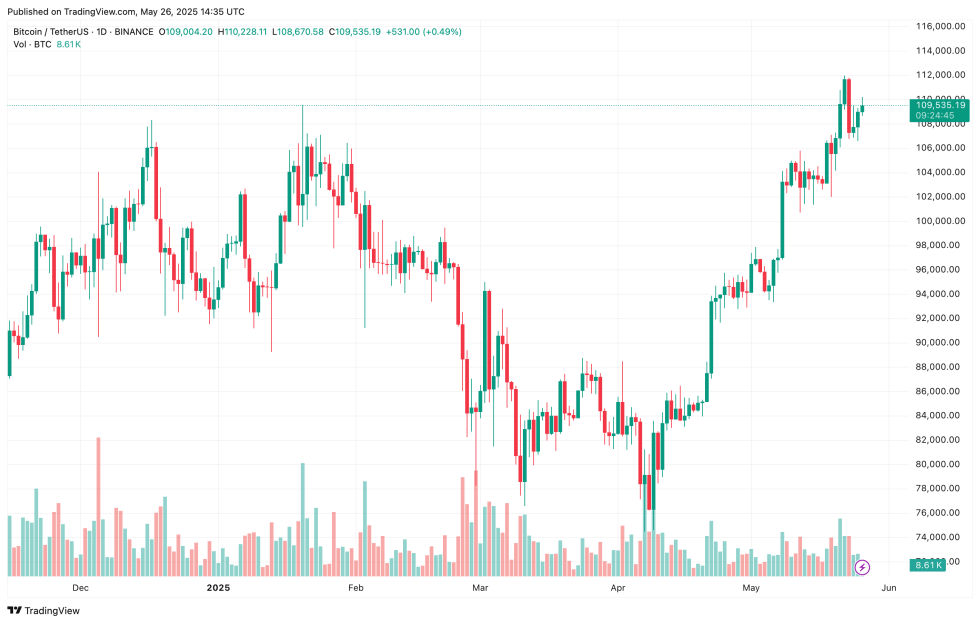

Recently, Bitcoin (BTC) faced a slight decline over the weekend, dropping from approximately $112,000 to $106,600. This downturn significantly impacted over-leveraged traders, especially those holding late long positions, while seasoned investors capitalized on the dip to boost their BTC holdings.

Impact of the Price Correction on Long Positions

A detailed analysis from CryptoQuant contributor Amr Taha revealed that Bitcoin’s drop below the critical $111,000 threshold led to significant liquidations affecting those who entered long positions late in the rally. The market witnessed a staggering $185 million wiped out in long position liquidations due to this price movement.

For those new to cryptocurrency trading, “late longs” refer to positions taken by traders after a significant price increase, betting on continued short-term growth. However, these positions are particularly sensitive to abrupt declines in market prices, resulting in swift liquidations as support levels disappear.

The liquidations began notably when BTC fell below $110,900, leading to losses exceeding $97 million in long positions. A subsequent plunge beneath the $109,000 line triggered further liquidations, costing an additional $88 million predominantly from leveraged traders.

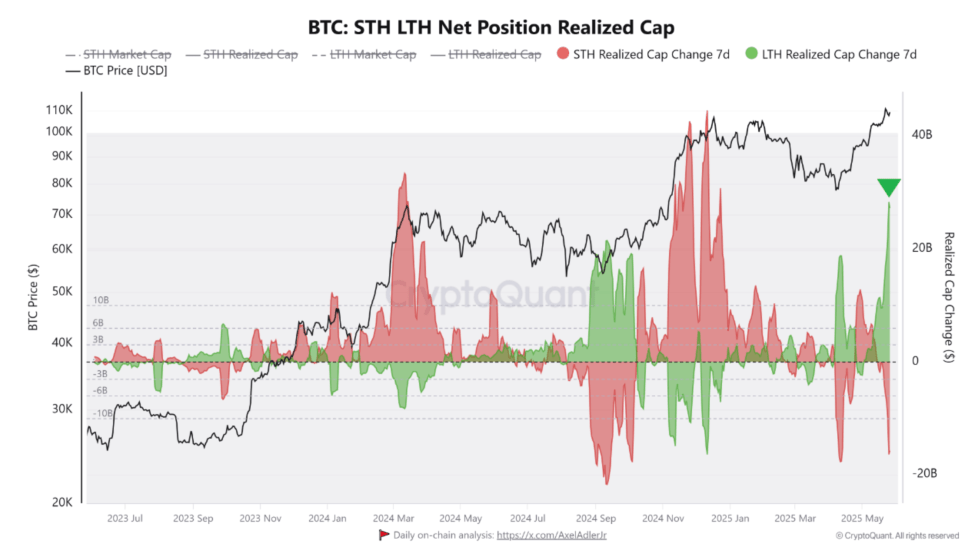

In stark contrast, long-term holders (LTHs) exhibited resilience, opting to enhance their Bitcoin positions instead of capitulating. This behavior showcases their commitment to the asset despite market volatility.

Taha noted that LTH realized capitalization has crossed $28 billion, a milestone not seen since April 2025. He remarked:

The increase in realized cap for LTHs indicates a robust strategy among long-term investors to expand their Bitcoin holdings during periods of market stress, highlighting their unwavering confidence.

According to crypto analyst Titan of Crypto, Bitcoin also recorded its highest weekly close, signifying a pervasive bullish sentiment among long-term investors who remain optimistic about future price increases.

Factors Supporting Bitcoin’s Growth

Several market analysts have remarked that this rally appears more durable compared to previous surges, with a noticeable lack of extreme euphoria. This suggests a healthier and more sustainable market environment for Bitcoin.

Technical analyses point towards ambitious future price targets for Bitcoin, with some experts like Gert Van Lagen projecting that BTC could potentially soar to $300,000 during the current bull cycle.

Institutional interest in Bitcoin remains robust, with notable figures like Strategy CEO Michael Saylor hinting at substantial upcoming purchases. At press time, Bitcoin was trading at $109,535, marking a 1.9% increase in the past 24 hours.