Recent observations indicate that the growth of the stablecoin market cap has seen a substantial decline, currently rising by only $1.1 billion. This slowdown raises concerns about liquidity levels for Bitcoin and other major cryptocurrencies.

Decline in Stablecoin Market Capitalization Compared to Previous Peaks

Research conducted by on-chain analytics provider CryptoQuant highlights that the stablecoin sector has experienced a significant cooling period. Stablecoins are digital currencies designed to maintain a stable value by pegging them to fiat currencies, with the US Dollar being the most prevalent.

Investors often turn to stablecoins to shield their investments from the high volatility typical of cryptocurrencies like Bitcoin. However, many of these investors plan to eventually reinvest their holdings back into the more unpredictable market. Since stablecoins can be readily exchanged for Bitcoin or other cryptocurrencies, their liquidity is an essential indicator of market health and potential growth. Increased supply of stablecoins is often perceived as a positive indicator for future price movements in the crypto sector.

Below is a graphical representation, courtesy of CryptoQuant, illustrating the trend in the 7-day change in the stablecoin market cap over the past year:

The graph reveals that during the late 2024 bull market, stablecoins experienced considerable market cap growth, with weekly net inflows peaking at approximately $7.7 billion. A secondary wave of capital inflow occurred in January this year, reaching $6.6 billion. However, the subsequent months have shown a marked decline in interest, with stablecoin inflows remaining well below those earlier figures.

Recent trends indicate that while the capital flow surged to $4.8 billion earlier this month, it was short-lived, leading to a current inflow of only $1.1 billion. This suggests that, although stablecoins are still seeing growth in market cap, the pace has drastically slowed compared to previous bullish periods.

According to CryptoQuant, “weaker liquidity conditions are hampering Bitcoin’s potential upward trend.” The onus is now on the market to see how long these subdued stablecoin inflows persist, and whether a shift towards outflows might soon follow.

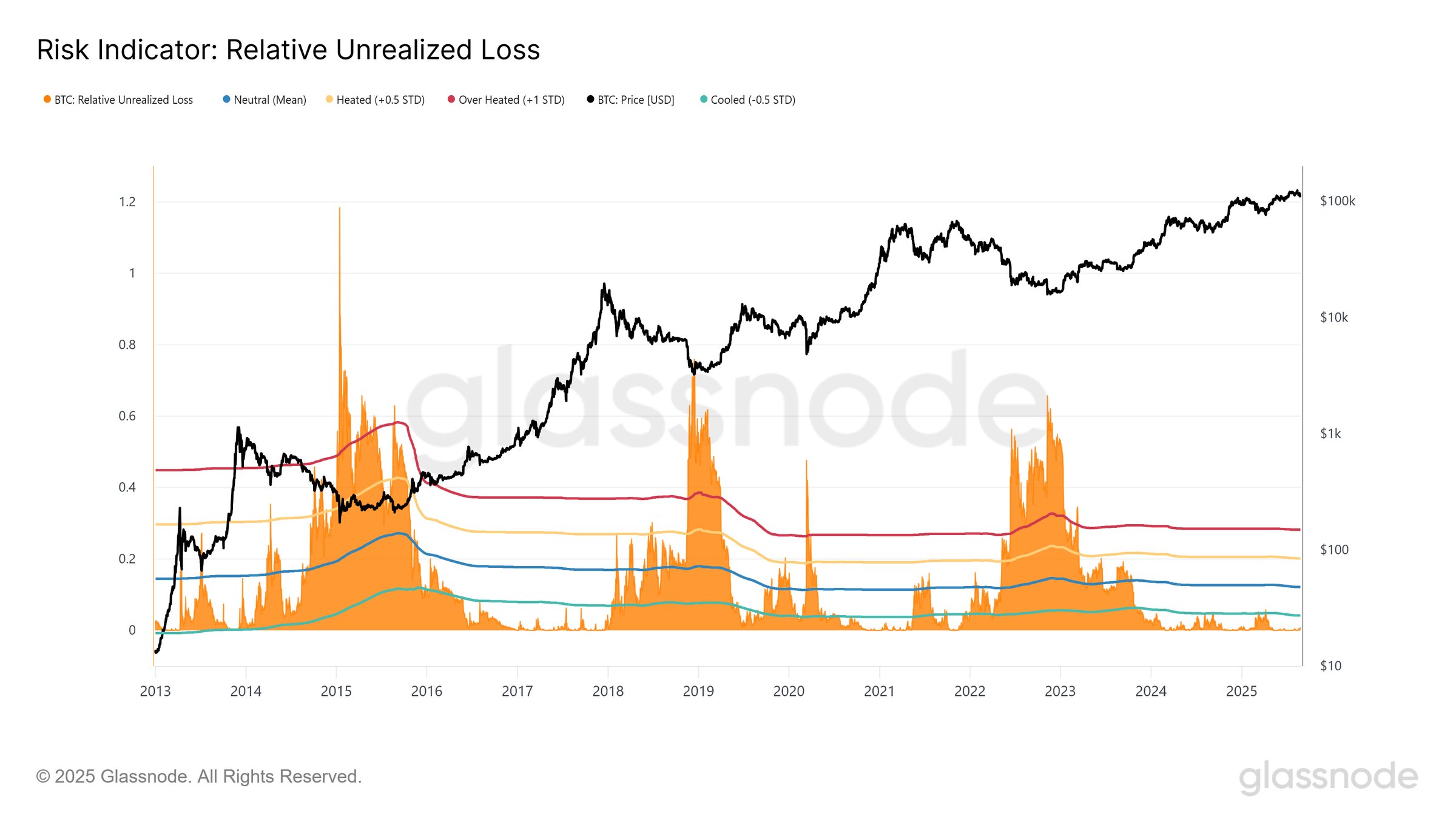

In related developments, a report from on-chain analytics firm Glassnode notes that Bitcoin investors’ Relative Unrealized Loss remains relatively minimal despite recent price fluctuations. You can see more details in their X post.

The Relative Unrealized Loss metric, representing total unrealized losses held by Bitcoin investors as a percentage of the total market cap, currently stands at a mere 0.5%. This figure is notably lower compared to figures observed during previous bear market phases.

Current BTC Price Status

At present, Bitcoin’s price is hovering around $113,400, reflecting an increase of almost 2% over the last day.