Cryptocurrency enthusiasts are closely watching Bitcoin as it approaches a significant price point just shy of the $123,000 mark. With the market demonstrating some bullish activity, there appears to be a temporary stall, necessitating a decisive breakthrough for the uptrend to continue. Following an impressive surge of around 20% since late June, all eyes are on further price action to establish a new high.

The overall market sentiment remains positive, buoyed by broader acceptance of crypto, clearer regulations in the United States, and favorable global economic conditions. Nonetheless, the latest data indicates a noticeable dip in actual buying pressure from spot markets. This mismatch between optimistic sentiment and the reality of demand suggests a cautionary approach from investors, possibly due to anticipation of profit-taking or a market correction.

As long as Bitcoin stays above the critical $115K support area, the bullish momentum holds. However, the lingering resistance around the $123K level raises questions about a potential short-term pullback or extended consolidation. Bitcoin’s current trend is still secure, but a marked increase in trading volume and aggressive buying would be essential for surpassing records and sustaining bullish momentum.

Market Sentiment Remains Optimistic, but Buying Interest Dwindles

Prominent crypto analyst Jordan Marks recently provided valuable insights through the Crypto Sentiment Gauge, indicating a reading of 64%, which reveals a strong bullish sentiment. However, Marks emphasized an important caution: while traders are leaning toward purchasing, there has been a noticeable absence of strong commitment to drive Bitcoin decisively past its previous all-time high of $123,000.

This reluctance aligns with the market’s current performance. Following a significant rally that propelled prices upward, Bitcoin is now stabilizing in a tight range between $115K and $120K. While this structure is reminiscent of strength, the lack of vigorous buying pressure at these elevated prices signals a hesitance among traders. Many seemed to be waiting for a substantial catalyst before increasing their positions.

The current period of compression might precede a significant price movement, as low volatility often sets the stage for dramatic shifts. Traders need to be prepared for a breakout, whether upward or downward. Although the overall trend favors a bullish trajectory, the chance of a correction looms, particularly if sentiment weakens or if there are unexpected changes in macroeconomic conditions.

BTC Displays Strong Consolidation Near Historic Highs

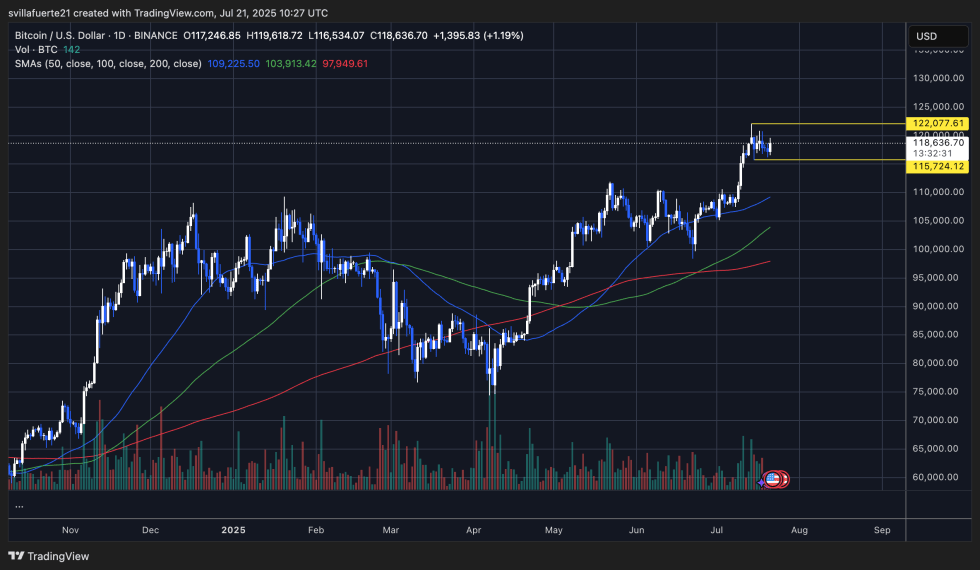

Analyzing the daily chart, Bitcoin is consolidating in close proximity to its historic high of $123,000, currently trading at approximately $118,636. The recent activity indicates robust bullish control; nevertheless, the failure to break past the crucial $122,077 resistance leads to short-term uncertainty. The overarching structure remains bullish, marked by the formation of consistent higher highs and higher lows since the bottom was reached in March around $97,000.

Critically, Bitcoin is maintaining levels well above its key moving averages—the 50-day ($109,225), 100-day ($103,913), and 200-day ($97,949)—which now provide strong support. This sustained consolidation above $115,724 indicates that bulls are actively defending this critical area.

Despite this, the trading volume during this consolidation phase has not been robust, which suggests that some traders are adopting a watchful waiting approach before deploying new capital. A breakout above $122,077 coupled with strong volume could signal a surge higher, whereas a fall below $115,724 may prompt a deeper retracement toward the 50-day moving average.

Overall, the market dynamics suggest that while confidence remains high, a strategic approach to trading and investing in Bitcoin will be necessary as the landscape evolves.