The cryptocurrency landscape showcased remarkable resilience in Q2 2025, primarily fueled by Bitcoin’s (BTC) stellar price advancements and a notable uptick in exchange-traded fund (ETF) investments. Nevertheless, this positive momentum did not translate into an increase in daily trading volumes.

Bitcoin’s Ascent: Trading Volumes Lag Behind

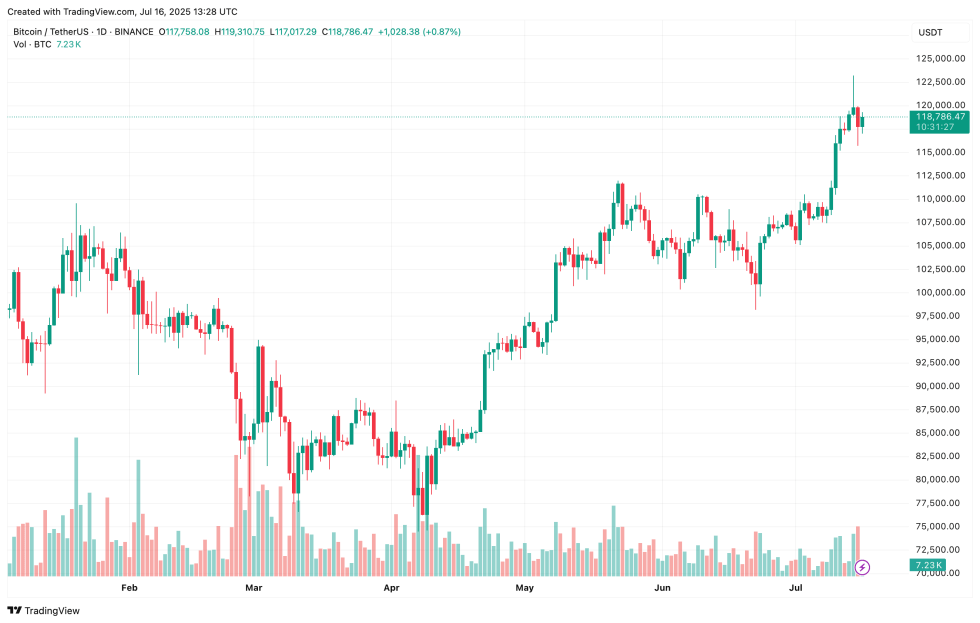

A recent analysis by CryptoMetrics revealed a concerning trend in the spot market; while Bitcoin enjoyed a meteoric rise from $83,000 to $111,900, daily trading volumes plummeted. The closing price for Bitcoin hovered around $106,000, yet the market’s average daily trading volume dwindled.

The report highlights a decrease in average daily trading volume from $51 billion in Q1 2025 to approximately $40 billion in Q2 2025, signifying a dip of roughly 10%. Furthermore, total spot trading across exchanges fell from $4.6 trillion to $3.6 trillion during this timeframe.

Looking towards Q3 2025, expectations remain cautious as factors such as macroeconomic instability, low liquidity, and sluggish altcoin trading may continue to suppress spot trading volumes. Projections suggest that total spot volumes could hover between $3 trillion and $3.5 trillion.

Interestingly, the share of spot trading volume declined across many exchanges, with only MEXC and Bitget experiencing increases of 2.70% and 0.66%, respectively.

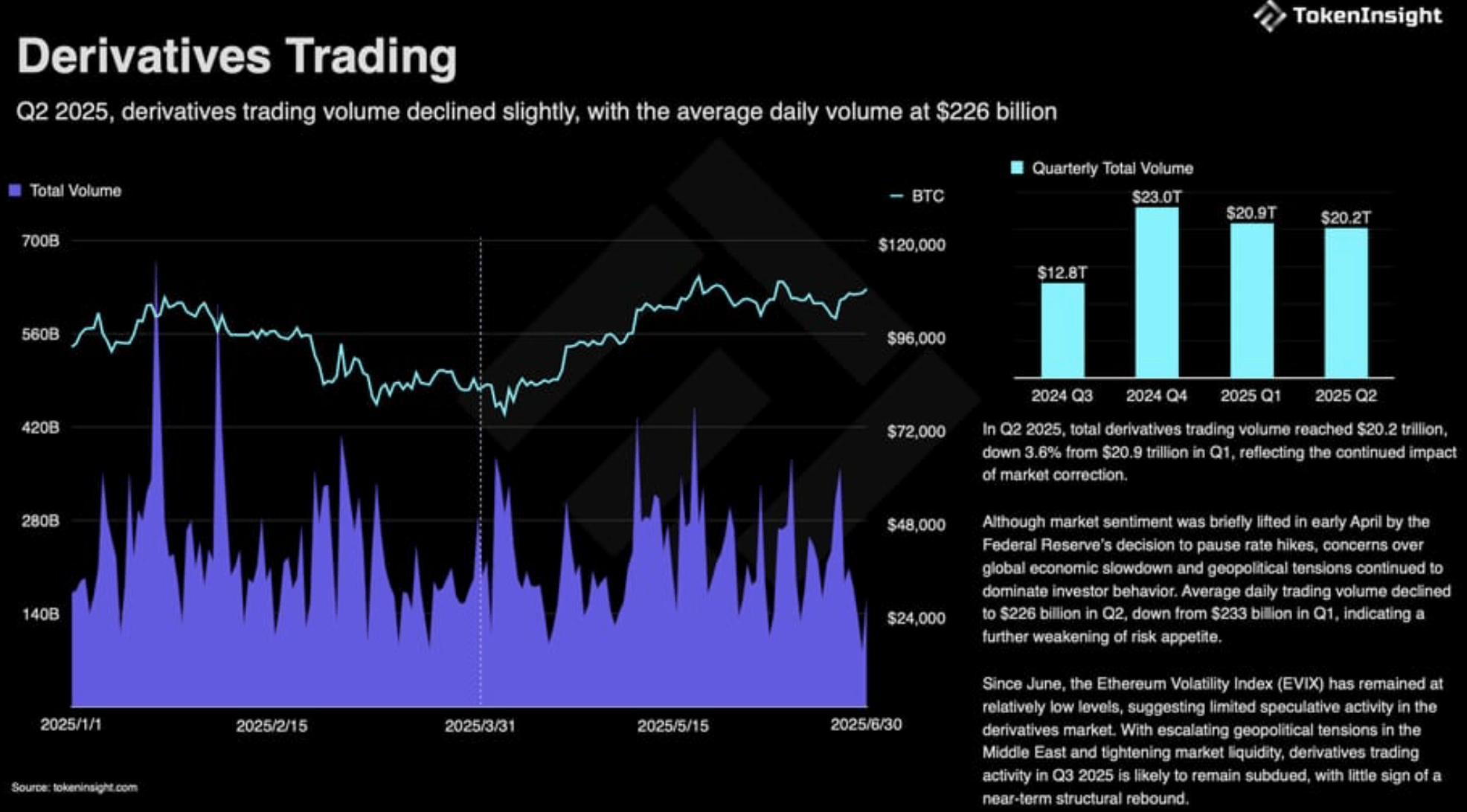

Amid the uncertainty, many traders have shifted towards risk management strategies, favoring high-frequency derivatives trading. This is consistent with trends observed in Q1 2025. As noted in the report:

The decline in the spot market underscores the challenging conditions; liquidity and trading volumes within altcoins have diminished significantly, contrasting with the steadiness observed in derivatives markets.

However, derivatives trading also experienced a slight contraction, dropping 3.6% from $20.9 trillion in Q1 2025 to $20.2 trillion in Q2 2025. Although a temporary rate pause by the US Federal Reserve invigorated the market in April, escalating geopolitical tensions have weighed heavily on investor interest in riskier assets.

Binance Maintains Market Leadership in a Volatile Quarter

During Q2 2025, Binance solidified its position as the foremost exchange, accounting for 35.39% of the overall trading volume, making it the only platform surpassing one-third of the market. However, this figure represents a slight decrease from the 36.57% recorded in Q1 2025.

In contrast, five other exchanges, including OKX, Bitget, HTX, Gate, and KuCoin, managed to capture greater market shares, with Gate leading with a 2.55% increase, closely followed by OKX at 1.08%.

Despite the drop in trading volume, optimism remains as liquidity continues to flow into the digital asset domain, buoyed by the growing market capitalization of stablecoins. As of now, Bitcoin’s price sits at $118,786, reflecting a 0.9% increase over the last 24 hours.