In a remarkable turn of events, Bitcoin recently reached an unprecedented value of $124,500, solidifying its position as the leading cryptocurrency. This notable achievement, part of its 2025 trajectory, quickly gave way to selling activity, hinting at a pivotal shift in the market landscape. The surge, driven by prolonged bullish sentiment, now faces potential headwinds that could redefine trading strategies.

Market experts remain divided regarding the future course. Some assert that the recent peak may signify a dwindling momentum, prompting investors to secure gains after such a significant leap. Conversely, there’s a faction that interprets the retracement as a necessary intermission before another ascendant phase, possibly targeting prices exceeding $125,000 if market enthusiasm reignites.

Insights from on-chain analytics reveal a significant trend amongst cryptocurrency holders. Short-term holders are currently experiencing losses, yet the scale of this selling appears less severe than in past downturns. This decrement in selling pressure may indicate that the market is better equipped to absorb surplus, potentially lessening immediate downside risks.

Shifts in Short-Term Holder Dynamics

Leading cryptocurrency strategist Axel Adler highlights a fascinating transition within the short-term holding demographic. During the pullback from the formidable $124,500 milestone, about 16,800 BTC were offloaded at a loss, showcasing a marked reduction compared to prior downturns. Historical data suggests that similar sell-off scenarios earlier in the year involved considerably larger volumes, signaling a possible evolution in market psychology.

Adler further notes a declining trend in the frequency of short-term holder capitulation, illustrated by diminishing amplitude in his graphic. This suggests an increased resilience among buyers who entered the market recently, resulting in stronger absorption dynamics. Essentially, the market now seems less reactive to price pullbacks, indicating that short-held participants may be displaying enhanced confidence.

Although bullish momentum has subdued following the all-time high, the underlying price structure appears robust. Bitcoin continues to trade substantially above key moving averages, signaling that broader market bullishness remains unbroken. Investors appear to be gearing up for the next impactful movement, whether it’s an initiative to breach the $125,000 threshold or a period of strategic consolidation.

Support Levels Under Scrutiny Post-Highs

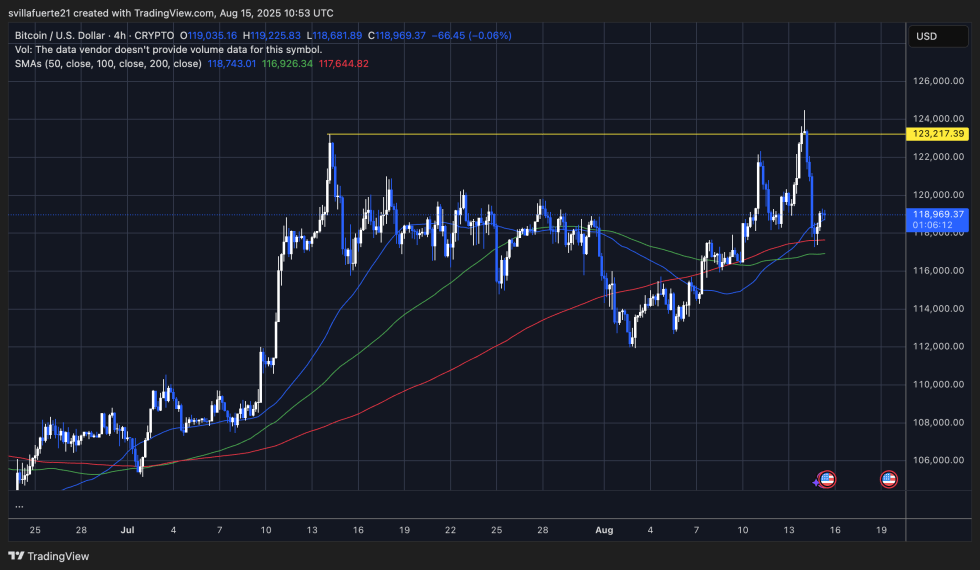

Bitcoin’s recent activity has been marked by volatility, with the price ascending to $124,500 only to encounter strong resistance around $123,217. This setback led BTC to retrace towards the $118,000 mark, where the 200-period SMA provided crucial support against further declines.

Current indicators suggest a fragile recovery. The 50-period SMA still sits above the 100-period SMA, keeping broader trends bullish despite recent pressures. Nevertheless, the price currently hovers below $119,000, indicating potential market inertia as it awaits the next significant movement.

For bullish traders, reclaiming the $120,000 level is vital for rekindling momentum and positioning for another effort toward the $123,000–$124,500 zone. On the flip side, a decisive drop below $118,000 could signal a deeper retracement, possibly targeting $116,900, with further declines toward $115,000 not out of the question.

As BTC continues to hold onto its upward trajectory on the 4-hour chart, recent resistance at all-time highs and the ensuing consolidation may suggest a cooling period. Market participants will be keenly observing for either a breakout that could confirm a continuation of the uptrend or a retreat below support, which might shift sentiment towards caution in the near term.

Image courtesy of Dall-E, charts provided by TradingView.