Bitcoin has successfully surpassed the $100,000 threshold, currently trading around $104,300 after achieving this peak just a few hours ago. This significant rise follows weeks of upward momentum, indicating a notable transformation in market behavior. With resistance levels diminishing consistently, bullish traders are in control, and overall market sentiment is increasingly positive. As Bitcoin takes the lead, altcoins are also experiencing gains, contributing to a wave of optimism in the cryptocurrency sector.

Analysts are expressing growing confidence in a sustained upward trend, citing strong technical indicators and improving on-chain metrics. A key observation from CryptoQuant reveals that the 30-Day Capital Rotation (%) typically peaks around 35%, signaling speculative bubbles and over-exuberance. Currently, this metric is at 16.7%, indicating a steady influx of fresh capital without signs of irrational exuberance or frantic FOMO.

This measured capital flow suggests that the rally is founded on robust grounds. Should this momentum persist and Bitcoin maintain its position above $100K, we may be entering a significant new phase of the bull market—one powered by firm conviction rather than sheer enthusiasm.

Bitcoin Validates Recovery Rally as Market Shifts to Bullish Trends

Bitcoin has confirmed a recovery rally by overcoming the $100,000 barrier—a crucial psychological and technical threshold. This movement signifies a substantial shift in momentum, with Bitcoin surpassing resistance levels that had previously limited its price for an extended period. The rally, hitting a peak of $104,300, occurs alongside the overall strength in the cryptocurrency market, where Ethereum has also surged above $2,400, helping to lift altcoins simultaneously.

This unified breakout has rekindled bullish optimism, marking what many experts believe to be the onset of a new bullish cycle. Leading market analyst Axel Adler shared valuable insights that support this outlook, highlighting essential on-chain metrics that suggest the rally is driven by growing confidence rather than temporary hype.

Adler notes that the 30-Day Capital Rotation (%)—a measure of the proportion of capital realized from “new” coins (held for less than a month) relative to the total realized capital in the past 30 days—provides a crucial perspective. Historically, peaks close to 35% have coincided with euphoric, speculative surges. However, the current figure stands at 16.7%, indicating a controlled and steady inflow of new capital without signs of excess or overheated sentiment.

This trend indicates that new investors are entering the market, yet not in a panic—rather, they are doing so with assurance. It suggests a favorable accumulation environment where both long-term and short-term holders are aligned towards growth. With critical levels regained and on-chain data indicating sustainability, Bitcoin seems to be establishing a strong base for further gains. If this trend continues, the $100K breakout may mark not the end, but the beginning of a larger rally that could define the upcoming phase of this cycle.

BTC Price Overview: Momentum Favors the Bulls

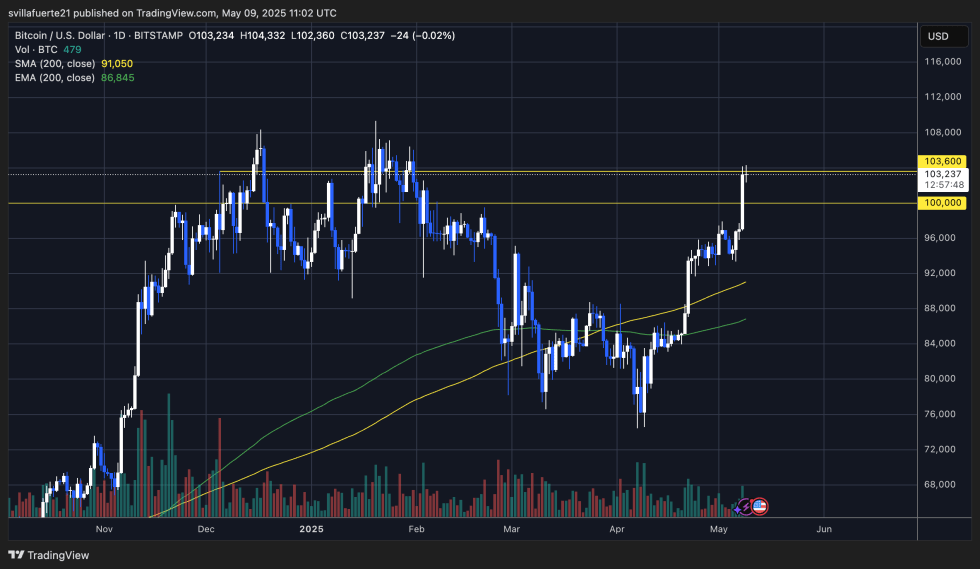

Bitcoin is currently priced at $103,237 after a significant breakout past the longstanding $100,000 psychological barrier. The daily chart illustrates Bitcoin’s upward movement through critical levels with robust bullish momentum, peaking at $104,332 earlier this day. This marks the first clear move above $100K since February, and the highest daily close in recent months.

The price activity confirms a substantial bullish transition. After consolidating above the 200-day EMA ($86,845) and 200-day SMA ($91,050), Bitcoin surged higher, breaking through resistance levels with increasing volume. The rise above $100K has now established this level as immediate support, with the next notable resistance located at $103,600—currently being tested by Bitcoin.

Should BTC close above $103,600, it would represent the highest daily closure in this cycle and might pave the way for price discovery. If it fails to maintain above $100K, a short-term pullback could occur, but the present momentum appears to favor the bulls. Increased volume has validated the breakout, and wider market conditions are improving, with Ethereum and altcoins riding on Bitcoin’s coattails.

In summary, the charts indicate strength, confidence, and potential for continuation. Keeping $100K as support will be vital in confirming this movement as the start of a new upward trend in the current bull market.