Recent data indicates that the cryptocurrency derivatives market has experienced significant liquidations, coinciding with Bitcoin reaching a new all-time high (ATH).

Bitcoin Breaks the $75,000 Threshold Today

Investors have finally seen the long-anticipated moment as Bitcoin has surpassed the $75,000 mark in price over the past day, setting a new record for the leading cryptocurrency.

Here’s how Bitcoin’s price has evolved recently:

This surge in Bitcoin’s value coincided with expectations surrounding a pro-crypto Donald Trump victory in the US presidential elections. Following the election, Trump has indeed returned for a second term.

Bitcoin isn’t alone in this upward trend, as various altcoins have also reported notable price increases, with many outperforming Bitcoin and Ethereum’s recent gains of 8% within the last 24 hours.

Given these dynamics, the derivatives market has also been notably active.

Crypto Derivatives Market Sees $574 Million in Liquidations

Data from CoinGlass reveals that a significant liquidation event occurred in the market over the past day. Liquidation happens when a trading platform automatically closes a losing position once it hits a specific loss threshold, which varies by exchange.

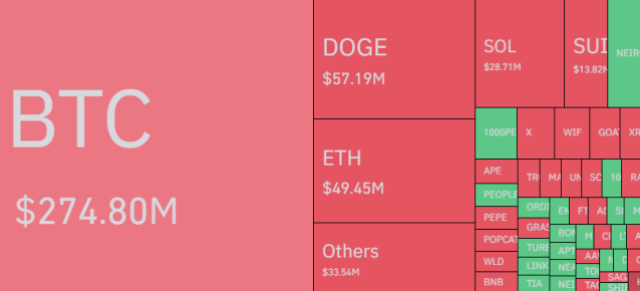

In total, approximately $574 million in cryptocurrency holdings were liquidated within the last 24 hours.

Of this amount, roughly $385 million came from short positions, making up 67% of the total liquidations. While this still represents a clear majority, it is less extreme compared to previous bullish situations.

Furthermore, over $189 million in long positions were liquidated during this price rally, indicating that many of these were opened at Bitcoin’s peak price.

Bitcoin led the way, accounting for almost $275 million of the total liquidations.

Interestingly, Dogecoin (DOGE) ranked second in liquidations, surpassing Ethereum, despite the significant gap between their market capitalizations. This indicates a growing speculative interest in the memecoin recently.

However, both Dogecoin and Ethereum reported liquidations of only $57 million and $49 million, respectively, which pale in comparison to Bitcoin’s figures. Thus, Bitcoin remains the primary focus for traders.

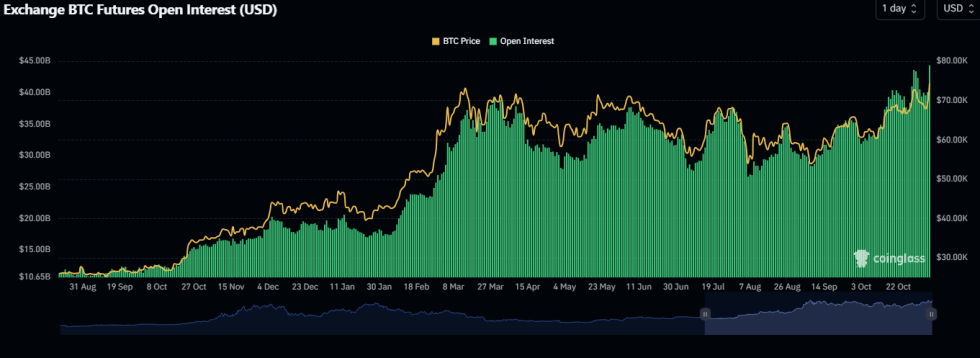

With $574 million in contracts liquidated so far, it doesn’t seem to have deterred traders, as Bitcoin Open Interest has surged to a new all-time high (ATH).