Cryptocurrency markets are facing turbulent times, and Bitcoin’s struggle to surpass the $90,000 mark reflects a broader atmosphere of uncertainty. As investors hold their breath, the price movement illustrates a period of consolidation marked by wavering confidence from both sides of the trading spectrum. This lack of clear direction has led to significant divergence among market analysts.

Some analysts suggest that Bitcoin is simply recalibrating after its recent rally, while others express concern over signals indicating a possible continuation of a bearish trend into 2026. Notably, the absence of strong buying momentum above critical resistance levels raises alarms, particularly given the fragile macro-economic conditions global markets are undergoing.

Compounding this cautious outlook, recent findings from a report by CryptoQuant reveal a significant change in on-chain metrics. The Supply in Loss (%) indicator has seen an uptick, a trend often associated with the initial phases of bear markets historically.

Historical patterns indicate that during previous downturns, this metric started to rise as price weaknesses became more pronounced. This trend signifies that losses are widening, impacting not just short-term speculators but also longer-term investors, indicating a potential shift in market sentiment from temporary pullbacks to more entrenched declines.

Rising Supply in Loss Sparks Bear Market Warnings

Reviewing past trends in Bitcoin’s history during 2014, 2018, and 2022 shows that the behavior of the Supply in Loss (%) followed a predictable path. This indicator frequently climbed before reaching a bottom, even as prices continued to sag. This early sign did not predict an immediate recovery but rather an enduring period of unrealized losses across the sector.

The current state of Supply in Loss is still below historical capitulation levels, which indicates that the market may not have entered a phase of widespread panic just yet. However, the critical factor lies in the changing dynamics; the recent increase suggests that losses are once again spreading, a situation often linked to the market shifting towards more defensive strategies.

This new insight contradicts the theory that ongoing price weakness is just a natural pause in a more extensive upward trend. Instead, it opens the door for a potential bear market scenario, characterized by elongated periods of price stabilization, recurring downward pushes, and delayed recoveries.

While short-term price rebounds are possible, current on-chain signals indicate a strong likelihood of continued downside risk until loss conditions either stabilize or approach the extremes noted during historical downswing cycles where market bottoms formed.

Bitcoin’s Challenge at Critical Resistance Levels

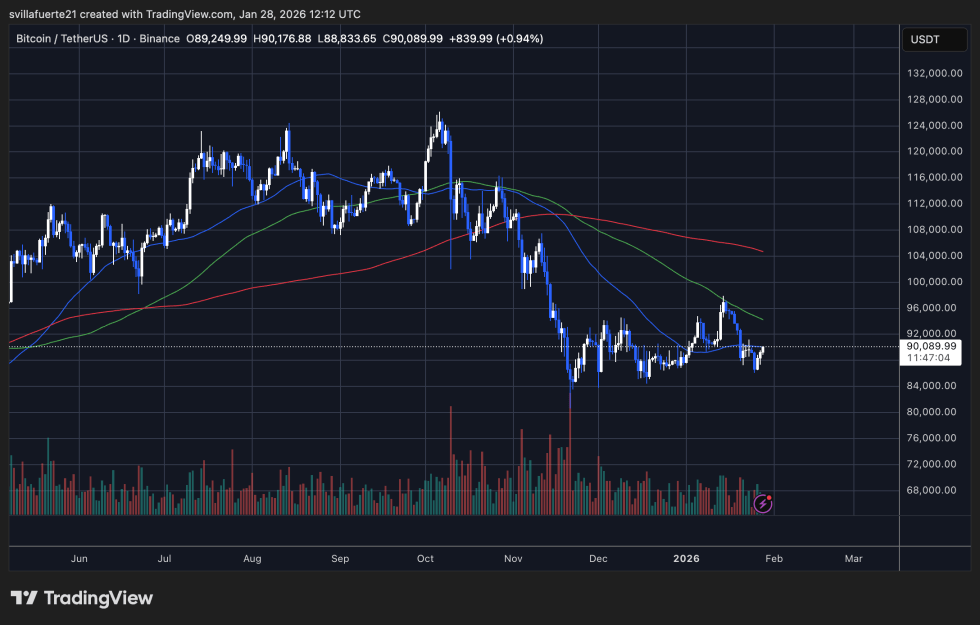

The price dynamics of Bitcoin reveal a market confined in consolidation following a sharp downturn. After hitting a resistance around $125,000 in October, BTC transitioned into a pronounced downtrend, characterized by sequential lower highs and lower lows. The substantial sell-off into late November breached both the 50-day and 100-day moving averages, indicating a significant shift in market control towards sellers.

Since early December, Bitcoin’s price has found relative stability between approximately $85,000 and $92,000, establishing a sideways trading range rather than a swift downward trend. This behavior suggests a tempering of aggressive sell pressure, yet determination among market participants remains tepid.

The direction of the 50-day moving average maintains a downward trend, acting as a barrier to upward moves, while the 100-day also declines, reinforcing resistance around the $94,000–$96,000 resistance zone. Additionally, the 200-day moving average is positioned significantly lower near the mid-$70,000s, hinting that the major cycle has not fully reset, despite the recent declines.

Although selling activity peaked during the November drop, it has since slowed, indicating diminished market engagement rather than a resurgence in demand. As long as Bitcoin prices linger below the declining moving averages, upward movements are likely to be corrective. For a more optimistic near-term outlook, sustained trading above $92,000 is essential, while a breach below $85,000 would renew downside vulnerabilities.

Featured image from ChatGPT, chart from TradingView.com