Recent analyses indicate that Bitcoin short-term investors are facing significant challenges as they adjust their positions in response to market volatility.

Behavior of Bitcoin Short-Term Holders During Market Fluctuations

In a recent update on X, a Cryptocurrency analyst highlighted the actions of short-term holders (STHs) amidst falling Bitcoin prices.

Short-term holders are those who acquired Bitcoin within a timeframe of less than 155 days. Historically, these holders are known to make decisions based on market sentiments rather than long-term strategy, often leading to impulsive selling during downturns.

As witnessed, this group has instinctively reacted to the latest price drops. The accompanying chart reveals a marked increase in transactions where these holders have incurred losses by moving their assets to centralized exchanges.

Data suggests that short-term holders collectively transferred approximately 32,000 BTC at a loss to exchanges amid the recent price plunge. Typically, such transfers occur when holders seek to liquidate their positions, an evident signal of market anxiety.

This tactic of loss realization indicates a behavior known as capitulation, where investors abandon their positions to limit further loss. The most recent downturn saw Bitcoin price drop below the $109,000 threshold, prompting similar patterns from the community.

Cumulatively, short-term holders have relinquished more than 60,000 BTC, translating to an estimated $6.5 billion across different sell-off episodes. This strong reaction exemplifies the stress permeating the market during such turbulent times.

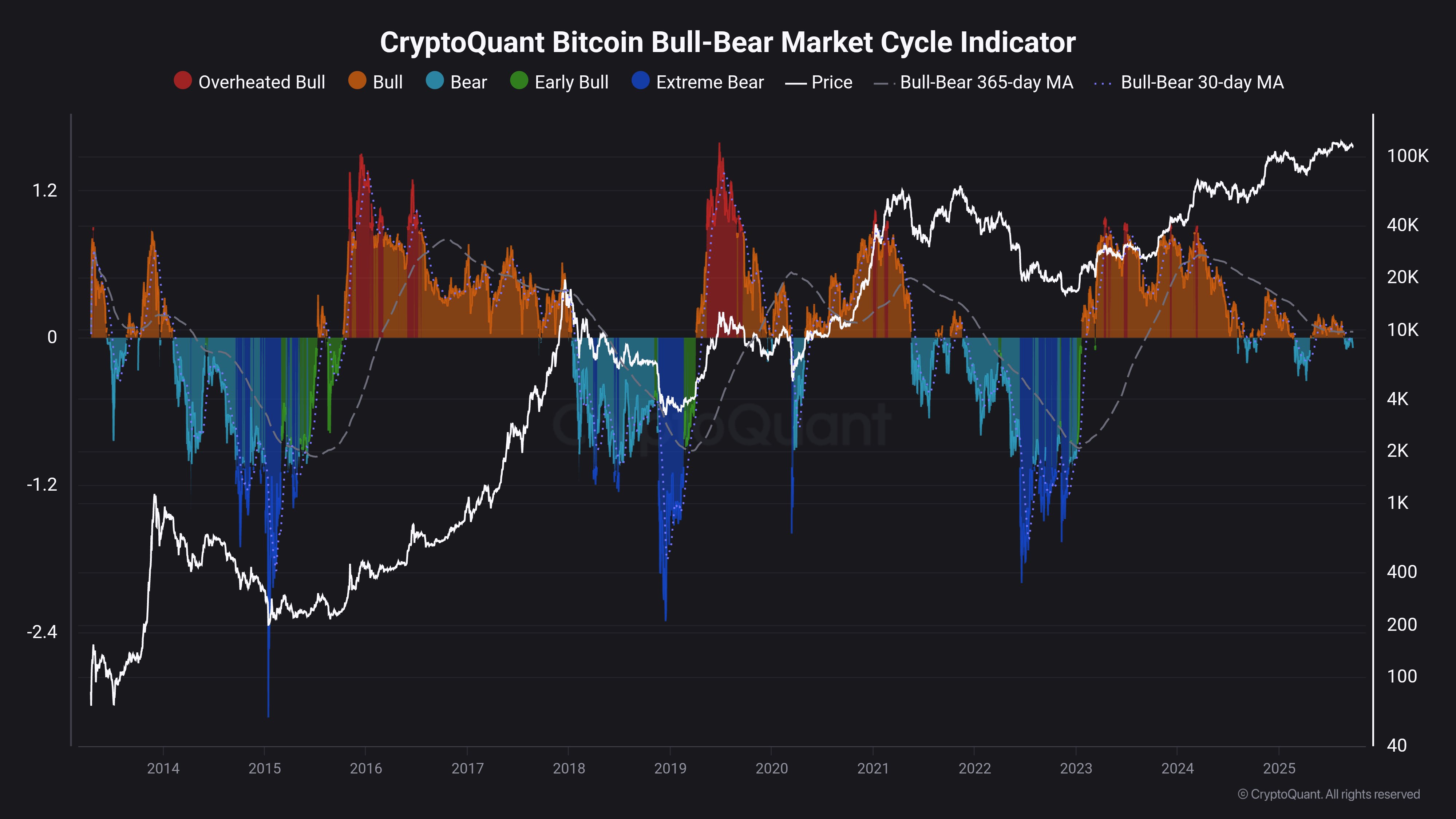

In addition, the latest readings from CryptoQuant have revealed a bearish signal from the Bitcoin Bull-Bear Market Cycle Indicator, corroborating the sentiment of market participants, as noted in another post.

The Bull-Bear Market Cycle Indicator incorporates data from various on-chain metrics to assess the current market cycle phase. Present indications point to a prevailing bearish trend for Bitcoin.

Moreover, the 365-day moving average (MA) remains on a downward trajectory, which historically precedes less favorable market conditions. “Typically, significant gains in Bitcoin are observed when this metric is on the rise,” the analyst emphasized.

Current Bitcoin Price Dynamics

As of now, the price of Bitcoin has dipped to approximately $108,900, reflecting a decline exceeding 5.5% in recent trading sessions.