Cryptocurrencies, especially Bitcoin (BTC), are experiencing significant shifts in market dynamics with recent developments surrounding Strategy (MSTR). Formerly known as MicroStrategy, this firm is recognized as a leading entity in the Bitcoin treasury sector, controlling a substantial stake in the cryptocurrency.

Potential Boost from S&P 500 Inclusion

In a recent update, industry expert Lark Davis indicated that Strategy may be added to the S&P 500 Index soon. This inclusion could result in a significant influx of capital for both Strategy and Bitcoin, showcasing their intertwined destinies.

Presently, Strategy is holding approximately 632,457 BTC, equating to a market value near $69 billion. Their initial investment in Bitcoin was just over $46.5 billion, illustrating a remarkable return considering the recent price surges.

The S&P 500 Index, a key benchmark for the health of the US economy, tracks 500 of the largest publicly traded firms, representing about 80% of market capitalization. Understanding this index is vital for grasping the broader implications of Strategy’s inclusion.

To be considered for the S&P 500, firms must satisfy certain criteria, such as being based in the US, maintaining a minimum market capitalization of $22.7 billion, and demonstrating considerable trading history.

Prominent analyst Josh Man recently took to Twitter to assert that Strategy’s inclusion in the S&P 500 is not far off, with only the official word pending.

Strong Financial Performance in Q2 2025

Despite facing economic challenges, Strategy posted impressive figures for the second quarter of 2025. The company reported operating income of $14 billion, net income of $10 billion, and total revenue hitting $114.5 million.

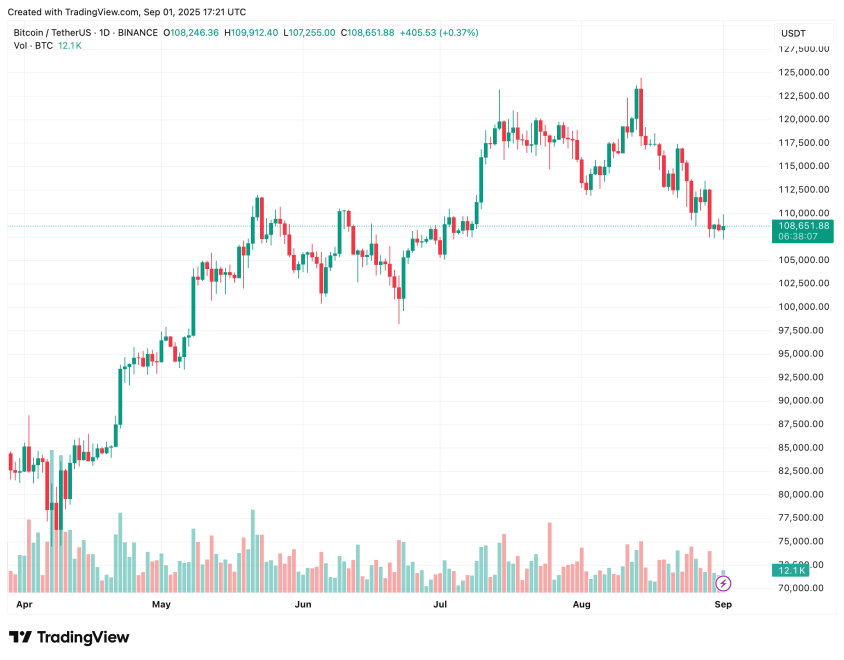

The positive outcome can be attributed to the adoption of new fair-value accounting practices that have enhanced the firm’s ability to showcase unrealized gains from its Bitcoin holdings, especially as BTC achieved new all-time highs recently.

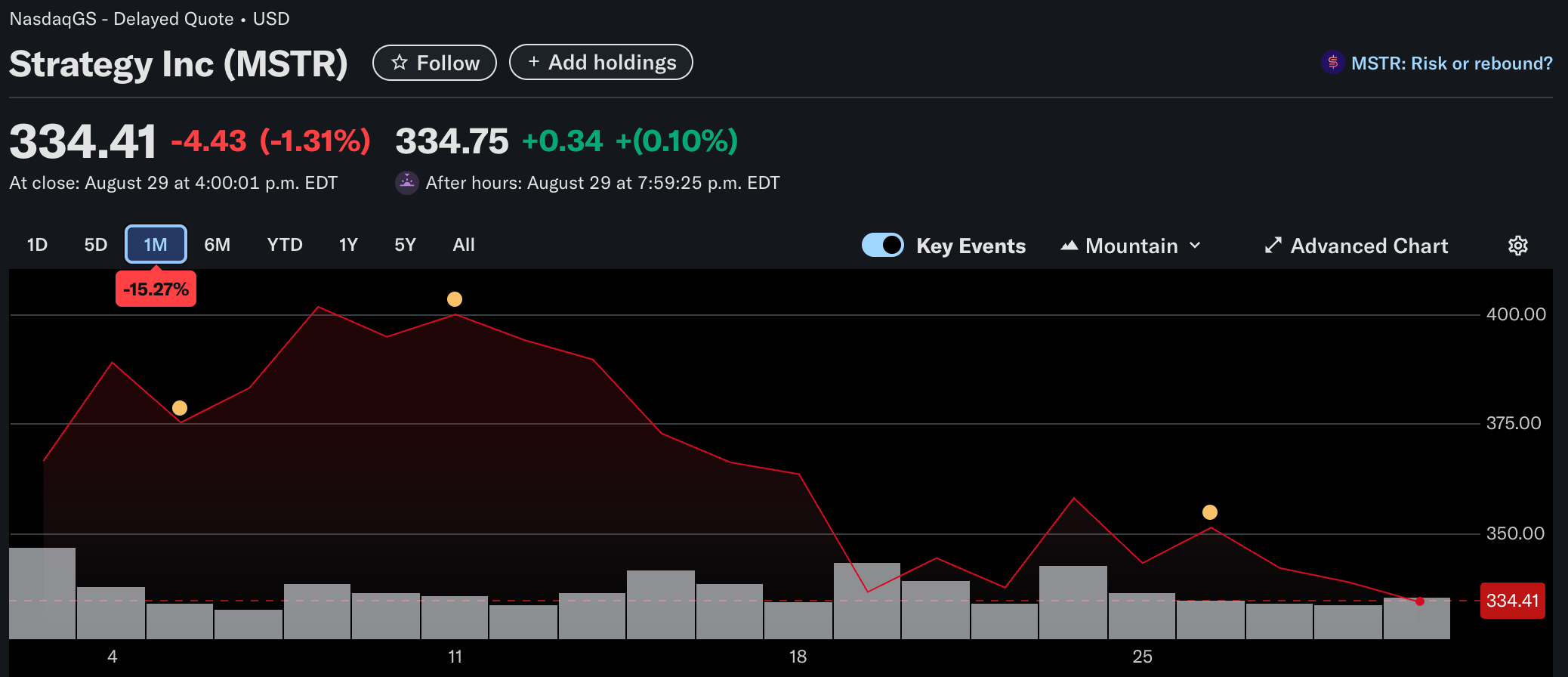

However, it is essential to note that Strategy’s share price has seen some fluctuations, dipping by over 15% in recent weeks. As of late August, shares were trading at $334.75.

If Strategy secures its spot in the S&P 500, it would join the ranks of Coinbase and Block, creating a notable trio of cryptocurrency-related companies in this prestigious index. As Bitcoin’s price currently stands at $108,651, it shows a minor decline of 0.2% in the last day, signaling a potentially volatile market ahead.