Recent insights from the analytics firm Santiment have highlighted the current sentiment trends surrounding two major cryptocurrencies: Bitcoin and Ethereum.

Ethereum Gaining Momentum in Social Media Sentiment

In a recent update on social media platform X, Santiment analyzed the shifting “Positive/Negative Sentiment” regarding Bitcoin and Ethereum. This metric provides a perspective on how users feel about these cryptocurrencies across major digital platforms.

Utilizing an advanced machine-learning model, the metric evaluates various social media posts mentioning these cryptocurrencies, categorizing them as either bullish or bearish. By counting these posts, the model calculates a sentiment ratio that offers insights into public opinion.

When the sentiment ratio exceeds 1.0, it indicates that there are significantly more positive comments than negative ones. Conversely, a ratio below this threshold points to a prevailing negative sentiment among users.

The accompanying chart details the latest trends in the sentiment for both Bitcoin and Ethereum, illuminating the public’s stance on these digital assets.

According to the data presented, Ethereum’s positive sentiment surged to an impressive level of 3.0. This indicates a robust interest, with three times more bullish comments than bearish ones among social media users.

While Bitcoin also remains above the 1.0 threshold, its positive sentiment is comparatively muted, with a ratio of merely 1.3. This suggests that while optimism exists, it’s not as overwhelming as what we see with Ethereum.

The recent uptick in ETH’s sentiment correlates with its notable price increase of over 40% in just a month. This is a striking rebound, especially after a period of underwhelming performance that left many traders feeling apprehensive. A potential shift in sentiment could signify a turning point.

However, it is essential to approach such enthusiasm cautiously. Historically, markets show a tendency to counteract the prevailing crowd sentiment. A situation marked by excessive optimism might indicate potential price corrections ahead. Observing the price movements of both Bitcoin and Ethereum in the near future will be critical.

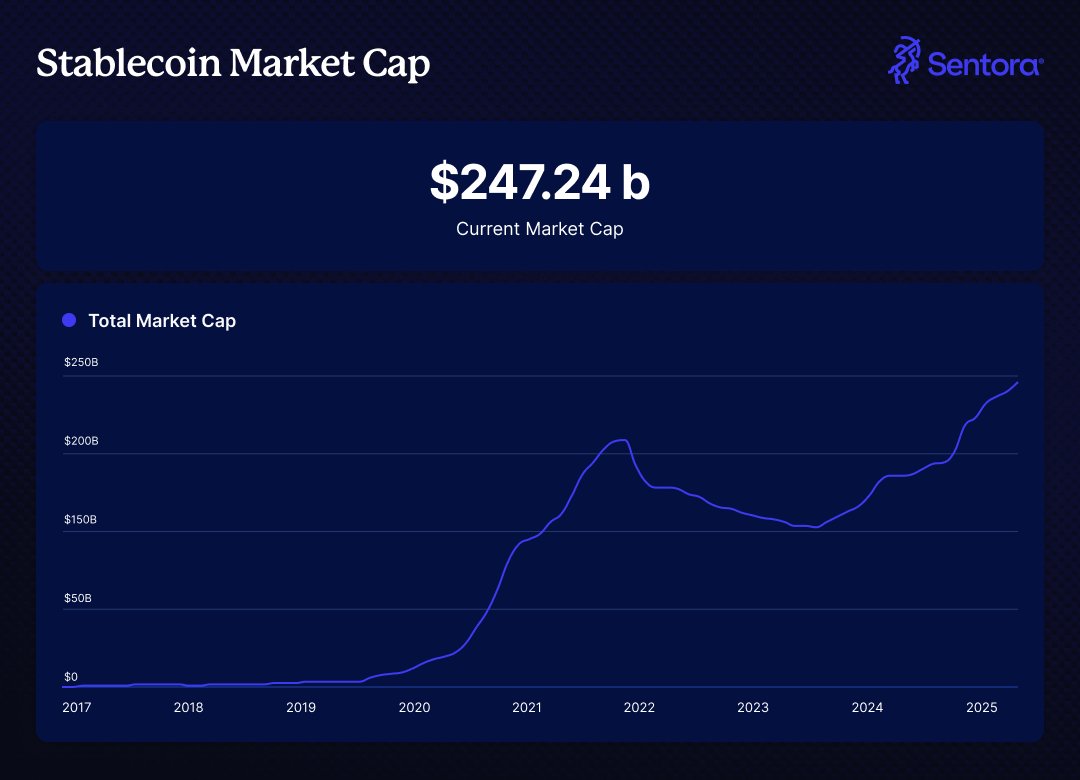

In another development, recent reports indicate that the stablecoin market cap has been reaching new heights. The institutional DeFi solutions provider Sentora (previously IntoTheBlock) shared this observation in a post on X.

The current market cap of stablecoins has now reached an impressive $247.24 billion, reflecting a robust growth of 56% over the past year.

Current Bitcoin Pricing Trends

As for Bitcoin, it is still struggling to regain its upward momentum, with its price hovering around the $105,900 mark.