Bitcoin has recently entered a significant phase of consolidation following its remarkable surge to new all-time highs. As the digital currency continues to occupy a pivotal space in the market, analysts are keeping a close eye on the critical levels that could define its trajectory. The earlier rally infused a wave of optimism; however, the momentum appears to be waning, with bulls battling to defend essential support zones. Without a surge in buying pressure, experts anticipate that BTC could retreat below the crucial $105,000 mark, a point many are monitoring closely.

Latest insights from CryptoQuant indicate that the cycle-adjusted MVRV has settled at 39%. This metric juxtaposes Bitcoin’s market valuation with its realized value while factoring in market volatility, showcasing a balanced risk-reward scenario. Typically, such readings signal a cooling-off period for the market, suggesting a transition into consolidation rather than extremes of panic or exuberance.

This positioning places Bitcoin in a precarious state. On one hand, the stabilization indicates that the asset is not currently overbought. Conversely, this neutrality points to a market eagerly awaiting direction and prone to fluctuations as liquidity evolves. With ongoing volatility, the upcoming weeks are essential in determining whether Bitcoin will stabilize for another upward surge or plunge into a more pronounced correction.

Bitcoin Market Stabilizes as MVRV Indicates Balanced Risk

Prominent analyst Axel Adler emphasizes that the current cycle and volatility-adjusted MVRV paints a clear picture of the market’s stance. Historically, a metric reading near 100% often aligns with extreme market conditions, indicative of potential tops. In stark contrast, a figure nearing 0% corresponds with significant investor capitulation, characterized by frantic selling and exhausted pressure.

Currently sitting at 39%, this metric puts Bitcoin squarely in what Adler describes as a neutral risk/reward zone—neither buoyantly bullish nor decidedly bearish. It underscores that the exuberance propelling BTC to unprecedented heights has transitioned to a period of calm without extreme fluctuations.

This neutral phase, while presenting opportunities, also invites uncertainty. On one side, reduced extremes diminish the risk of a swift downturn fueled by unchecked speculation. Yet, the absence of strong bullish indicators implies that Bitcoin currently lacks the catalysts needed for a short-term rally.

Adler suggests that the formative weeks ahead will be crucial in charting Bitcoin’s future. Should the asset maintain support and see increased accumulation, BTC might stabilize and prepare for another upward push. Conversely, if bearish trends take hold, the market could risk slipping below vital levels like $105,000, paving the way for a deeper correction.

Bitcoin Faces Challenges Below Essential Resistance Levels

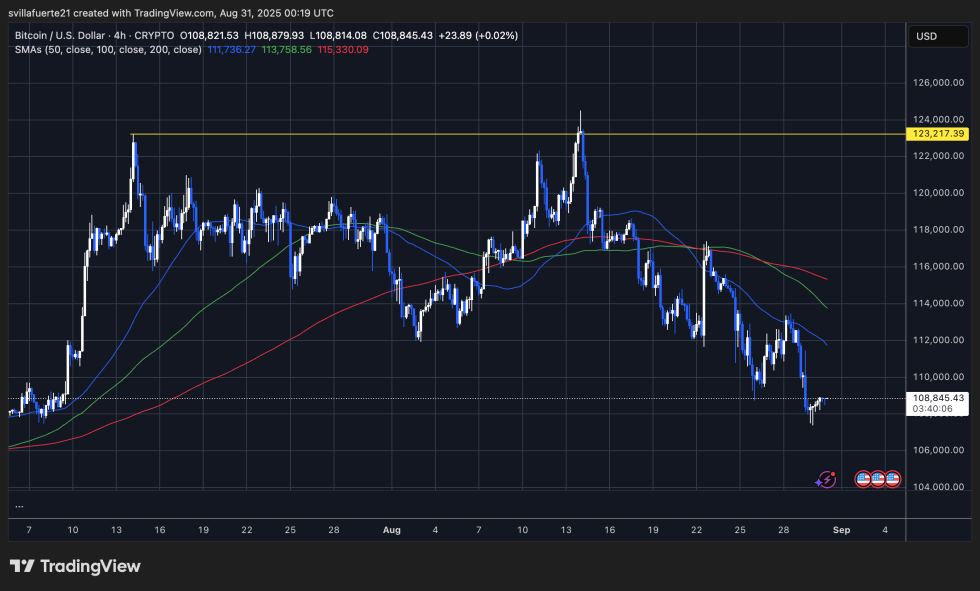

Trading around $108,845, Bitcoin is showing signs of fragility as it endures persistent selling pressure. The price has struggled to regain momentum after facing rejection near $123,200, a key resistance level that continues to hinder upward potential. Since mid-August, Bitcoin’s trading patterns have exhibited a distinct downward trajectory, marked by declining highs and lows.

The moving averages reinforce this bearish sentiment. With the 50, 100, and 200-period SMAs aligning bearishly, the short-term averages now trend below their longer-term counterparts, signaling a continuation of downward pressure unless bulls can mount a substantive recovery. Presently, Bitcoin’s brief attempts to rebound appear less like a robust reversal and more like a static consolidation.

A critical support zone exists just above the $105,000 threshold, where previous buyers have intervened to stave off deeper declines. A decisive break below this point could expose Bitcoin to further downside risks, possibly leading toward the psychologically significant $100,000 milestone. Conversely, reclaiming the $112K–$115K region will be vital in shifting momentum back to the bullish side.

Insights gathered from various analyses and charts illustrate Bitcoin’s intricate dance within these broad market complexities, emphasizing the importance of strategic positioning in the evolving landscape.