Recent data reveals that the Open Interest in Bitcoin derivatives has surged to an all-time high (ATH). Let’s explore the implications for the asset’s price.

Bitcoin’s Open Interest Surges

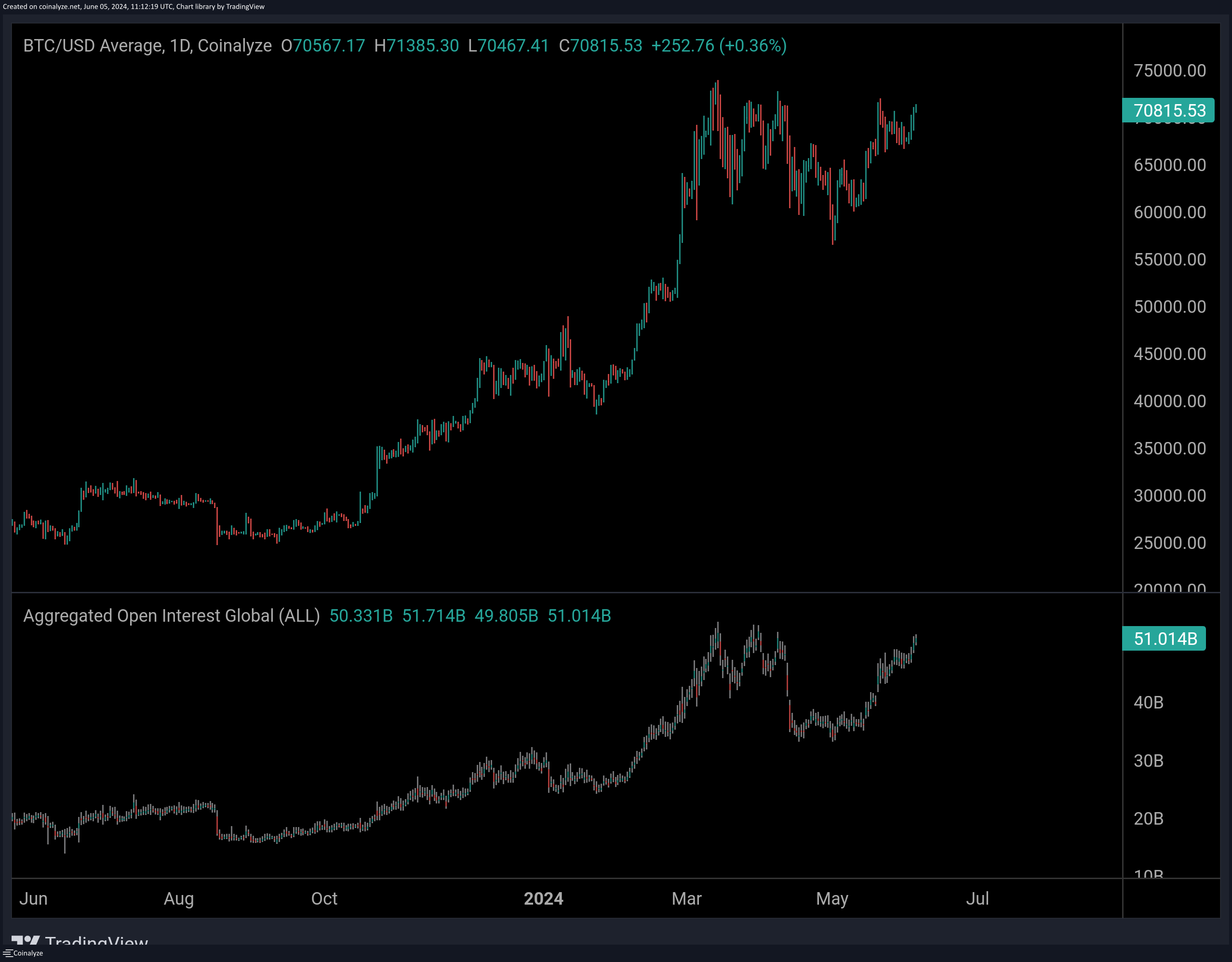

In a post on X, Maartunn, a manager at CryptoQuant Netherlands community, discusses the recent spike in Bitcoin’s Open Interest. This metric represents the total value of derivative positions related to the cryptocurrency across all exchanges.

An increase in Open Interest indicates investors are opening new positions, potentially leading to higher price volatility due to increased leverage. Conversely, a decrease suggests users are closing positions or facing forced liquidation, which could stabilize the asset by reducing leverage.

The chart above shows the trend in Bitcoin’s Open Interest over recent years, with a significant spike earlier in the year during a price rally to a new ATH.

Following a period of consolidation post-ATH, the metric cooled down. However, with Bitcoin’s recent recovery, Open Interest has surged again, surpassing previous highs and signaling increased speculation in the market.

High Open Interest levels historically lead to heightened volatility and the potential for sharp price movements in either direction due to increased leverage and mass liquidations.

In another X post, Maartunn highlighted that overall cryptocurrency Open Interest was nearing an ATH, indicating a broader trend of speculative activity beyond Bitcoin.

Bitcoin Price

Currently, Bitcoin is trading around $71,000, reflecting a more than 4% increase over the past week.