Recent analyses of on-chain data reveal that the Bitcoin network has achieved an impressive new record for its 7-day average Hashrate, even as the overall difficulty of mining continues to rise.

Record-Breaking Increase in Bitcoin Hashrate

The term “Hashrate” indicates the cumulative computing power that miners contribute to the Bitcoin blockchain. Traditionally measured in hashes per second (H/s), this has now evolved into exahashes per second (EH/s), representing a significant scaling of the network’s power.

When this metric experiences an upturn, it often signifies that new miners are entering the ecosystem or existing miners are enhancing their operations. This indicates rising confidence in the Bitcoin network, suggesting it is an appealing investment option for miners.

Conversely, a declining Hashrate may indicate that some miners are exiting the market, possibly due to decreasing profitability associated with Bitcoin mining.

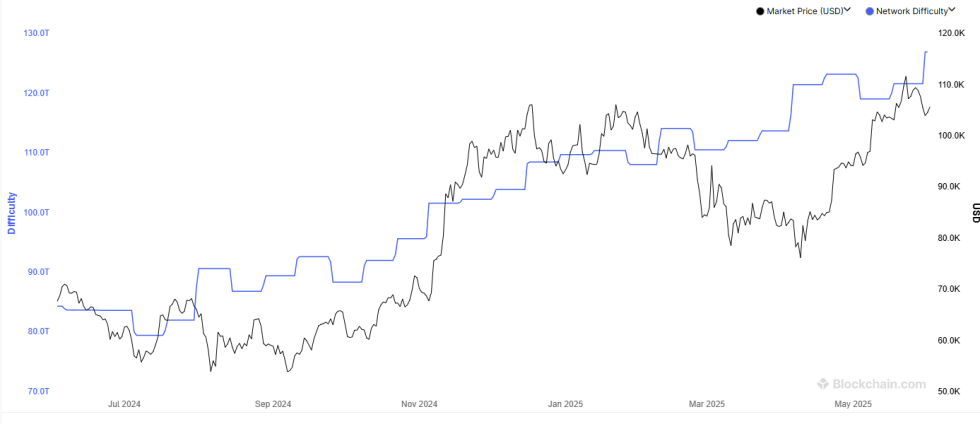

Below is a visualization from Blockchain.com illustrating the trend of the 7-day average Hashrate for Bitcoin over the preceding year:

The chart clearly indicates a dramatic uptick in the 7-day average Bitcoin Hashrate, now reaching a remarkable value of 942.6 EH/s, marking a historic high.

This increase is particularly noteworthy in light of recent challenges. Notably, Bitcoin’s price has been on a downward trend since its all-time high of approximately $112,000. Given that miners earn income primarily in BTC while facing expenses in fiat currencies, fluctuations in price can significantly impact their bottom line.

Interestingly, even with the ongoing price decline, miners continue to increase their computing resources, indicating a strong belief in Bitcoin’s long-term viability. It is essential to note that this metric represents a 7-day average, which leaves open questions about future trends and potential delays in changes.

Another aspect complicating the mining landscape is the heightened Difficulty level—a built-in mechanism of the Bitcoin protocol that regulates the challenge miners face when trying to validate transactions and mine new blocks.

This Difficulty metric is automatically adjusted roughly every two weeks, ensuring that the Hashrate fluctuations do not provide a windfall for miners, maintaining a stable earning rate for block rewards.

Therefore, miners must navigate increasingly competitive conditions, where new entrants into the market dilute earnings potential while rising operational difficulties can squeeze profit margins, all assuming constant market prices.

Such complications can lead to increased operational costs and may render mining economically unfeasible for those operating on thin margins. The most recent adjustment on Friday set a new all-time high for Difficulty; however, miners seem undeterred as they press forward with their expansions.

Current State of Bitcoin Prices

As it stands, Bitcoin has not demonstrated significant recovery signs, currently hovering around the price of $104,200.

The ongoing market dynamics present a complex picture for miners and investors alike, as the landscape continues to evolve.