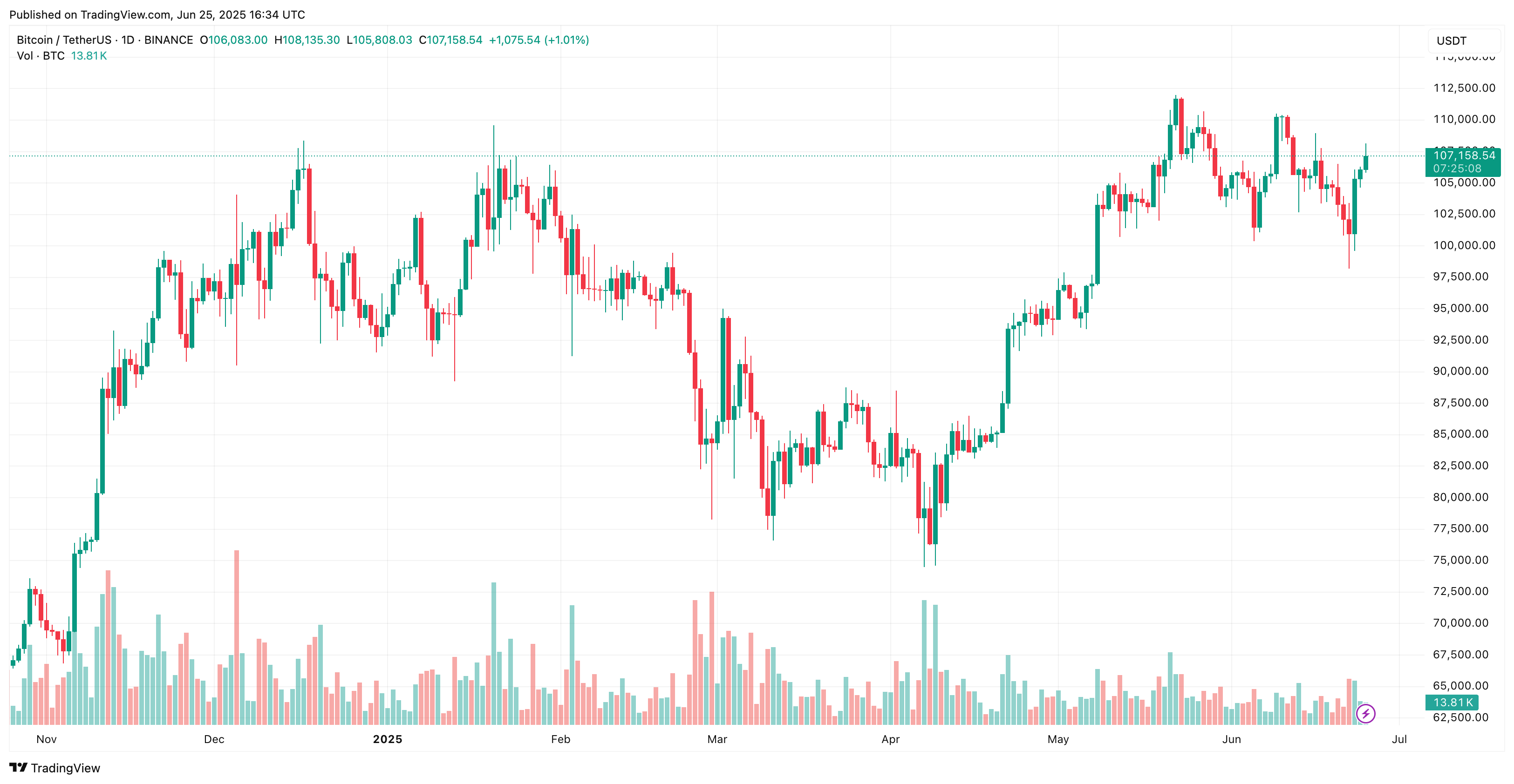

In light of the ongoing tensions in global markets, Bitcoin (BTC) has exhibited impressive durability, climbing from just under $98,000 in late June to over $107,000 recently.

Bitcoin’s Resilience Amidst Geopolitical Uncertainty

The performance of Bitcoin, especially during turbulent times between nations like Israel and Iran, highlights its evolving role as a reliable asset. Compared to June 2024, BTC has surged by 73.7%, showcasing an increased interest from institutional investors in the cryptocurrency landscape.

Despite this upward trend, there are significant indicators signaling caution. A recent analysis from CryptoQuant contributor Yonsei_dent suggests that the momentum of Bitcoin’s Market Value to Realized Value (MVRV) Ratio may be diminishing.

The MVRV ratio serves as a key metric, comparing Bitcoin’s current market worth to the value of all coins based on their last transaction price (realized value). A high MVRV might indicate that Bitcoin is overvalued and approaching market peaks, while a low value could suggest the opposite—creating potential buy opportunities.

When examining historical data, there’s a notable correlation between the MVRV ratio’s 365-day moving average peaks and significant market turning points. Presently, a flattening slope hints at a potential decrease in momentum.

Nevertheless, it’s important to clarify that this trend does not automatically signal an upcoming downturn. Instead, it may suggest that the market could be entering a transitional phase where investors focus more on strategic asset allocation and managing risks. As Yonsei_dent noted:

Typically, bull markets conclude with significant price inflations—often referred to as a “final blaze” before hitting their zenith. While there may be chance for tactical plays, investors should remain vigilant of long-term patterns indicated by on-chain metrics.

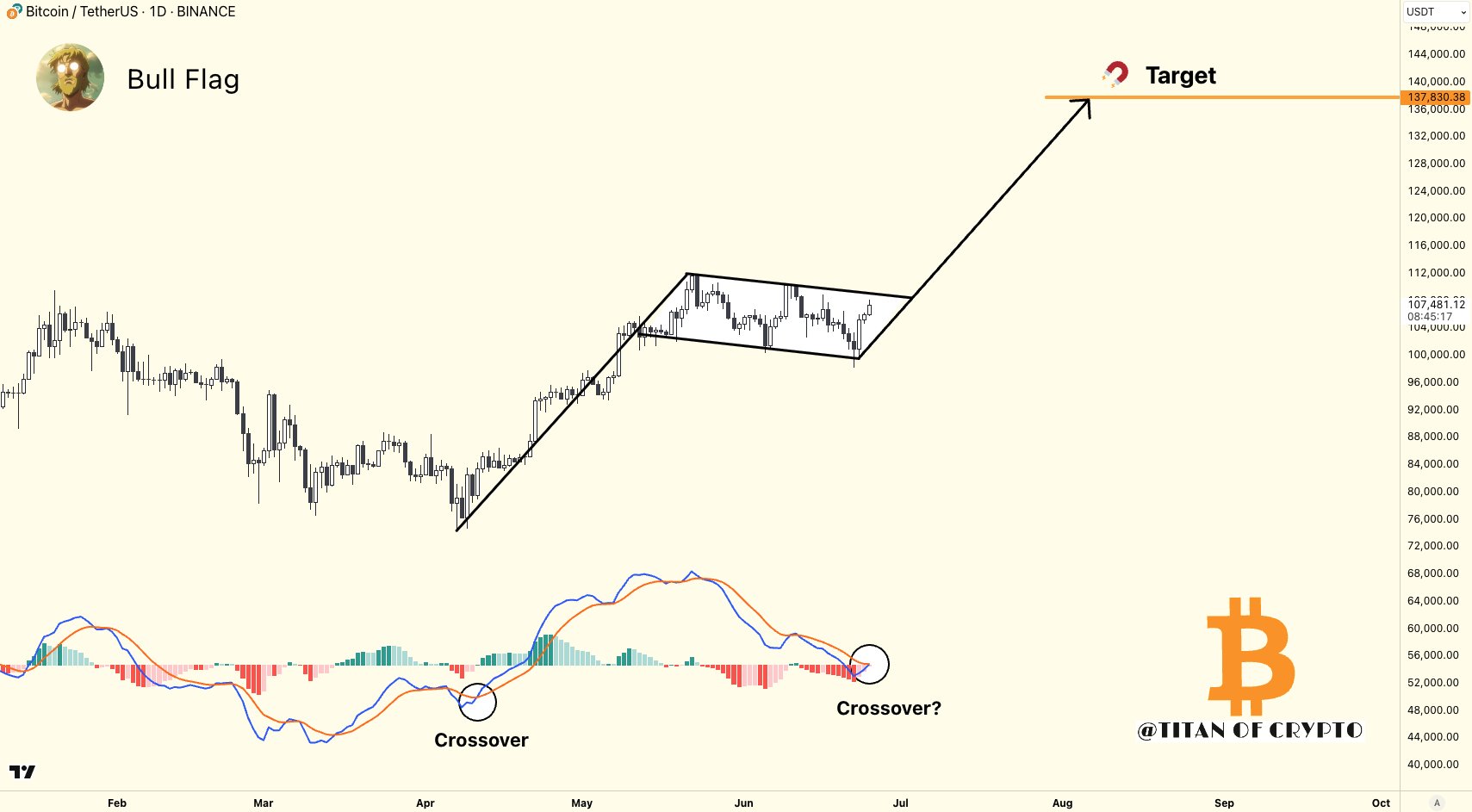

Furthermore, popular crypto analyst Titan of Crypto anticipates Bitcoin could soar to $137,000. His analysis points to a bullish flag pattern observed on daily charts, coupled with a forthcoming MACD (Moving Average Convergence Divergence) crossover, a key bullish indicator.

Growing Institutional Adoption of Bitcoin

While the MVRV ratio might paint a cautious picture for Bitcoin, institutional players are seemingly unfazed by these short-term volatility signals. Recent developments illustrate this trend clearly.

For instance, Michael Saylor, CEO of Strategy, has made bold predictions regarding Bitcoin prices, claiming it could reach as high as $21 million by 2046. Additionally, investments in Bitcoin have also surged from high-profile individuals, such as one of Mexico’s wealthiest entrepreneurs.

On a governmental level, more jurisdictions are recognizing Bitcoin as a viable strategic reserve asset. Notably, the Texas State Government has recently sanctioned a Bitcoin reserve as part of its financial strategy to diversify resources.

However, some analysts suggest that Bitcoin could experience a short-term pullback, possibly dipping to the $93,000 to $94,000 range. As the market stands now, Bitcoin trades at approximately $107,158, reflecting a 1.9% increase within the last day.