As we look towards 2025, data indicates a significant surge in Bitcoin mining challenges, with overall Difficulty escalating by an impressive 35% during this period.

Bitcoin Mining Difficulty Surpasses 148 Trillion Hashes

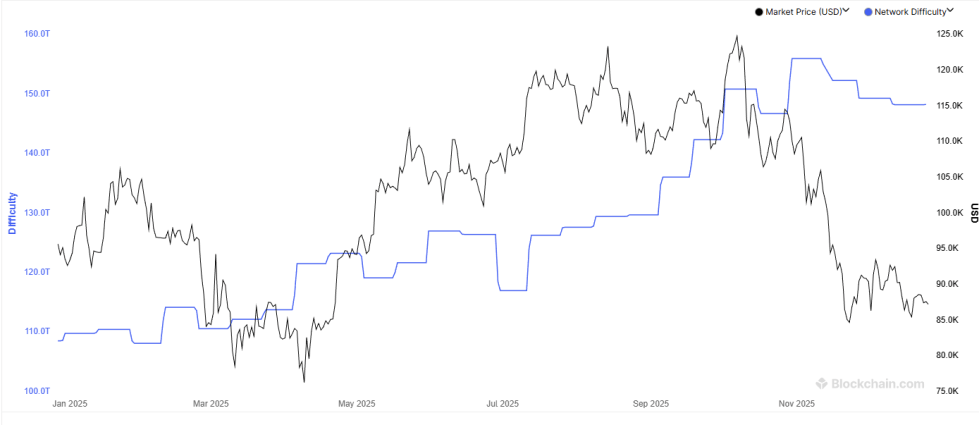

The close of 2025 marks a pivotal year for Bitcoin miners, who have expanded their operations substantially. Recent information from Blockchain.com illustrates that the network’s Hashrate, which quantifies the combined computational power utilized by miners, has seen a remarkable move from 795.7 terahashes per second (TH/s) at the onset of the year to an impressive 1070.3 TH/s currently.

This growth phase for Hashrate resulted in several record-breaking figures, with the final all-time high (ATH) reaching 1,151.6 TH/s in October. Although there has been a slight cooldown in growth since that peak, the current level remains approximately 34.5% higher than it was on January 1st.

Miner revenue relies heavily on the block subsidy, which holds steady in BTC value during non-Halving periods. Therefore, miners often look to the price of Bitcoin for enhanced earnings. This dependency is why increases in Hashrate typically mirror price advancements.

The graph reveals that the Hashrate ATH coincided with the cryptocurrency’s price peak, and the subsequent decline in Hashrate has paralleled a downturn in Bitcoin’s value. Miners have shown remarkable endurance, as BTC has faced year-to-date losses while Hashrate continues its upward trajectory.

An increase in the Bitcoin Hashrate invariably leads to a rise in another critical metric known as Difficulty. This Difficulty metric, part of the blockchain’s code, dictates the challenge miners face when uncovering the next block in the network.

It undergoes automatic adjustments approximately every two weeks based on miner performance since the last review. Initially established by Satoshi Nakamoto, the network aims for an average block time of 10 minutes. If miners complete blocks faster than this target, the chain adjusts to increase Difficulty levels.

The adjustment magnitude is calibrated to balance the miners’ quicker pace, thus stabilizing the Hashrate jumps.

As miners witnessed growth throughout the year, Bitcoin’s Difficulty had to increase correspondingly, consistently setting new ATHs.

Bitcoin Difficulty" width="980" height="425">

Bitcoin Difficulty" width="980" height="425">

Since reaching over 155 trillion hashes in October, Bitcoin Difficulty has experienced some fluctuations. Nonetheless, it currently stands around 148.2 trillion hashes, representing a notable 35% increase from the 109.8 trillion hashes at the start of the year.

The rise in Difficulty levels has closely mirrored the Hashrate trends, a logical outcome of the interplay between these two metrics.

Current BTC Price Trends

Bitcoin recently bounced back over $89,000; however, this rally proved transient as the asset has reverted to approximately $87,300.