$BTC is undoubtedly the titan of the cryptocurrency space, holding a staggering 58.6% of the entire market. Its latest surge has brought it to an impressive price of $124K, marking an all-time high driven by speculation regarding a possible rate cut by the US Federal Reserve in September.

Such shifts in macroeconomic policy typically amplify interest in higher-risk assets like $BTC, creating a powerful demand surge. However, as enthusiasm peaks, the pressing question remains: can the Bitcoin network sustain this increasing transactional load?

Fortunately, there’s optimism on the horizon as the Bitcoin Hyper ($HYPER) Layer-2 solution is on the brink of unlocking new capabilities — currently just $300K away from a $10M presale milestone.

Market Speculation and Interest Rate Predictions Fuel $BTC Growth

Data from the CME FedWatch tool indicates that there’s a 92.5% chance the Fed will implement a quarter-point rate cut, bringing rates between 4% and 4.25%. This would mark the first decrease since December 2024.

Historically, lower borrowing costs encourage a pivot towards higher yield, risk-on assets, and with $BTC’s current valuation of $118K, it’s at the forefront of this trend.

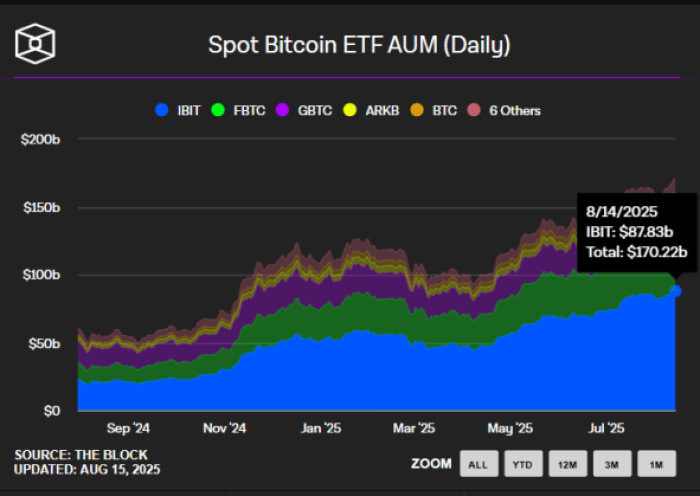

Moreover, the rise of US-listed spot Bitcoin ETFs is noteworthy, with these funds collectively managing around $170.22B in assets. BlackRock’s iShares Bitcoin Trust leads the pack with about $86.83B.

As institutional interest surges, the liquidity of $BTC decreases, intensifying HODL sentiment and strengthening the case for $BTC to ascend even higher.

The US government’s recently favorable posture towards cryptocurrency is also pivotal. Legislative efforts like the ‘GENIUS Act’ and the ‘Clarity Act’ aim to solidify understanding in the realm of digital asset regulation.

Additionally, the initiative ‘Project Crypto’ seeks to revamp securities laws, fostering Web3 developments. Major companies like Ripple, Coinbase, and Kraken have faced SEC challenges regarding unregistered securities, highlighting the necessity for regulatory clarity.

A crucial element in supporting $BTC’s future trajectory is the US Bitcoin Reserve, intended to affirm the country’s leadership in the cryptocurrency arena, while also acting as a safeguard against economic upheaval.

Pointing to its effect on the market, Treasury Secretary Scott Bessent’s statements regarding halting government purchases of $BTC momentarily erased approximately $55B from its market cap.

However, Bessent clarified his position on X, indicating a commitment to ‘budget-neutral pathways’ to expand $BTC holdings. This prompted a recovery in $BTC, uplifting the market overall.

These developments fortify the outlook for $BTC, promoting institutional engagement and fostering a robust foundation of market confidence, even amidst volatility.

Nonetheless, the pressing concern persists: can the Bitcoin network scale efficiently to accommodate the anticipated surge in activity?

Challenges in Bitcoin’s Scalability & Smart Contracts

When it comes to transaction speed, Bitcoin’s network is not leading the way. It manages a mere seven transactions per second (TPS). This pales in comparison to Ethereum’s 15-30 TPS and Solana’s staggering 1,000 TPS.

The limitation in Bitcoin’s block size—capped at 1MB—and its lengthy 10-minute block confirmation time often inflate transaction costs during busy periods.

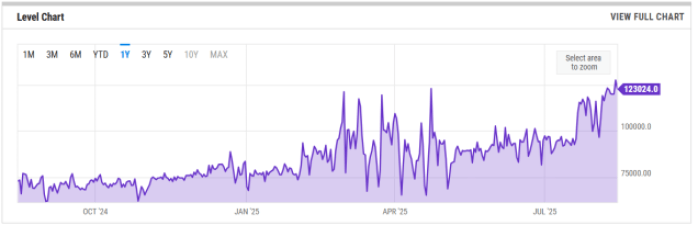

In contrast, Ethereum, with its relatively fast block confirmation time (approximately 12 seconds) and adaptive block size, regularly handles larger transactions. Its average block size has reportedly risen to around 123,024 bytes.

This flexibility enables Ethereum to maintain a higher transaction throughput, seamlessly accommodating network demand and supporting a range of decentralized finance (DeFi) protocols, decentralized applications (dApps), and non-fungible tokens (NFTs).

Bitcoin, conversely, is structurally designed to prioritize security, which limits its capability to manage intricate smart contracts and large-scale DeFi or NFT ecosystems like Ethereum does.

As a result, Ethereum boasts the largest total value locked (TVL) at $94.356B, significantly outpacing Bitcoin’s modest $7.63B.

These critical issues are precisely what the Bitcoin Hyper initiative intends to address.

Bitcoin Hyper: Preparing for the Next Phase

Anticipated to launch this quarter, Bitcoin Hyper endeavors to enhance the Bitcoin network by introducing faster, more affordable transactions and enabling DeFi capabilities.

The strategy is straightforward yet transformative: it processes transactions off-chain before settling them on the Bitcoin mainnet, significantly improving efficiency and reducing costs.

In the evolving landscape of cryptocurrencies, innovations like Layer-2 solutions are paving the way for enhanced scalability and efficiency. These advancements have the potential to transform transactions by minimizing fee structures and accelerating confirmation times.

Moreover, incorporating cutting-edge technologies such as the Solana Virtual Machine (SVM) brings forth the exciting possibilities of smart contracts on Bitcoin. This integration could lead to a new era for decentralized finance (DeFi), allowing for various applications, including dApps and a range of innovative tokens.

The introduction of a Canonical Bridge aims to authenticate SVM smart contracts while facilitating the minting of wrapped Bitcoin for broader utility across multiple DeFi platforms.

Crucially, these advancements will occur without sacrificing the inherent security that Bitcoin users have come to rely on. Utilizing Zero-Knowledge Proofs (ZKPs) will further enhance transaction integrity, making it easier to keep the Bitcoin network efficient and unclogged.

Bitcoin Hyper Presale Approaches Milestone as Demand Surges

As market trends shift and institutional interest rises, the momentum behind $BTC is becoming increasingly apparent, highlighting the urgent need for network modernization.

Bitcoin Hyper is strategically positioned to leverage this momentum, enhancing the Bitcoin network amid a surge in global adoption of $BTC.

To maximize benefits within the Bitcoin Hyper ecosystem—including reduced fees and enticing governance rights—investors can participate in the presale of $HYPER, currently offered at $0.012725. With total presale contributions exceeding $9.7 million, interest continues to rise steadily.

This information is not financial advice. Always conduct your own research and invest responsibly, only what you can afford to lose.