Current analyses indicate that the Bitcoin mining Hashrate has recently dipped to a level not seen since October, as many miners are shutting down their operations.

Recent Trends in 7-Day Average Bitcoin Mining Hashrate

The Bitcoin Hashrate acts as a key indicator measuring the overall computational power dedicated to securing the network. This value is essential not only for assessing miner activity but also for understanding potential profitability in the sector.

An increase in Hashrate typically signifies that more miners are entering the market or existing miners are enhancing their setups. This trend generally indicates that Bitcoin mining is perceived as a rewarding venture.

Conversely, a decline can reflect that some miners are disconnecting their equipment, often due to reduced profitability in light of Bitcoin’s price dynamics.

To visualize this, we can refer to the graphical representation on Blockchain.com, which tracks the 7-day average Bitcoin Hashrate throughout the past year:

The chart illustrates that the 7-day average Hashrate achieved a record high of approximately 1,151 exahashes per second (EH/s) in October, but has since experienced a notable decrease.

This downward trend could be largely influenced by miner revenues. Earnings are primarily composed of block rewards and transaction fees, where block rewards predominate.

It is important to note that while block rewards remain constant in BTC terms, their value in USD fluctuates with Bitcoin’s market price. Thus, the viability of mining operations is closely tied to the overall market sentiment.

Following October’s surge in Bitcoin’s price, many miners upgraded their rigs in anticipation of continued bullish conditions. However, as these conditions did not sustain, many started scaling back operations, resulting in the current 7-day average Hashrate falling to around 998 EH/s—its lowest in over three months.

Interestingly, this latest decline in Hashrate has transpired despite some recovery in cryptocurrency prices. This situation may indicate that miners remain skeptical about a full trend reversal.

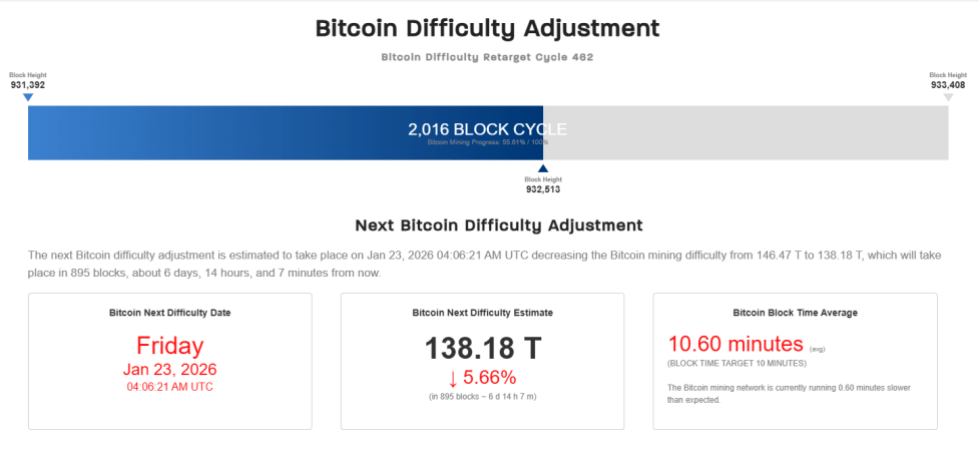

One potential consequence of declining Hashrate could be a reduction in Bitcoin mining Difficulty at the next scheduled adjustment. Data from CoinWarz suggests that the average block time has stretched to 10.6 minutes since the last Difficulty adjustment, which is significantly longer than the usual target of 10 minutes.

If trends hold, Bitcoin could see its Difficulty drop by approximately 5.6% during the next biweekly adjustment. However, with about a week remaining before this occurs, the ultimate direction of Hashrate may still affect the network’s response.

Current BTC Market Price

As of this writing, Bitcoin is trading near $95,500, having increased over 5% in the last week.