Investment in cryptocurrency products has consistently drawn in funds for the fourth week in a row, as stated in the latest weekly report from CoinShares, a European asset management firm concentrating on digital assets.

The figures show that global inflows reached $882 million last week, bringing the total for the year to $6.7 billion—just below the earlier peak of $7.3 billion noted in February 2025.

Bitcoin Dominates Inflows; Sui Surpasses Solana

Bitcoin continues to be the preferred investment, pulling in $867 million in a single week. Bitcoin ETFs listed in the US achieved a new milestone, with total net inflows of $62.9 billion since their launch in January 2024.

This surpasses the earlier peak of $61.6 billion reached earlier in the year, highlighting the importance of institutional products in elevating Bitcoin demand.

On the other hand, Ethereum’s inflows were relatively low, despite an increase in price. ETH products managed to attract only $1.5 million for the week, a minor amount when compared to Bitcoin.

In contrast, the alternative layer-1 protocol Sui experienced a $11.7 million inflow, raising its annual total to $84 million, surpassing Solana’s $76 million. Interestingly, Solana faced outflows of $3.4 million during the same timeframe, indicating a shift of investments to newer blockchain technologies.

The continuous increase in investment comes amidst growing macroeconomic uncertainties. CoinShares’ Head of Research, James Butterfill, identifies several key factors contributing to the rise in digital asset investments.

These factors include a global rise in the M2 money supply, fears of stagflation in the US, and recent state-level regulations classifying Bitcoin as a strategic reserve asset. Collectively, these elements seem to be enhancing institutional interest in cryptocurrency.

Geographical Insights and General Patterns

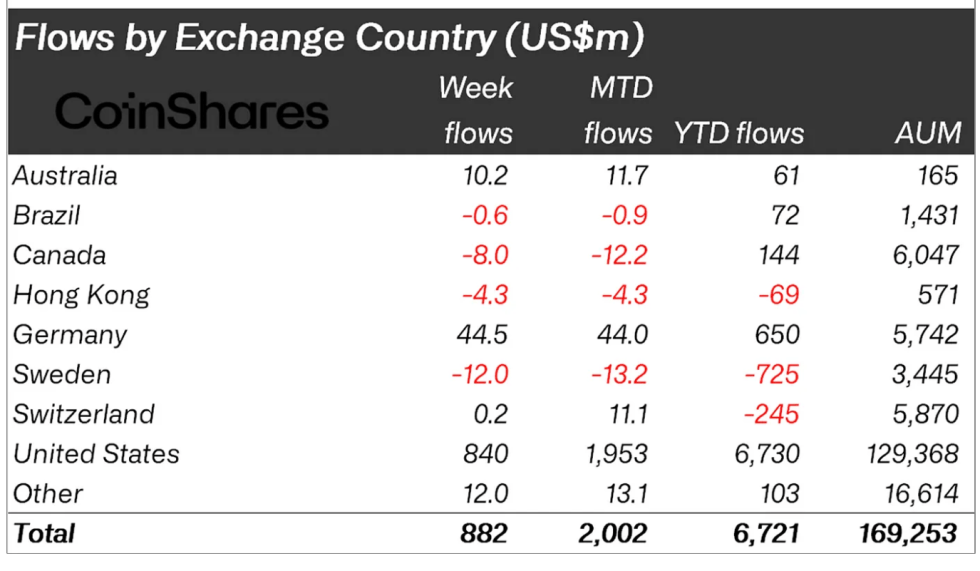

Regionally, the US led the market with $840 million in inflows, followed by Germany with $44.5 million and Australia at $10.2 million. In contrast, Canada and Hong Kong experienced slight outflows of $8 million and $4.3 million, respectively.

This regional variation may indicate differing levels of investor attitudes, regulatory environments, and availability of institutional products across different areas.

According to the CoinShares analysis, macroeconomic influences are increasingly shaping crypto investing strategies. The findings suggest that institutional investors are viewing digital assets as a means to hedge against fiat currency devaluation and economic instability.

This perspective is further validated by movements like state legislation in the US recognizing Bitcoin as a reserve asset and the overall rise in liquidity of fiat currencies.

While Bitcoin remains at the forefront of inflows, the performance of emerging assets like Sui reveals a growing fascination with alternative blockchain infrastructures. Should this trend continue, fund managers might increasingly seek to diversify their offerings beyond the traditional top two cryptocurrencies in their investment strategies.

Image created with DALL-E, Chart sourced from TradingView