Dall-E, chart sourced from TradingView.