Bitcoin has recently witnessed remarkable upward momentum, trading just below the $120,000 threshold after achieving an unprecedented peak of $123,200 earlier this week. Many market analysts view this slight dip as a natural phase of consolidation, helping to fortify investor confidence rather than signal any impending downturn. The prevailing bullish sentiment remains robust, bolstered by strong technical indicators and a sound market structure that supports expectations of further growth in the near future.

Recent data from blockchain analytics platforms like CryptoQuant sheds light on this optimistic outlook. On July 17, 2025, the Short-Term Holder Net Unrealized Profit/Loss (STH NUPL) metric measured at 13%, a slight decrease from 16% during the previous peak. This statistic implies that most short-term investors are enjoying reasonable gains but aren’t overly euphoric, which usually precedes market corrections.

This blend of steady pricing patterns and favorable on-chain metrics suggests that the market is still on an upward trajectory rather than reaching a saturation point. With Ethereum and other alternative coins gaining traction alongside Bitcoin, overall sentiment across the cryptocurrency landscape appears increasingly positive, setting the stage for significant moves ahead.

Bitcoin Signals Strong Potential for Growth

According to leading analyst Axel Adler, Bitcoin still possesses substantial potential before entering a phase of speculative frenzy. Historically, Adler highlights that the STH NUPL metric approaching 25% has often indicated a peak of excitement among short-term holders. Many investors tend to cash out at that point, potentially triggering a wave of profit-taking that typically impacts overall market momentum.

As of July 17, 2025, the relatively low STH NUPL of 13% suggests that unrealized profits among short-term holders are still moderate. Adler anticipates that to reach the 25% profit threshold, Bitcoin would need to surpass the $137,000 mark, a price point that could trigger mass profit-taking—representing a crucial psychological barrier that might lead to increased market volatility or a period of consolidation.

For now, the data illustrates there is space for ongoing bullish momentum without the immediate threat of mass profit liquidation. This is particularly timely as the U.S. Congress contemplates three significant cryptocurrency bills during what many are referring to as a pivotal “Crypto Week.” Following the rejection of proposals in recent sessions, upcoming discussions may either clarify regulatory frameworks or exacerbate existing uncertainties.

Key Support Levels Strengthen as Volume Rises

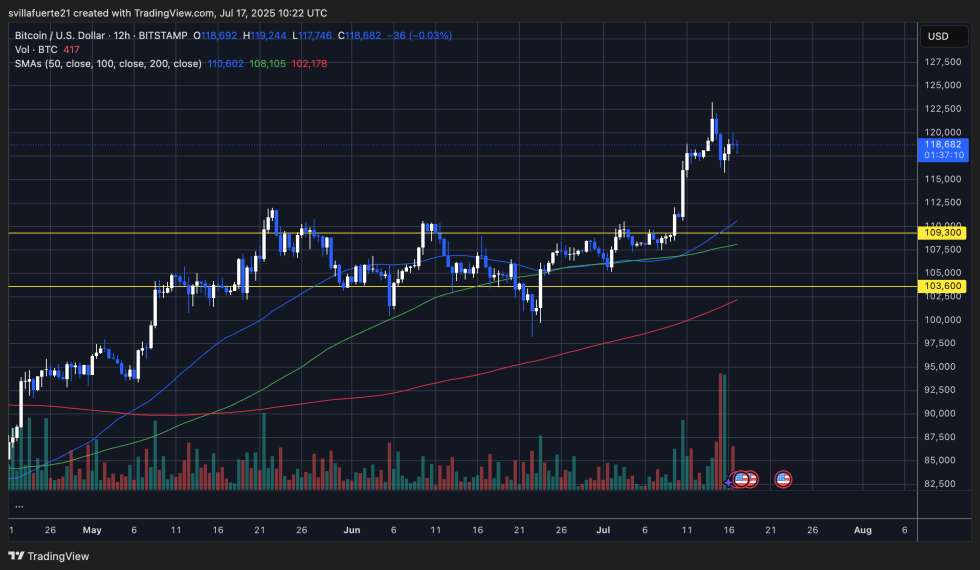

On the 12-hour chart, Bitcoin maintains its position just beneath the $120,000 level after recently setting a record at $123,200. Despite the minor retracement, Bitcoin continues to demonstrate a solid bullish structure, trading securely above essential moving averages: the 50 SMA at $110,602, the 100 SMA at $108,105, and the 200 SMA at $102,178. These key moving averages now serve as dynamic support areas, emphasizing the strength of the current bullish trend.

Moreover, trading volume has surged significantly in recent sessions, with consecutive high-volume candles accompanying both the ascent to new heights and the subsequent pullback. This uptick in volume indicates increased market engagement, likely arising from a combination of profit-taking and new investments as traders prepare for further advancements.

So far, this consolidation phase appears to be healthy. As long as Bitcoin remains above the short-term moving averages and the vital threshold of $109,300, the bullish market structure is maintained. A decisive reclaim of the $120,000 mark would pave the way for new attempts at record highs, with the $130,000–$137,000 range becoming a focal target.

Featured image from Dall-E, chart from TradingView