Bitcoin Approaches $100K as Inflows Propel Breakout Movement

Bitcoin has successfully surpassed the important $98,000 resistance threshold and is nearing a historic milestone after reaching $99,890—just a stone’s throw from the much-anticipated $100K level. The bulls have taken the reins, with momentum picking up and price trends validating the uptrend that many experts forecasted. Following weeks of gradual consolidation and ascending lows, BTC is clearly demonstrating robust strength as it targets new all-time highs.

Backing this positive trend, on-chain data from CryptoQuant indicates a strong and ongoing influx of capital into Bitcoin in recent weeks. This phase of accumulation signifies a resurgence of investor confidence, resulting in Bitcoin’s Realized Cap hitting a new peak for the third consecutive week. Realized Cap, which gauges the total worth of all coins based on their last transaction, serves as a critical indicator of long-term commitment among holders.

As capital inflows surge and the $100K breakout approaches, the market’s attention is sharply focused. A confirmed elevation above $100K could ignite the next significant phase of Bitcoin’s bullish cycle, while ongoing accumulation suggests that investor enthusiasm remains high, even at these historic price points.

Bitcoin Gains Traction as Realized Cap Indicates Increased Demand

Bitcoin is experiencing notable momentum as it nears a breakout beyond the psychological threshold of $100,000. The bulls are firmly in charge, with the selling pressure that characterized much of the year seemingly dissipating. The current price action is decisively bullish, with Bitcoin trading just below $100K after hitting $99,890 earlier today.

This bullish trajectory is bolstered by solid on-chain fundamentals. According to insights from CryptoQuant analyst Carmelo Alemán, Bitcoin’s Realized Cap—a highly trusted measure of network capital—has reached a new all-time high for the third week in a row. Currently, as of 11:00 a.m. today, the Realized Cap stands at $890.742 billion. This figure is calculated by adding up the purchase price of all Unspent Transaction Outputs (UTXOs) multiplied by the amount of BTC held, reflecting the total dollar value of coins based on their last movement.

The increase in Realized Cap illustrates ongoing capital inflows and rising investor confidence. Both Long-Term Holders (LTHs) and Short-Term Holders (STHs) continue to accumulate BTC, bolstering the market’s recovery and setting the stage for a potential breakout.

This influx of investment reveals not only a shift in sentiment but also a strengthening belief in Bitcoin as a long-term financial asset. With increasing momentum and consistent capital inflows, the market seems to be preparing for significant price expansion. If this trend continues, a verified breakout above $100K could signify the start of a new and potent bullish cycle—driven by solid, data-supported accumulation rather than mere speculation.

Price Review: Approaching $100K Barrier

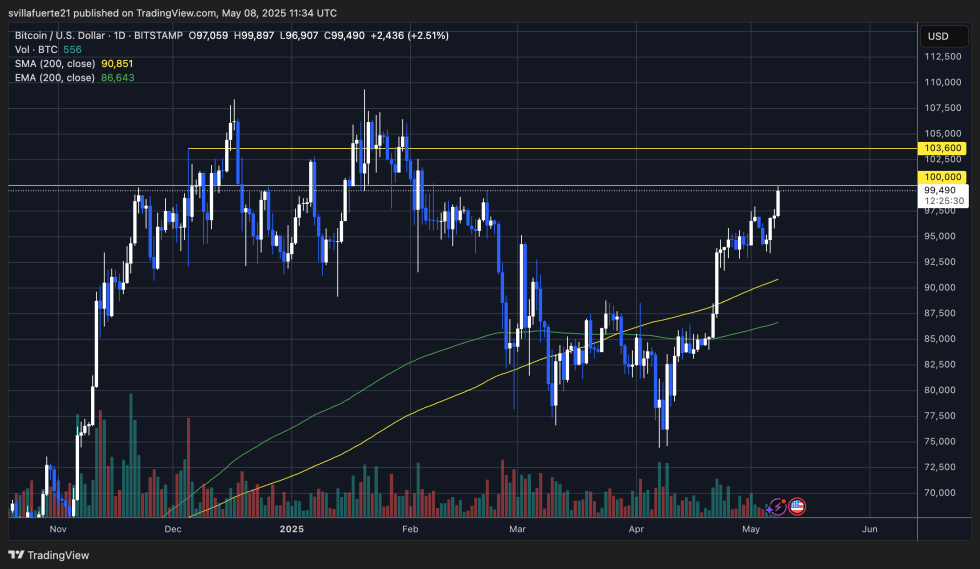

Bitcoin is currently trading at $99,490 after a noteworthy +2.51% daily increase that has brought it close to the $100,000 psychological barrier. The daily chart shows BTC breaking past recent consolidation peaks and moving into a crucial price zone between $100,000 and $103,600. This range represents the last hurdle before potentially entering price discovery and revisiting all-time highs from earlier this year.

The momentum is decidedly positive. Bitcoin is currently trading significantly above both the 200-day simple moving average (SMA) at $90,851 and the 200-day exponential moving average (EMA) at $86,643—two critical technical levels that have previously acted as dynamic resistance. The current configuration highlights a strong uptrend, bolstered by increasing volume and continual higher lows since the rebound in mid-April.

What remains crucial is whether BTC can close above $100K to convert it into a support level. A clear breakthrough could attract additional capital and accelerate movement toward $103,600 and beyond. Nonetheless, traders should remain vigilant for a possible pullback around $100K, which has historically functioned as a significant profit-taking zone.

In summary, Bitcoin’s price action is robust, and technical momentum suggests further gains. The next few daily closes will be pivotal in determining whether BTC can successfully break through this final barrier and initiate a new bullish phase.

Featured image from Dall-E, chart from TradingView