The cryptocurrency landscape is witnessing a pivotal moment as Bitcoin hovers around the $110,000 mark. Following a phase of intense selling pressure, the market is in a state of uncertainty. As traders analyze previous bullish trends that propelled BTC to its all-time peak of $124,500, the current consolidation phase raises questions about future price movements.

Leading market analyst, Darkfost, has pointed out a noteworthy trend on Binance: the ratio of BTC to stablecoin reserves is nearing thresholds that have historically indicated rare buying opportunities. This particular ratio sheds light on how investors are positioning themselves amidst fluctuating market conditions.

Darkfost emphasizes the significance of this setup, revealing that such signals have only emerged twice since the last bear market. The last noteworthy occurrence was in March, prior to a dramatic rebound from a low of $78,000 to around $123,000. The resurgence of this signal may hint at an underlying strength, even as price action appears subdued.

Unveiling the BTC and Stablecoin Reserve Dynamics

According to analyst Axel Adler, a pivotal moment is unfolding on Binance, where the BTC/Stablecoin ratio is nearing the crucial level of 1. This situation illustrates that Bitcoin reserves on the exchange are nearly equal to stablecoin holdings, suggesting a shift in liquidity dynamics.

This trend indicates that investors are currently opting for stablecoins rather than Bitcoin. Moreover, the latest data reveals that ERC-20 stablecoin reserves on Binance have reached a staggering $37.8 billion, signaling consistent demand while BTC experiences a correction.

Implications of this trend could be substantial. On one hand, the rising stablecoin reserves might act as a catalyst for a quick rally if market sentiment shifts positively. Conversely, Adler notes that such accumulation is often seen in bearish market conditions, implying a more cautious approach from traders.

This contrasting scenario offers an intriguing perspective. As Bitcoin consolidates post the $124,500 surge, the market stands at a crucial juncture. Observing the evolution of these reserves over the following weeks will be vital in determining whether Bitcoin can rekindle its bullish spirit or succumb to a more extended correction.

Bitcoin’s Current Consolidation Phase: A Deep Dive

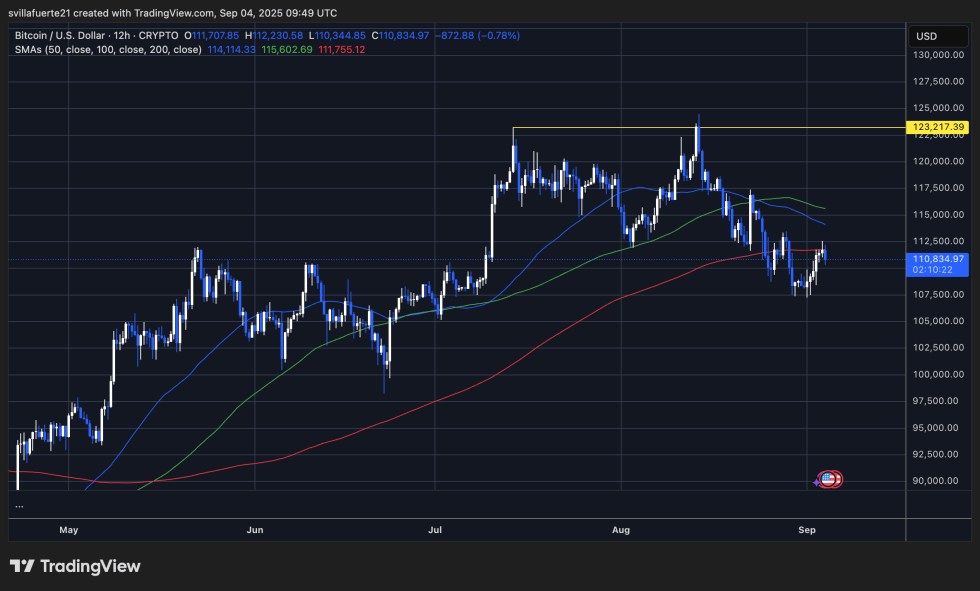

Analyzing Bitcoin’s recent price action on a 12-hour chart indicates a consolidation trend around $110,800 following significant market volatility. After its record-breaking ascent toward $124,000, BTC faced a notable retracement and is struggling to build upward momentum. Notably, the price hovers just above the 200-day moving average, which is currently acting as a key support point near $111,700.

The 50-day and 100-day moving averages remain above current price levels, reinforcing the notion of ongoing bearish pressure in the short term. A sustained recovery is unlikely until BTC reclaims the $113,000–$115,000 region, making it crucial to monitor these levels closely.

Recent resistance near $112,500 has stymied any attempts at recovery, with immediate support situated between $108,000 and $109,000. A decisive move below this support zone could drive BTC down to about $105,000, where stronger buying interest may be anticipated. Alternatively, successfully reclaiming $115,000 would boost prospects for aiming at the $120,000 range.

This period of indecision may serve as a critical moment for Bitcoin’s future trajectory, and understanding these dynamics will be crucial for traders and investors alike.