Cryptocurrency enthusiasts are buzzing with excitement as Bitcoin approaches a crucial phase in its market journey, currently hovering around the $110,000 threshold. This resurgence comes after a period of unease characterized by market fluctuations and sideway trading. Observers are keenly monitoring key resistance levels which, if breached, could herald a new era for this digital asset, potentially leading to significant market movements.

Prominent analysts, including industry expert Lina Cooper, have noted a surge in trader optimism. Fresh data indicates substantial increases in open interest (OI) levels across various trading periods. For instance, throughout 2024, there has been an astonishing rise, peaking at 79% in the spring months, followed by noteworthy elevations of 59% in autumn and 36% in May. Interestingly, the last month showcased a shift from a decline of -9% to a rise of +5%, indicating a cautious but steady resurgence in futures trading.

This transformation in the derivatives market coincides with favorable macroeconomic conditions as investor sentiment begins to stabilize. Nevertheless, to catalyze a breakthrough past present resistance levels, Bitcoin will need a significant trigger, be it a technological advancement or a favorable macroeconomic indicator. The forthcoming days promise to be pivotal in determining Bitcoin’s trend as we head deeper into the quarter.

Momentum Builds as Bitcoin Eyes Record Highs

As Bitcoin nears its all-time high of around $112,000, excitement builds among investors and market participants. This bullish momentum seems to suggest potential for further growth; however, the prospect of a failed breakout looms large. With general market sentiment leaning positively, buoyed by advancements in equity markets and an alleviation of economic uncertainties, the risk of a pullback becomes more pronounced. Analysts caution that without a decisive breach past resistance, Bitcoin may face downward adjustments.

The surge in the US stock market, which has reached unprecedented peaks, adds fuel to the optimistic fire, often propelling cryptocurrencies higher. However, a surmounting movement past the $112,000 mark will require more than mere chart patterns; it necessitates undeniable catalysts to maintain bullish momentum. Lina Cooper highlights the evolving derivatives landscape as a potential precursor to market confidence. This indicates a cautious return of traders into the fray with a more conservative approach to leveraging their positions.

Conversely, bears are primed to defend the all-time high zone. For bullish forces to gain traction, they may need a compelling narrative — perhaps driven by strengthened regulatory support, favorable signals from the Federal Reserve, or significant market triggers that can instigate a renewed risk appetite to propel Bitcoin decisively towards new price territories.

BTC Price Dynamics: Approaching Breakout Territory

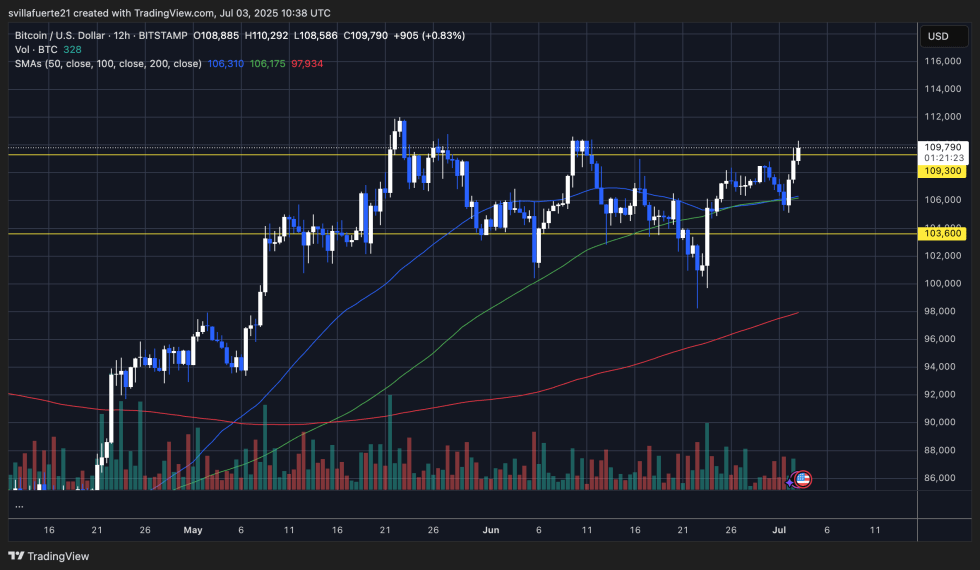

A deeper examination of the 12-hour BTC/USDT trading chart reveals Bitcoin’s tentative attempt to break past the $109,300 resistance area. Following several thwarted attempts in recent weeks, Bitcoin is poised to test this critical level once more, creating bullish candlestick patterns that hint at imminent price discovery nearing the previous all-time high. The bulls have successfully defended the support at $103,600, which aligns perfectly with both the 100-day and 50-day simple moving averages converging around $106,200.

This confluence of moving averages has acted as a dynamic support level, reaffirming the recent bullish bias. Moreover, trading volume has seen a slight uptick during this critical surge, which is a positive indication following weeks of dwindling trader interest. A clear break and sustained movement above the $109,300 threshold would pave the way to retesting the all-time highs and potentially embarking on a new bullish journey.

However, traders should remain vigilant against potential market manipulations or false breakouts. Given the historical resistance this level has posed for the last two months, any sign of rejection may push Bitcoin back towards the $106,000 support zone or even lower. Currently, the bulls seem to be maintaining control, yet reliable upward momentum accompanied by increasing trading volume will be essential to validate this breakout and support a journey towards new record highs.

Featured image from Dall-E, chart from TradingView.