Recent analytics illustrate that the cryptocurrency derivatives landscape has witnessed extensive liquidations in the wake of Bitcoin’s impressive rise to a record market value.

Bitcoin Achieves Record-High Pricing

After a period of steady trading just below the previous peak, Bitcoin has surged to uncharted territory. This sudden momentum enabled BTC to breach the $112,000 level, although the spike was quick to stabilize.

Take a look at the graphic below that encapsulates Bitcoin’s latest movements:

The chart clearly indicates a slight pullback to around $111,000 following the groundbreaking spike. As is often the case, this upward trajectory has ignited enthusiasm across the broader cryptocurrency realm, encouraging altcoins to register their own price surges.

Several altcoins have outpaced BTC in terms of performance, with Ethereum (ETH) posting a commendable gain of approximately 4.5% in the past day. Additionally, Sui (SUI) stood out with a striking increase of over 9% during this timeframe.

This wave of bullish sentiment has certainly posed challenges for investors who anticipated a bearish trend in the derivatives market.

Crypto Liquidations Surpass $500 Million

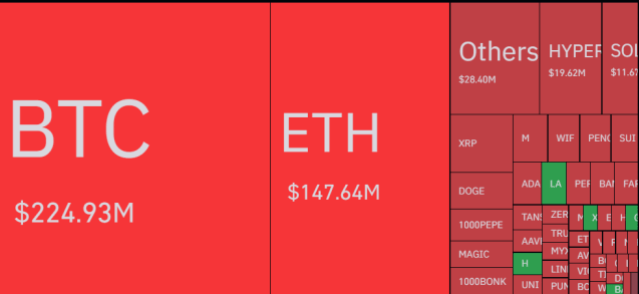

According to statistics from CoinGlass, derivative exchanges have noted monumental liquidations in the last 24 hours. The table below highlights the significant figures.

Overall, the cryptocurrency market has experienced liquidations near the $528 million mark during this period. Notably, a staggering $453 million—comprising 85% of the aggregate amount—originated from short-selling participants.

On the individual scale, Bitcoin and Ethereum led the charge in contributing to liquidations, totaling $225 million and $148 million, respectively.

Occurrences of mass liquidations are relatively common within the cryptocurrency domain, primarily due to the high volatility and the easy access to significant leverage.

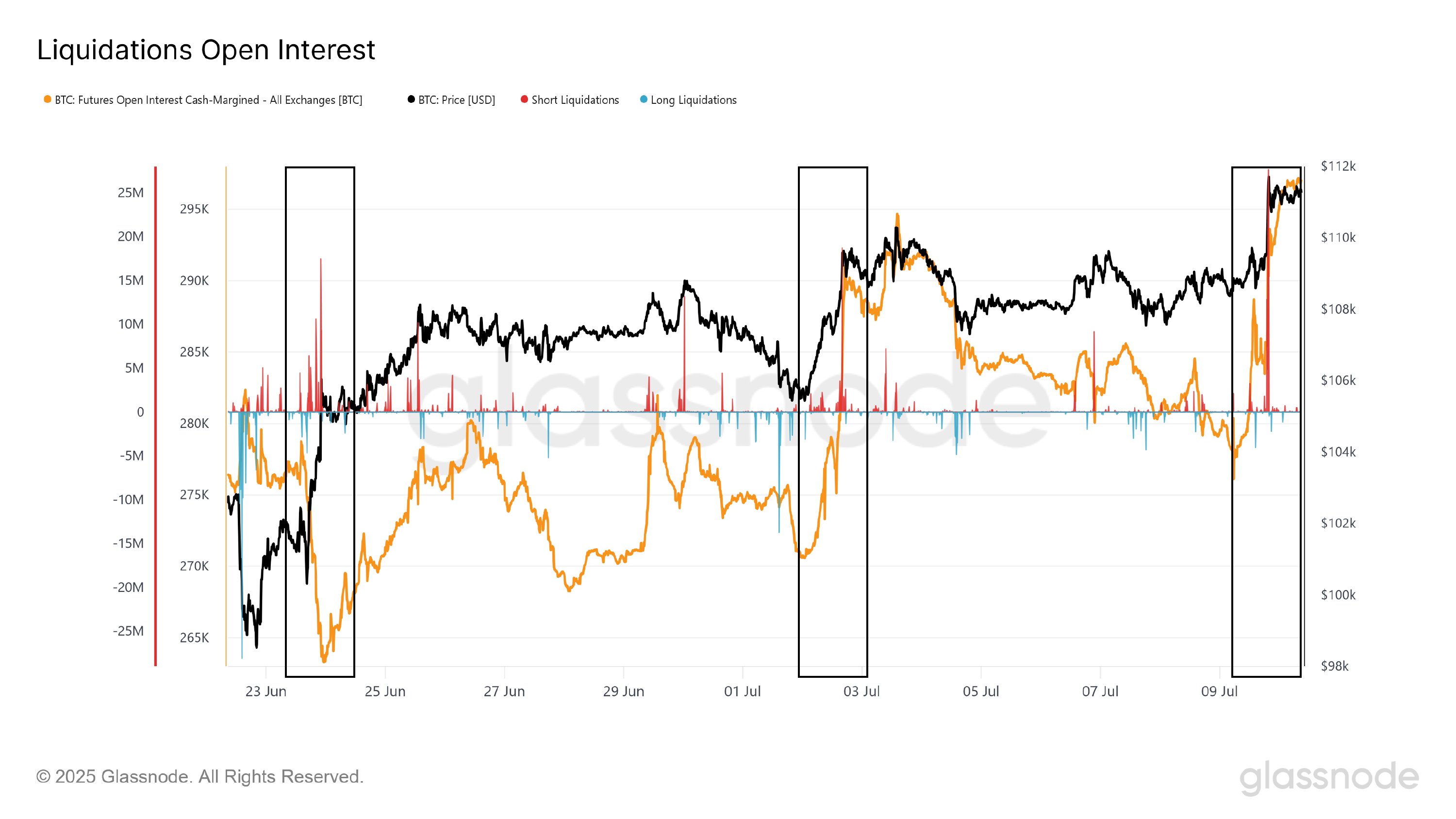

In recent weeks, there have been notable short squeezes. However, analytics from Glassnode indicate interesting shifts regarding Open Interest. This term refers to the total number of outstanding positions related to Bitcoin on centralized derivatives platforms.

Typically, during liquidation events, it’s common for Open Interest to decline as positions are closed or liquidated. This trend was prominent in the previous two squeezes as well as the current one.

However, the latest chart suggests that while Open Interest dipped following the most recent price surge, it rebounded relatively quickly afterward. This pattern may imply a resurgence of long positions forming within the market.